Thursday’s Insider Activity: Top Buys and Sells in US Stocks

- Palantir reported better-than-expected earnings for Q1 2023.

- Post earnings, its stock rose nearly 29%.

- The company is focusing on increasing its profitability this year.

Palantir Technologies (NYSE:PLTR) has been soaring since reporting better-than-expected earnings for the first quarter of 2023 earlier this week.

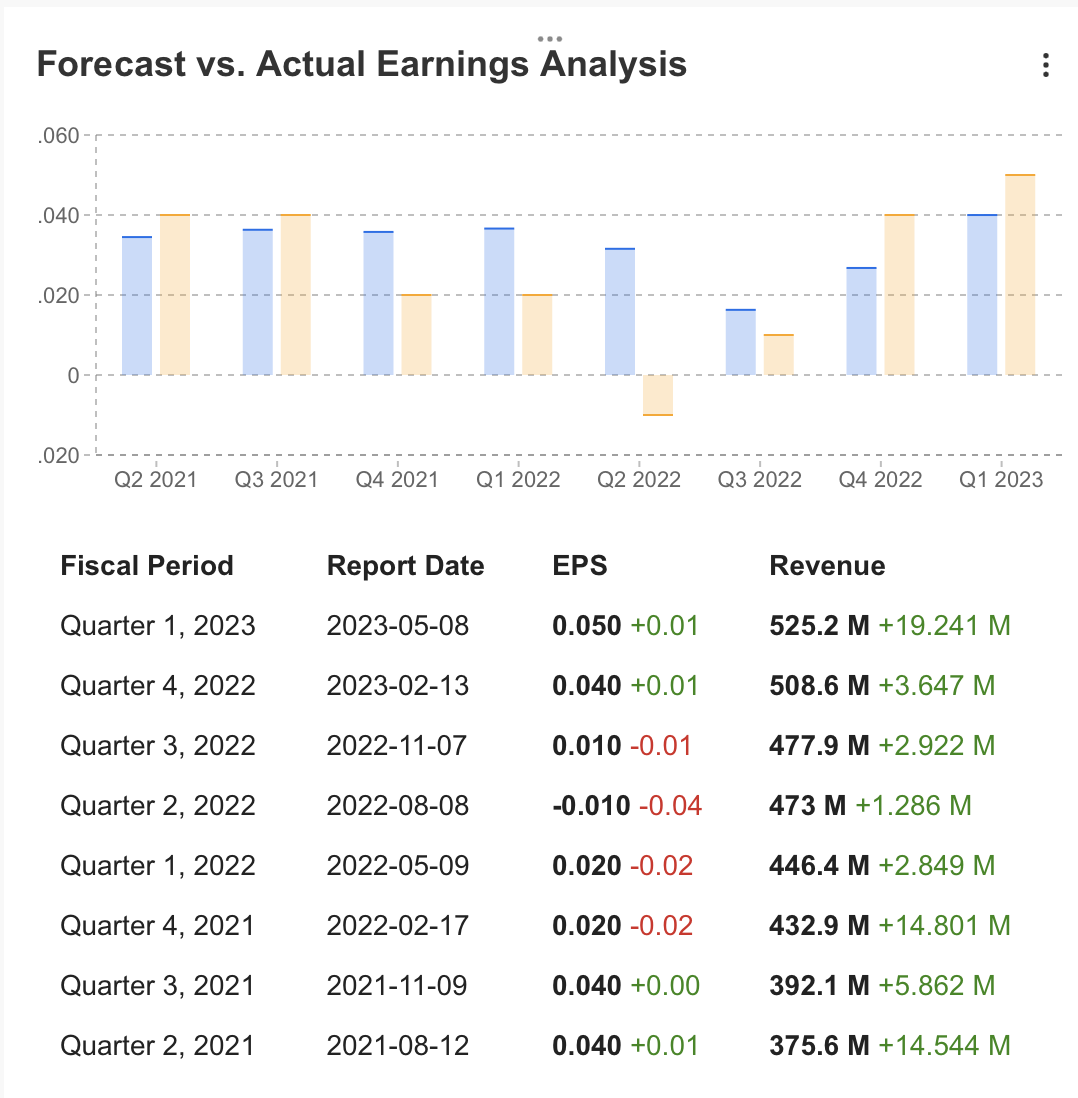

Among the software giant's numbers for the period, analysts were particularly happy to learn that the company's revenues came out at $525.2 million, beating the Street's expectations of about $505 million.

