Bitcoin price today: struggles at $111k as trade tensions, risk aversion weigh

- Cannabis stocks have been in a downtrend since 2020

- However, the bears are showing signs of slowing down

- And analysts predict strong growth for cannabis stocks in the next 12 months

- InvestingPro Summer Sale is on: Check out our massive discounts on subscription plans!

While the initial decline appeared to be a correction after a rapid and strong surge, it simply did not come to a halt. Disappointment over the lack of progress in federal legalization in 2021, coupled with inflation, rising central bank rates, and oversupply leading to plummeting prices, have impacted the cannabis industry in 2022.

According to the Department of Justice, a pound of marijuana cost on average $6,000 in 2000. However, now, with the influx of new cultivators, supply has far exceeded demand, resulting in a market surplus and cultivators earning only $1,000 per pound for their products.

With lower prices and greater competition, it has become particularly tough for the sector's companies to produce healthy margins — particularly in the face of the current inflationary macro environment. The significant drop in cannabis stock prices, thus, can be attributed, in large part, to the inability to cover cultivation expenses.

Will Cannabis Stocks Rebound?

The ETF AdvisorShares Pure Cannabis (NYSE:YOLO), for instance, plummeted over 92% from its peak of $31.87 in February 2021 to a low of $2.53 this week.

However, the bearish trend shows signs of slowing down, suggesting a potential bullish reversal. Financially, this could be justified by the currently extremely low valuations of cannabis stocks.

Moreover, despite structural issues, the cannabis market holds a promising future, with most studies projecting an annual market growth rate of over 10% in the next decade.

While federal legalization may be delayed, it is widely acknowledged as a significant campaign issue for the 2024 presidential election, fueling hope and potentially driving a new bull market for cannabis stocks.

Considering this context, it is worth examining cannabis stocks closely to identify opportunities and pinpoint the best stocks to capitalize on the sector's rebound in the second half of 2023 and beyond.

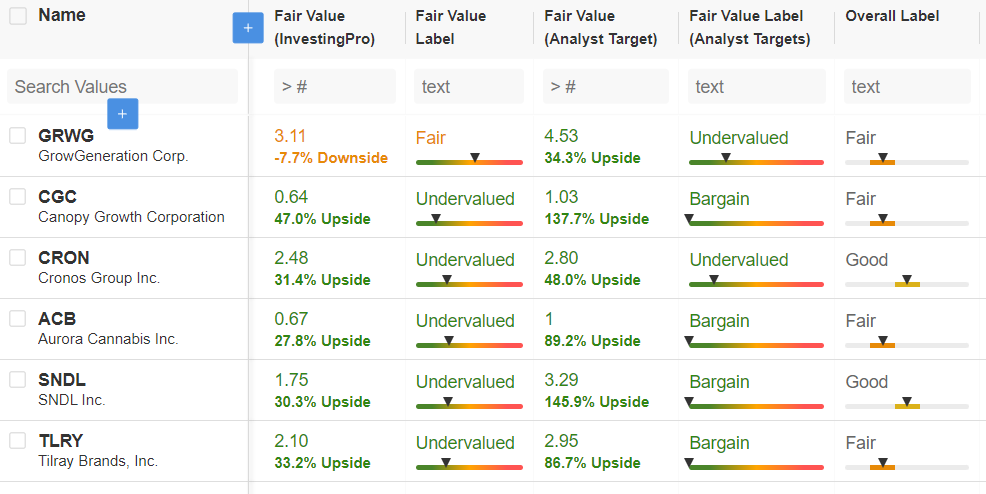

For this purpose, we turn to InvestingPro, mainly the Advanced Watchlist tool, where we have compiled the key U.S.-listed cannabis stocks: Tilray (NASDAQ:TLRY), Canopy Growth (NASDAQ:CGC), Aurora Cannabis (NASDAQ:ACB), Cronos Group (NASDAQ:CRON), GrowGeneration Corp (NASDAQ:GRWG), and SNDL (NASDAQ:SNDL).

Source: InvestingPro

Based on an initial analysis, we observe the following:

- All these stocks are considered undervalued or bargain opportunities by analysts.

- Analysts predict strong growth for these stocks in the next 12 months, with expected performance ranging from +34.3% to +197.3%.

- Except for one, all stocks are considered undervalued according to InvestingPro's models.

- All stocks have an average financial health score, either "fair" or "good."

In other words, these initial findings confirm that cannabis stocks could present high-potential investment opportunities, albeit not without risks.

SNDL: Best Cannabis Stock to Buy?

