Japanese Bitcoin treasury Metaplanet surges on $620 mln buy

Q1 earnings season is drawing to a close for the retail sector on a slightly positive note. Despite the massive disappointment in retail sales reported earlier this week, the majority of the industry's companies have reported above-consensus Earnings Per Share (EPS).

In our Pro research of the week, we will delve into these results to identify the best stock within the sector to consider buying right now.

InvestingPro users can do the same analysis for every industry just by signing up on the following link: Try it out for a week for free!

Screening the Retail Sector

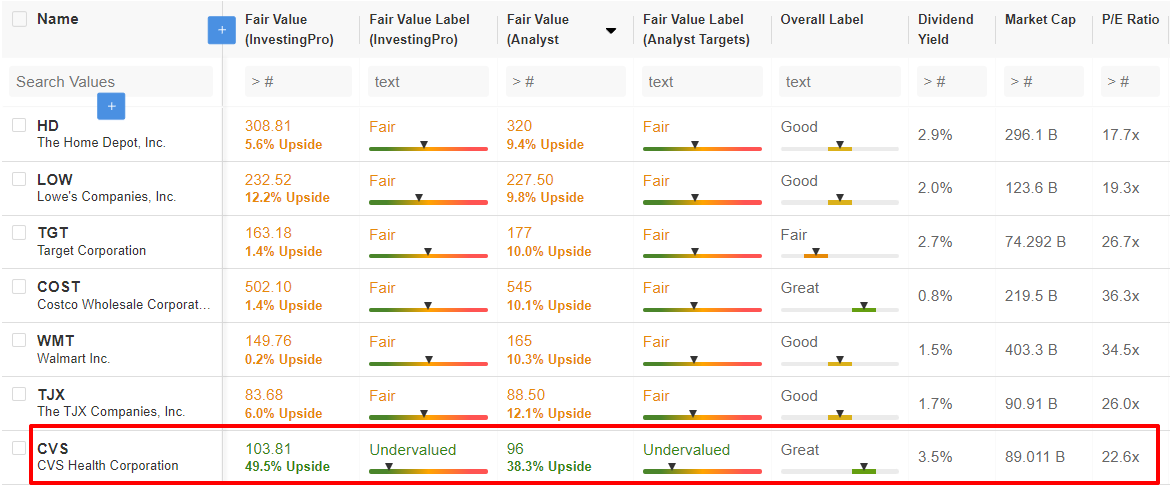

We begin our research by putting together an InvestingPro Watchlist featuring seven prominent U.S. retail stocks based on their market capitalization (excluding Amazon (NASDAQ:AMZN) as it falls under the technology category).

The companies on our list include Walmart (NYSE:WMT), Home Depot (NYSE:HD), Lowe's (NYSE:LOW), Target (NYSE:TGT), Costco (NASDAQ:COST), TJX Companies (NYSE:TJX), and CVS Health (NYSE:CVS).

Source: InvestingPro, Watchlist screen

In this list, we have included the InvestingPro Fair Value (which consolidates multiple reputable financial models), its bullish potential, label, average analysts' valuation, and objectives for your reference.

Additionally, we have analyzed the dividend yield, P/E ratio, and overall financial health score.

Among the stocks listed, the majority demonstrate limited upside potential based on InvestingPro's Fair Value or the average analysts' targets. However, one stock notably stands out: CVS Health.

Zooming Down on the Potential Winner

Based on the aforementioned metrics, CVS Health emerges as a standout choice due to its substantial upside potential of nearly 50% according to InvestingPro Fair Value and over 38% according to analysts' targets. Furthermore, both Fair Value and analysts classify the stock as "undervalued."

It is noteworthy that CVS Health, along with Costco, is one of only two stocks on the list to receive the highest possible overall financial health score. A more detailed analysis of CVS Health's financial health score on InvestingPro reveals the company's strong profitability.

It is important for investors to recognize that while CVS Health is indeed a major player in the U.S. retail sector, its focus on healthcare services and pharmaceuticals sets it apart from the other stocks on the list, resulting in different characteristics and outlook. Notably, with economists predicting an imminent recession, CVS Health proves to be a prudent choice in the sector, as healthcare spending tends to be less affected than discretionary spending during periods of economic weakness.

Another factor that deserves attention is CVS Health's decline in year-to-date performance, which presents a potential opportunity for investors to acquire the stock at an attractive price.

Source: Investing.com

At the May 17 close of $69.43, CVS Health was down more than 24% from the beginning of the year.

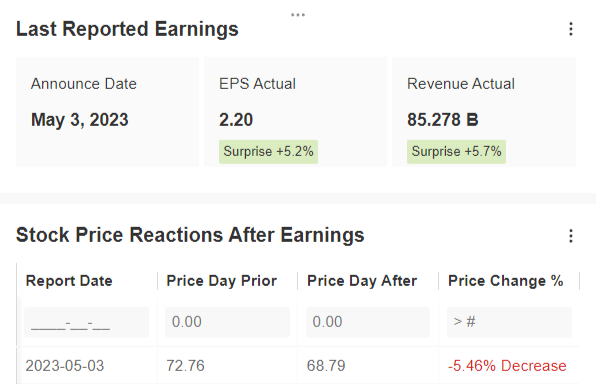

It is also interesting to note that the latest quarterly results released on May 3 exceeded expectations in terms of both earnings and revenue. Still, the stock reacted strongly negatively the next day, dropping more than 5%.