The company's year-over-year revenue growth was also impressive, coming out at a solid 17.7%. Among revenue streams, government revenue was a significant contributor to growth, increasing 20% year-over-year. The Palo Alto, California-based company also grew its customer portfolio by 40% year over year, which is significant. And although Palantir's year-over-year revenue growth rate has declined since last year, its earnings continue to grow.

In fact, Palantir's numbers were so impressive that they raised the question: can the Palo Alto, California-based giant keep growing at this rate?

To try to answer that question, the company told investors it is prioritizing its artificial intelligence operation, aiming at further improving its profitability throughout the year.

But is the Talk Cheap, Or can Palatir Really Keep Up the Positive Momentum Going Forward?

With our InvestingPro tool, Let's take a deep dive into Palantir's financials. Readers can do the same for virtually every company or fund in the market just by clicking this link.

Source: InvestingPro

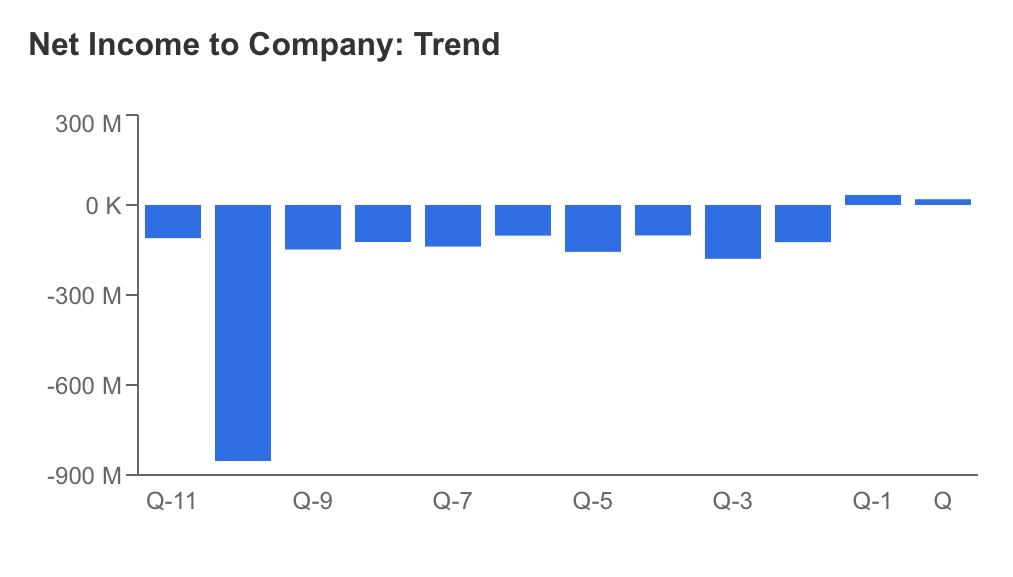

Palantir's positive profitability trend continued in the first quarter of 2023, with a net profit of $19.2 million. This follows a successful previous quarter where the company achieved a quarterly profit of $33.5 million.

In contrast, during the same period last year, Palantir experienced a net loss of $101.4 million.

Remarkably, this marks the first time the company has reported a profit in the last two consecutive quarters since its initial public offering in 2020.

Source: InvestingPro

Palantir reported earnings per share of $0.05 for the first quarter. This represented a 25% increase in earnings per share and was above the Street's expectations of $0.04.

According to data from InvestingPro, 8 analysts have revised their estimates for the next quarter to the upside. Analysts maintained their EPS estimate of $0.05 for Palantir's Q2 results while forecasting revenues to increase to $530.7 million.