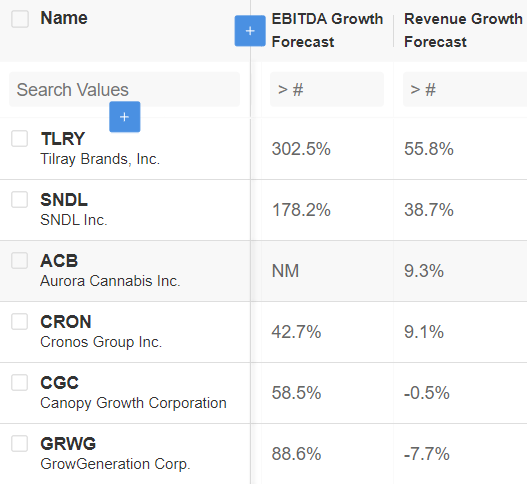

To identify the best cannabis stock to buy for the second half of 2023, we start by eliminating stocks with an overall "fair" financial health score. This narrows down the list to Cronos Group and SNDL. Our preference leans towards SNDL, mainly due to analysts' EBITDA and revenue growth projections.

Analysts anticipate a 178.2% EBITDA growth for SNDL over the next 12 months, while revenues are expected to increase by 38.7%, according to InvestingPro.

Source: InvestingPro

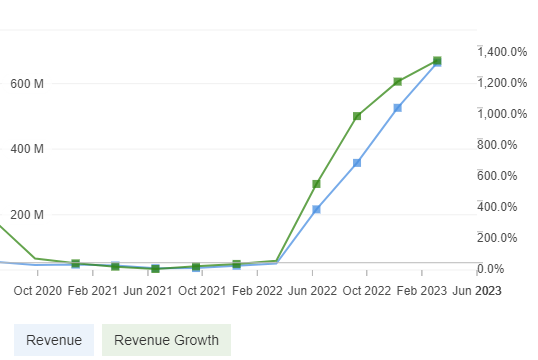

Examining the financial metrics' evolution in recent years, we note that revenues have surged since the second quarter of 2022, as shown in the chart sourced from InvestingPro.

Source: InvestingPro

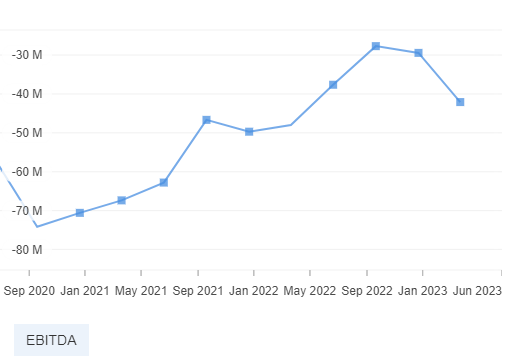

Regarding EBITDA, although there have been some recent declines, the overall trend remains positive:

Source: InvestingPro

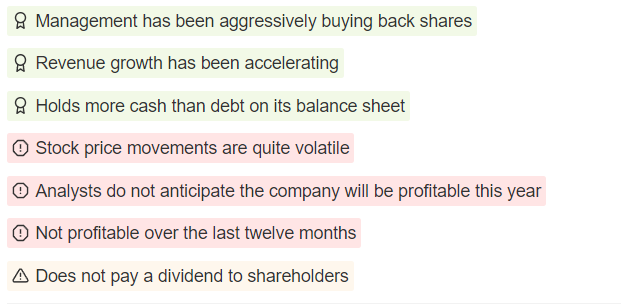

Furthermore, InvestingPro's company profile summary highlights aggressive share buybacks by the management and a stronger cash position than debt on the balance sheet.

Source: InvestingPro

However, like most cannabis stocks currently, InvestingPro acknowledges the stock's volatility and the company's lack of profitability over the past 12 years, with analysts expecting a similar scenario for the current fiscal year.

Conclusion

Cannabis stocks, which have yet to rebound after over two years of a powerful bearish trend, undoubtedly present a risky bet. However, the currently extremely low valuations and favorable long-term prospects of the cannabis market as federal legalization approaches make cannabis stocks a high-potential investment opportunity worth considering for bold investors.

Access first-hand market data, factors affecting stocks, and comprehensive analysis. Take advantage of this opportunity by visiting the link and unlocking the potential of InvestingPro to enhance your investment decisions.

And now, you can purchase the subscription at a fraction of the regular price. So, get ready to boost your investment strategy with our exclusive summer discounts.

As of 06/20/2023, InvestingPro is on sale!

Enjoy incredible discounts on our subscription plans:

- Monthly: Save 20% and get the flexibility of a month-to-month subscription.

- Annual: Save an amazing 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Annual (Web Special): Save an amazing 52% and maximize your profits with our exclusive web offer.

Don't miss this limited-time opportunity to access cutting-edge tools, real-time market analysis, and expert opinions.

Join InvestingPro today and unleash your investment potential. Hurry, the Summer Sale won't last forever!

Disclaimer: This article was written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel, or recommendation to invest, nor is it intended to encourage the purchase of assets in any way.