Broadcom shares slide 4% as margins, OpenAI concerns overshadow strong earnings

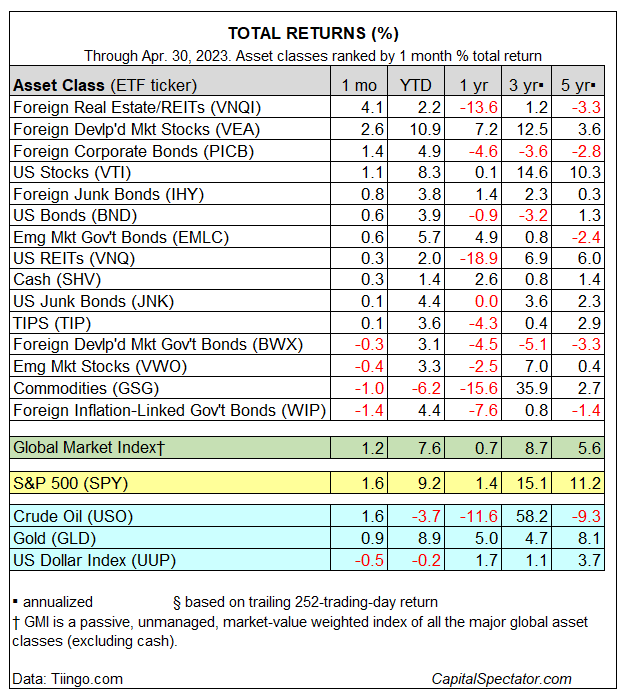

Most of the major asset classes continued to rebound in April, led by property shares ex-US, based on a set of ETF proxies. The downside outliers: foreign government bonds in developed markets, stocks in emerging markets, and commodities.

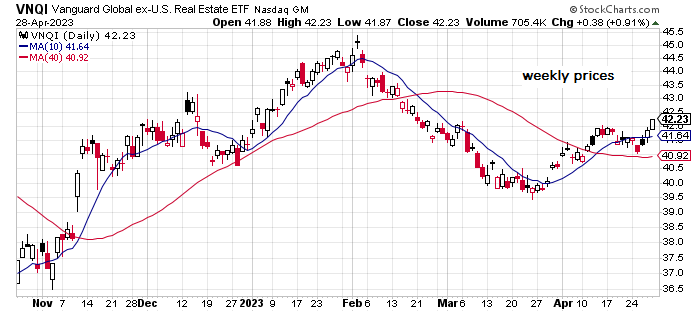

Vanguard Global ex-U.S. Real Estate Index Fund ETF Shares (NASDAQ:VNQI) headed the rallies last month, posting a strong 4.1% return in April. The gain marks VNQI’s first monthly advance since January.

Stocks in developed markets ex-US also had a good month. Vanguard FTSE Developed Markets Index Fund ETF Shares (NYSE:VEA) rose 2.6% in April, the second-best performer for April.

The ETF is the top performer for the major asset classes this year, with a 10.9% year-to-date increase. VEA’s recent strength suggests that outperformance for multi-asset-class strategies in 2023 is associated with relatively high exposure to foreign stocks in developed markets.

The deepest loss last month: inflation-indexed bonds ex-US. SPDR® FTSE International Government Inflation-Protected Bond ETF (NYSE:WIP) declined 1.4% in April, reversing a portion of the strong gain in March. For the year so far, WIP is up 4.4%.

The Global Market Index (GMI) continued to recover in April, rising 1.2%. This unmanaged benchmark (maintained by CapitalSpectator.com) holds all the major asset classes (except cash) in market-value weights and represents a competitive benchmark for multi-asset-class portfolios. GMI is now up by a strong 7.6% year to date.

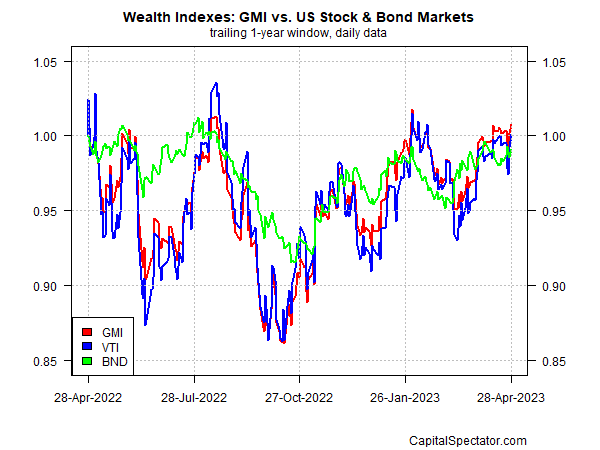

Reviewing GMI’s performance in context with US stocks (VTI) and bonds (BND) over the past year shows a tight range of comparable results. GMI’s one-year performance is a thin 0.7% gain, which leads equities and fixed income slightly over the past 12 months, based on a trailing 252-trading-day window.