Source: InvestingPro

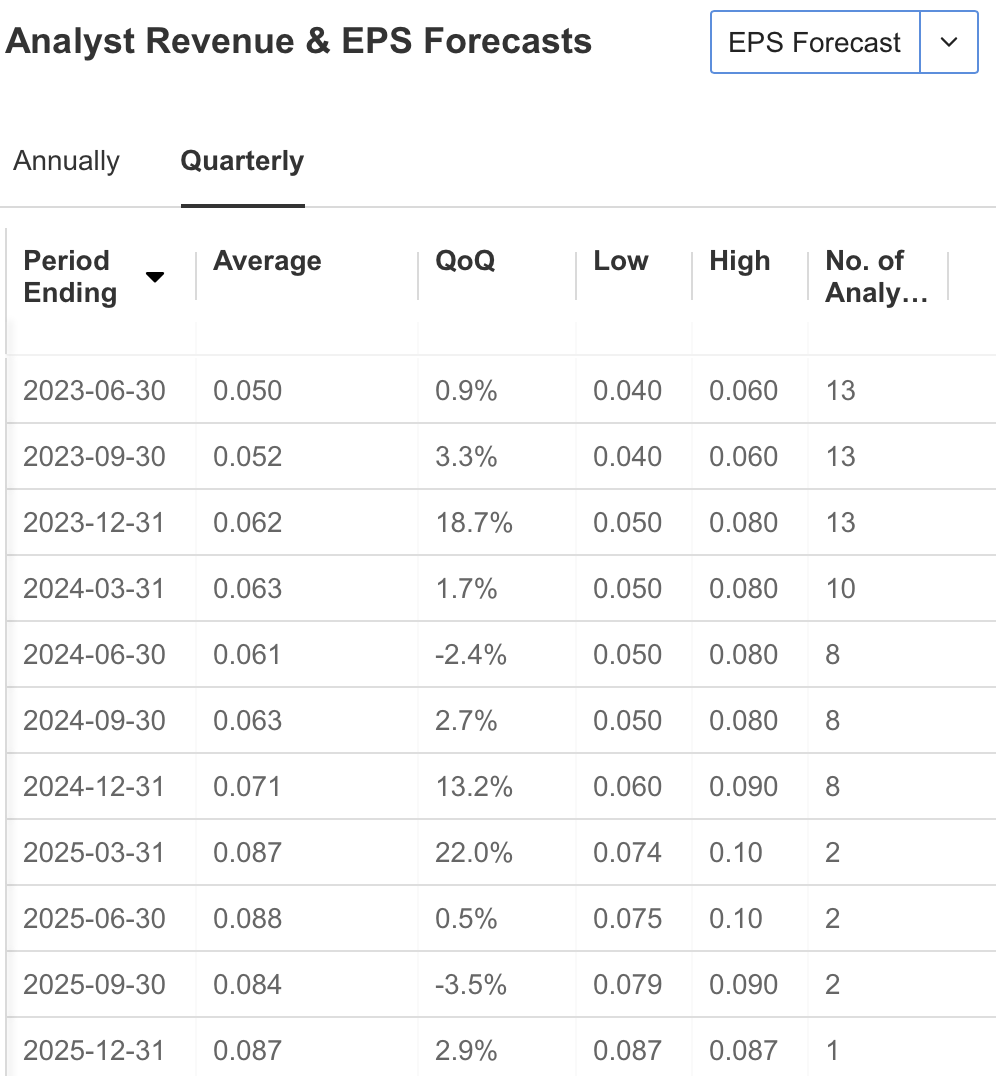

On the other hand, analysts predict that Palantir's earnings per share will grow throughout the year in line with the company's expectations.

Source: InvestingPro

Palantir Technologies has reported upbeat earnings for the last two quarters, and its stock has risen significantly too.

After Q1 results, PLTR rose nearly 29% to $9.55. There was a similar increase in the previous period, as shown in the table below.

Source: InvestingPro

The company has a lot of confidence in its new artificial intelligence platform. It has taken a more profitability-focused approach this year.

However, there may be some concerns about the positive impact of the company's profit-focused approach on the stock price.

