Gold prices rebound as risk-off mood grips markets; US payroll data awaited

An eventful week for the Rand to say the least!

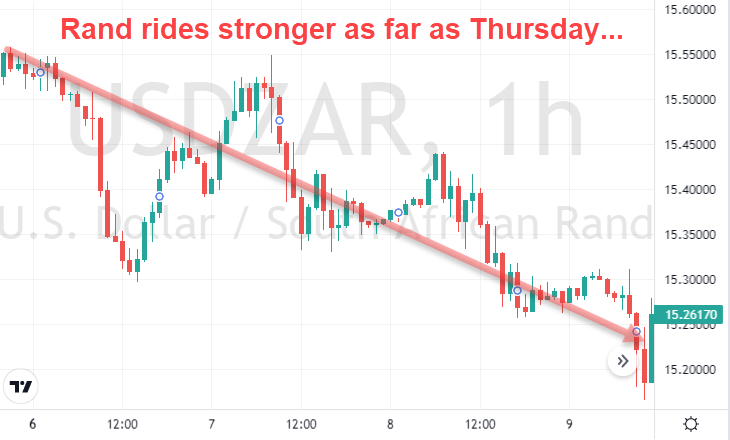

The local unit continued to make an impressive recovery, reaching its best levels since April on Thursday morning only to give it all back by Friday afternoon.

Ongoing volatility and tensions have continued to impact inflation rates, with markets globally being affected amidst growing concerns that the end is nowhere in sight.

However, the resilience shown by the Rand in a turbulent global market has certainly been eye-catching among emerging markets (not as eye-catching as the Ruble!) - but to hold onto that resilience through the week was just a bridge too far.

Perhaps it is the weight of major uncertainty and skepticism around the major local issues and events on the horizon, let’s have a look at the full review to shed some light on what we can expect.

Key Moments (6-10 June 2022)

Before we get into the Rand's activities, here were the biggest talking points of the week:

- US Inflation Soars - Friday marked the release of the US CPI figures which made for some grim reading, with the consumer price accelerating by 1% during the month.

- SA GDP - a strong showing on the GDP front brought some cheer to the week for the Rand, as hopes for more economic recovery were boosted

- Market Volatility - forex, stocks, cryptos, you name it - it didn't seem to matter what market was, but economic releases on Friday sent markets running for cover.

So getting back to the Rand, while our forecasts from Friday indicated an imminent bottoming out, the week kicked off with the local unit barrelling on and gaining ground against the major currencies. The market opened at R15.54 and sharply gained further ground on Monday, reaching R15.31 by midday, with similar improvements being seen against the Euro and the Pound.

It was a big week in terms of economic events, with SA's GDP, US Inflation, EU interest rates and more expected to come into the spotlight as key triggers for Rand movement.

And while the Rand was a little uneasy through the week, losing some of Monday's gains, by the time we got to Wednesday (GDP Day), it was now testing R15.20 levels.

GDP arrived...and it brought good news!

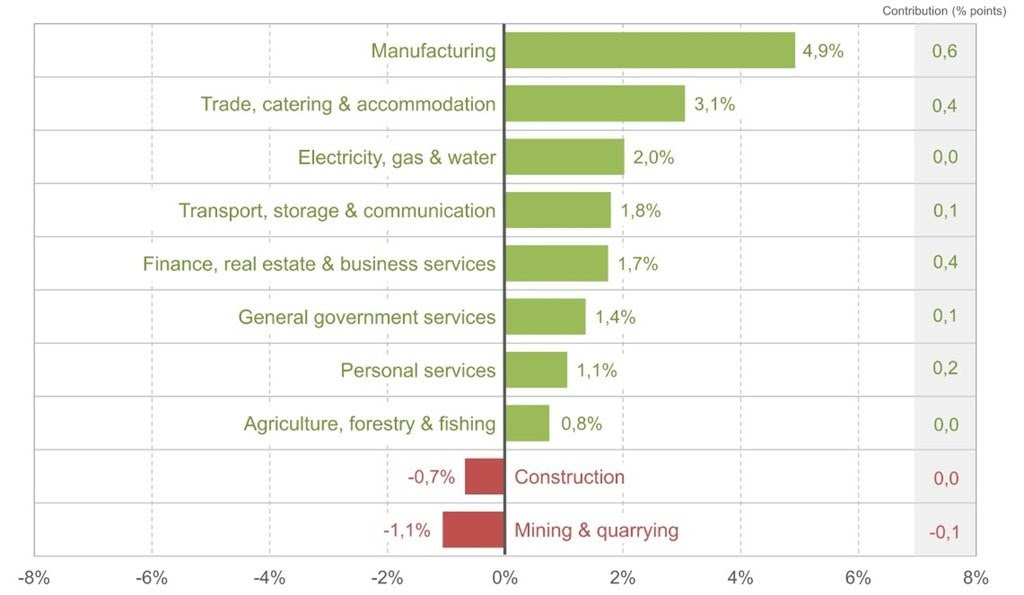

The results were stronger than expected in the first quarter of 2022, with real gross domestic product (GDP) growing by 1.9% from the previous quarter. The manufacturing sector saw strong growth of almost 5%, driven by a rise in the production of petroleum and chemicals, food and beverages, and metals and machinery.