Source: InvestingPro Earnings screen

Deep Diving Into CVS' Financials to Ensure They're Solid

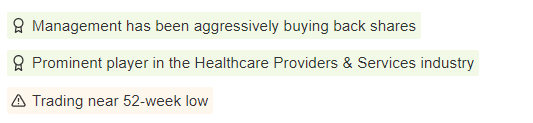

In other words, there is reason to believe that the stock may have been unfairly punished, suggesting a buying opportunity as it sits near its 52-week low, as highlighted by the company's strengths highlighted on the InvestingPro fundamental analysis tool.

Source: InvestingPro Company Profile screen

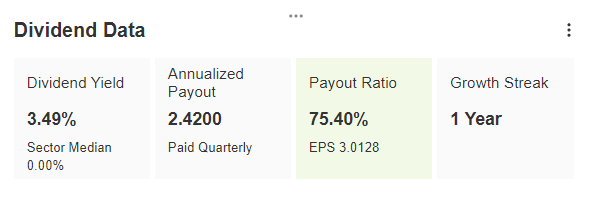

Dividend and profitability also warrant interest in CVS Health.

Source: InvestingPro Dividends screen

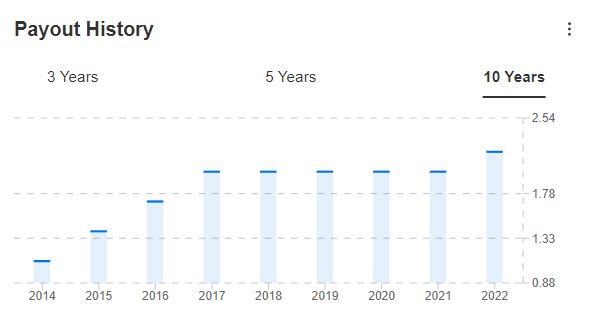

Another strength of CVS Health stock is its dividend, which currently represents a yield of 3.49%.

Source: InvestingPro Dividends screen

In addition, after several years of stagnation, CVS Health increased its dividend in 2022, and results released since then suggest that payouts could be raised again in 2023.

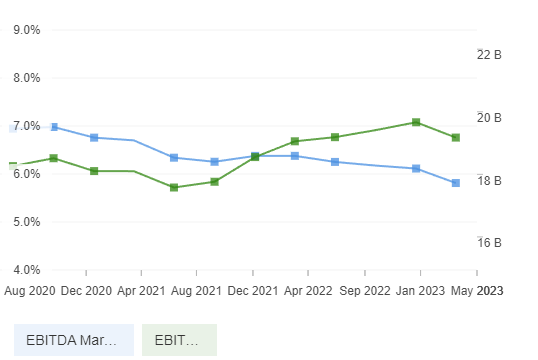

As noted above, profitability is one of CVS Health's stock strengths.

Source: InvestingPro Charts screen

While EBITDA and EBITDA margins have weakened slightly according to the latest quarterly data released, these metrics remain well within the top tier relative to other comparable companies.

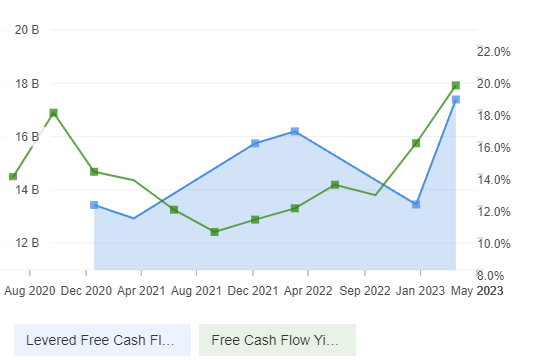

Source: InvestingPro Charts screen

In addition, the leveraged free cash flow and free cash flow yield have improved significantly over the past quarter.

Conclusion

With the threat of an economic slowdown, investors should be cautious about gaining exposure to large U.S. retailers. That's why CVS Health, focusing on healthcare and pharmaceuticals, seems like a defensive choice.

Moreover, the company's financial strength is not in doubt based on InvestingPro data, and the stock's sharp year-to-date decline suggests a tactical opportunity that could yield considerable gains based on InvestingPro Fair Value and analyst targets.

Try InvestingPro free for 7 days to do your own research and prepare your portfolio for the turbulent times ahead!

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or investment recommendation. As such, it is not intended to incentivize the purchase of assets in any way. I want to remind you that any type of asset is evaluated from multiple points of view and is highly risky; therefore, any investment decision and the associated risk remain with the investor.