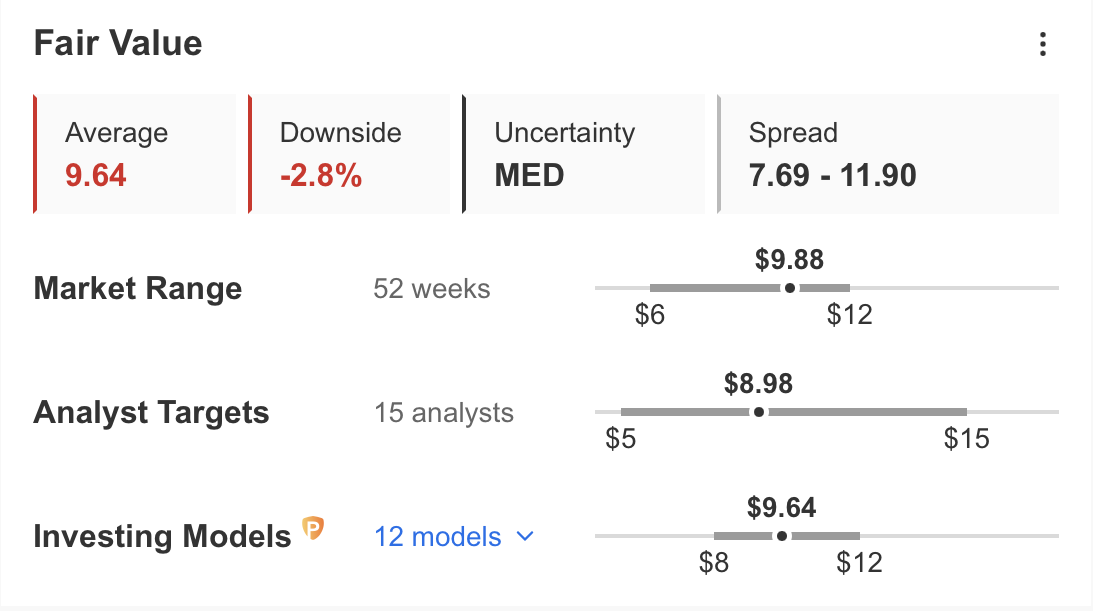

As seen in InvestingPro, the fair value of PLTR is $9.64. This is calculated using 12 models.

In addition, 15 analysts estimate that the stock could fall below $9. Based on these forecasts, PLTR's current price is trading at a premium of nearly 3%.

Source: InvestingPro

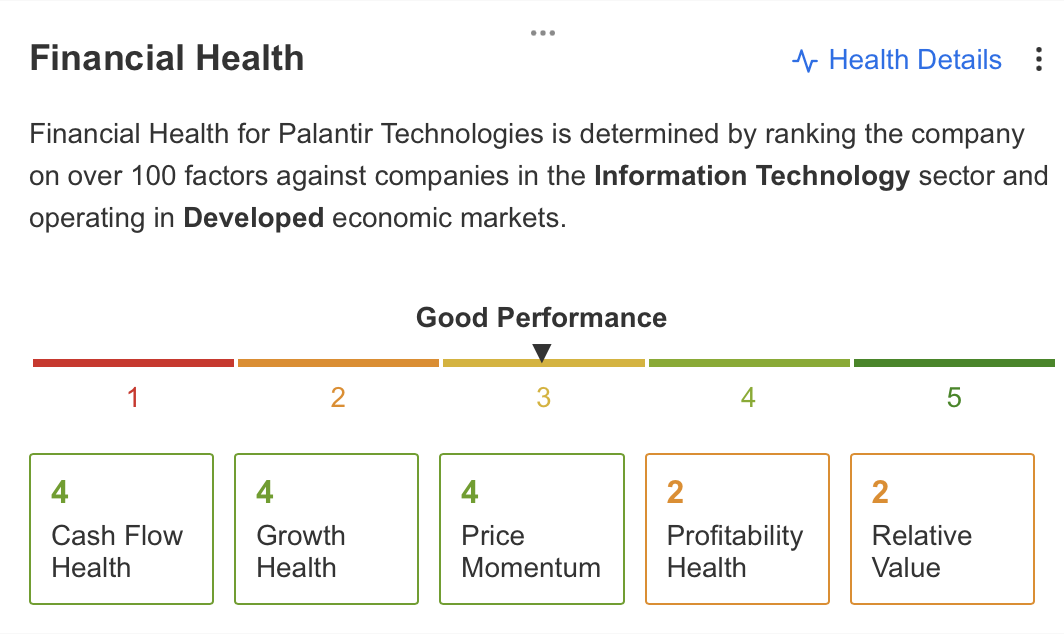

Looking at Palantir's financial health, which can be tracked on InvestingPro, we can see that the company is doing well, scoring 3 out of 5.

The company's fundamentals continue to do well regarding cash flow, growth, and price momentum. However, profitability is one of the areas that need improvement.

And it recognizes that need. Palantir's profit focus this year is a step in the right direction.

Source: InvestingPro

Palantir's growth rate and profitability have pleased investors. On the other hand, the company's revenues come mainly from the government.

But, the concern is that the company has not been able to grow its other commercial revenues as expected.

Nevertheless, Palantir may be able to increase its commercial revenues with its foray into the artificial intelligence sector, which will likely remain in the spotlight soon.

You can also use InvestingPro tools to analyze the companies you are investing in or considering investing in and benefit from analyst opinions and up-to-date forecasts calculated using dozens of models.

Disclaimer: This article is written for informational purposes only; it is not intended to encourage the purchase of any assets, nor does it constitute a solicitation, offer, recommendation, advice, consultation, or suggestion to invest. We remind you that all assets are valued from different perspectives and are extremely risky, so the investment decision and the associated risk are the investor's.