Fed independence crucial for U.S. and global economy, says Williams

- WTI oil futures rose slightly last week, ending a four-week slide, while Brent oil fell again.

- Weak Chinese economic data and high oil inventories raise concerns about falling demand.

- Increased oil rig counts and bearish technical indicators suggest WTI prices may continue to drop.

- For less than $9 a month, InvestingPro's Fair Value tool helps you find which stocks to hold and which to dump at the click of a button.

WTI oil futures eked out a small gain last week, ending a 4-week losing run. It looks like it was the hurricane disruptions that helped WTI recoup its losses for the week. Indeed, the Brent oil contract finished down for a fifth week.

Both oil contracts thus remain in danger of resuming lower, with investor concerns about demand in China growing further following the release of further negative data from the world’s second largest economy at the weekend.

The big concern for oil investors right now is that demand growth is not going to be strong enough to offset the supply growth. These concerns have been highlighted by oil agencies such as the International Energy Admiration and the OPEC lowering their demand growth forecasts, owing to weakness in data in key economic regions.

Among these regions are China and the Eurozone. While WTI closed well off its lows last week, it may now resume lower as prices test key resistance and given the renewed weakness in Chinese data.

Weak Chinese data further fuels demand concerns

Industrial production grew at an annual pace of 4.5% in August versus 4.7% expected, and down from 5.1% in July. Fixed asset investment growth fell to the lowest level of the year at 3.4% y/y, down from 3.6% previously and below the expected 3.5% reading.

On top of this, home prices declined at an accelerated pace, with new home prices falling by 0.73% m/m compared to 0.65% m/m drop in July. This was the steepest monthly decline for the year.

China’s latest oil numbers paint a grim picture, too.

Chinese refiners processed around 12.6 million barrels per day (b/d) in August, marking a near 10% drop compared to the previous month and a sharp 17.5% year-on-year decline. This suggests apparent oil demand in China dipped below 12.5 million b/d, a more than 15% drop from last year, bringing it to its lowest point since August 2022. On top of that, China's crude oil inventories surged by around 3.2 million b/d in August, the largest monthly build since 2015.

Rising supply: Rig counts reach highest since June

While the OPEC+ agreed to delay the expected oil output hike, there is no guarantee that they will delay future hikes as they don’t want to continue losing market share to US shale producers. Here, Baker Hughes data showed last week that the oil rig count saw a modest increase of five rigs, bringing the total to 588—the highest level since June. Rising drilling activity should mean more supply, all else being equal. That said however, the uptick in drilling activity may not be sustainable given the recent slide in prices.

With demand fears on the rise, speculators have turned increasingly bearish on the oil market. Positioning data shows that over the last week, they sold off 54,325 lots in ICE Brent, leaving them with a net short of 12,680 lots. This shift was driven by both liquidating long positions and fresh shorts entering the market.

WTI technical analysis and trade ideas

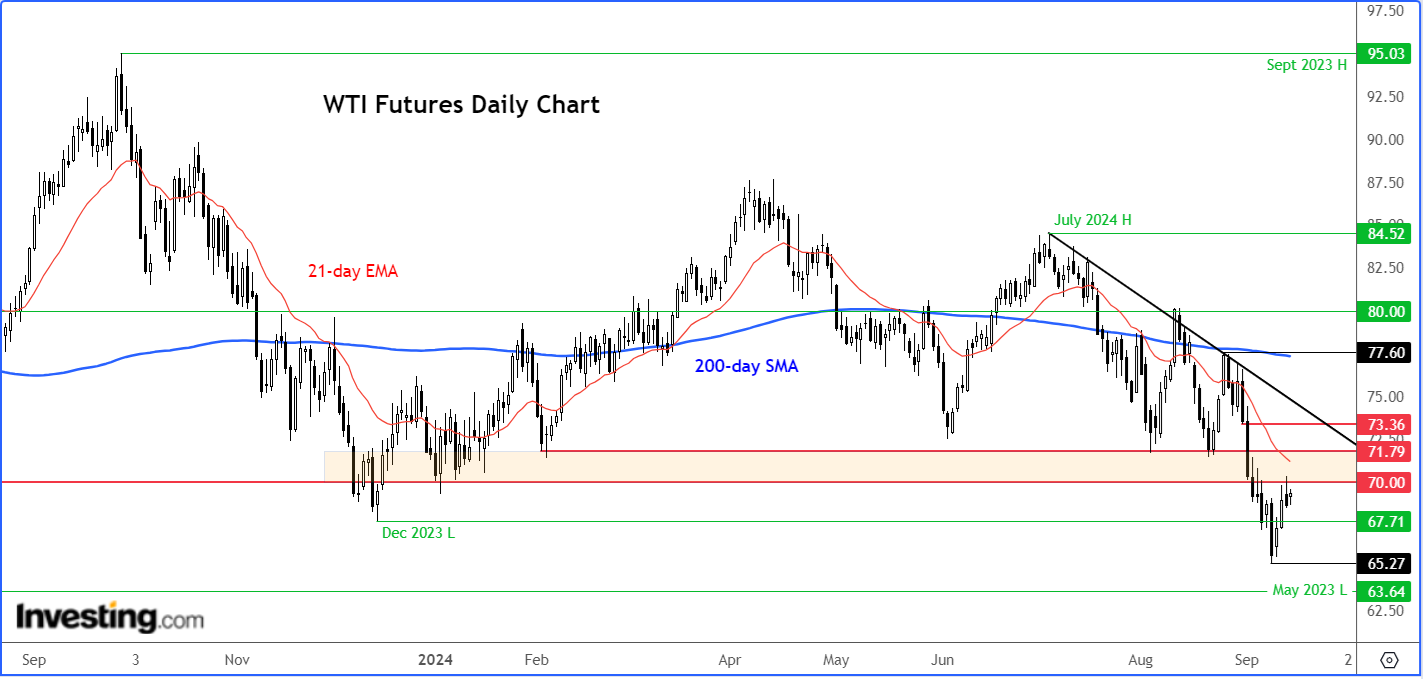

WTI has created several lower highs and lower lows in recent weeks. What’s more, the 21-day exponential moving average is below the 200-day simple moving average, and both have negative slopes. Objectively, the trend is bearish.

So, the path of least resistance is clearly to the downside until the charts tell us otherwise. This means that fading into short-term rallies make more sense than trying to pick the bottom until the trend changes.

Front-month WTI futures chart above shows prices are now testing the lower band of key resistance between $70.00 and 71.80. Previously this range was support and it could now turn into resistance, potentially leading to a fresh drop to the year below last week’s low of $65.27 at some stage. The next bearish target below this level is the May 2023 low of $63.64.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.