Following it, the Rand rode still deeper into the R15s, hitting R15.16 on Thursday!

However, investors were cautious as inflation continued to be a major concern both locally and internationally. And global stock markets took a hit on Thursday as a rally in oil further ramped up the inflation fears...

Those fears were further increased by the ECB's announcement confirming its intention to hike interest rates at the policy meeting next month....having already downgraded its growth forecasts.

But, despite all that, as of midday Thursday, things were looking rosy for the Rand:

And then in other news:

- Second-quarter GDP is expected to be hit by the impact of flooding in KwaZulu-Natal and increased load shedding, as well as the knock-on effects of the Ukraine conflict, which have impacted on higher food and fuel prices. In addition, higher interest rates are also expected to weigh on growth. This will be key to watch to see if Q1 was a fluke, or if the GDP recovery can overcome these kinds of problems...

- South African National shutdown threats are always around and cannot always be believed...but social media posts and chat groups have been widely sharing warnings and from security group Fidelity, allegedly detailing contingency plans for a national shutdown across the country in response to the rising fuel and basic goods costs. Concerns are growing, as similarities are emerging that were present prior to the unrest that took place in July 2021....

- Over in the EU, the ECB announced that they would deliver a rate hike of 25bps (first since 2011) next month and join most other major central banks in fighting inflation - it seems no one can escape it!

- And internationally, Biden plans to visit European allies Germany and Spain later this month as he tries to hold together the coalition opposing Russia’s military operations in Ukraine. As the Russia/Ukraine conflict continues, with no end in sight, Biden's control of the situation is not confidence inspiring.

And then we rolled into Friday. And just like that, fears turned into reality with the release of the US inflation rates. CPI jumped by 1% which was higher than expected, to say the least!

Some of the headline figures included gasoline increasing by 4.1%, food by 10.1%, and energy by an eye-watering 34.6% over the last year.

Inflation overall rose 8.6% in May - the highest since 1981!

And along with that, analysts and officials have said consumers were unlikely to get much reprieve until crude - a key driver of inflation - was brought under control.

On the local front though, South Africa’s inflation when compared to the rest of the world isn’t too bad having not breached 6%...yet, that is!

While things may still look fairly favourable on that front for SA, it is really a only a question of how long before the sufferings of other countries like the US will filter down to SA?

All the while, China is still battling with lockdown restrictions, further hampering productivity and manufacturing, which is having a material impact on prices - combined with the rising shipping costs for countries like SA or really most places in the world, these kinds of struggles of major manufacturing countries will without a doubt have an effect on inflation going forward.

But getting back to the Rand, things took a nasty turn as the end of the week drew near.

We had expected a reversal, based on our published forecasts, and we got one in spectacular fashion, as Thursday afternoon and Friday turned the market on its head, with the Dollar/Rand exploding all of 70c in a matter of hours!

Eish!

What had been such a promising week was turned into a disaster in no time at all!

And it was not just the Rand, as stock markets also tanked on Thursday late and into Friday on the back of the inflation news.

A whirlwind week eventually came to a close with the local unit trading near R15.90 again!

Time to take a breath....phew!

The Week Ahead (13-17 June 2022)

Q2 is rapidly coming to an end and the Rand has certainly navigated a few tricky weeks and slowly claw back the ground lost in April only to give a large chunk back later in the week.

Russia is expected to dominate headlines as they continue to impose sanctions on cross-border transactions, while the current battle for Sievierodonetsk could determine the direction of the broader battle for the Donbas.

With 2 months of gradual improvement were undone on Friday for the local unit, it leaves things in a rough situation for Saffers facing rising costs of fuel and goods.

Looking at the week ahead, there are some of the triggers that we are looking at for potential market movers:

- SA - Retail Sales

- US - Retail Sales, Interest Rate Decision, FOMC Economic Projections, Fed Press Conference, Jobless Claims, Fed Powell Speech.

- EU/UK - Balance of Trade, Goods Trade Balance, Unemployment Rate, Interest Rate Decision

The question is - can the Rand again prove resilient and make back the lost ground or has the trend changed? And our latest published forecasts are giving us some strong suggestions as to what lies ahead.

This is the kind of information that you need at this time to help keep a clear head with the right information when you need it.

So that you can make informed and educated decisions, that will enable you to take the right action - at the right time.

While many will be trying to decipher from all these news events where the markets are expected to head, we will instead be filtering out all the noise by simply watching what our Elliott Wave-based forecasting system is telling us.