AI-picked stocks now up 150%+; an 111% outperformance vs. the S&P 500

This article was written exclusively for Investing.com.

- Rare earth metals are critical for technology and a greener energy path

- China dominates the rare earth metals market

- China flooded the market to eliminate competition over the past years and now can squeeze consumers

- A strategic imperative for US national security - Afghanistan could increase Chinese dominance

- REMX is a rare earth metals ETF product

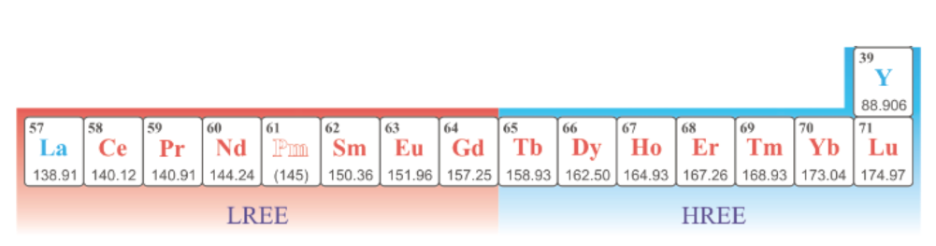

Rare earth metals are a group of seventeen elements. The fifteen members of the lanthanides on the periodic table together with scandium and yttrium comprise the group.

The rare earth metals include:

Source: https://lynasrareearths.com/products/what-are-rare-earths/

The chart shows the rare earth metals are categorized into light elements (lanthanum to samarium) and heavy elements (europium to lutetium). The heavier elements are rarer and more expensive to extract from the earth’s crust.

Rare earth metals are the commodities of the present and the future. They do not trade on futures exchanges, only in the physical market. China is the world’s leading producer of rare earth metals, and the country controls the market via strategic investments worldwide.

While the US, Europe, and other countries seek to increase rare earth metals production, the recent events in Afghanistan may only increase China’s dominant position.

Meanwhile, rare earth metals are critical ingredients for technology, and prices are rising. The VanEck Rare Earth/Strategic Metals ETF (NYSE:REMX) holds shares in companies that extract the elements from the earth’s crust.

Rare earth metals are critical for technology and a greener energy path

Rare earth metals are excellent electricity conductors, have unique magnetic properties, are luminescent, and have electrochemical properties. They are durable and lightweight, silvery-white, and soft, making them critical components for high-tech products. Permanent magnets account for approximately 38% of the total annual production.

The green energy revolution only increases the demand for rare earth metals as they are crucial ingredients in rechargeable batteries for electric and hybrid vehicles and wind turbines. Rare earth metals are also required for advanced ceramics, catalysts in vehicles and oil and petrochemical refineries, monitors, televisions, lighting, lasers, fiber optics, superconductors, glass polishing, and many other products. The rare earths are requirements for many military products, including night vision goggles, high-tech weaponry, radar systems, and others.

The metals are rare because they occur in other elements, making mining expensive.

China dominates the rare earth metals market

China is the 800-pound gorilla in rare earth metals production as it supplies over 85% of the world’s requirements. China produces rare earth metals within its borders. However, the foresight of the importance of the metals caused the Chinese to invest in production worldwide to secure supplies, leading to domination in the high-tech commodities.

The US views China’s rare earth domination as a national security issue. The administration has encouraged building a domestic supply chain. However, mining and processing rare earth metals is a dirty business that creates environmental challenges as the US addresses climate change. Ironically, the metals that are components of clean energy initiatives themselves create substantial environmental threats as mining and processing release hazardous byproducts into the atmosphere.

China flooded the market to eliminate competition over the past years and now can squeeze consumers

In 2019, China supplied 85% of the world’s rare earth element requirements. The leading destinations were Japan, the US, South Korea, and Italy.

A 2018 US Defense Department report documented how the Chinese strategically flooded the market with rare earth metals to push prices down and deter production and competition.

China is positioned to squeeze the rest of the world for higher prices or hold countries hostage for the strategic elements for political reasons. Deteriorating US-Chinese relations could threaten supplies for the US and its allies in Europe and other regions. At best, higher prices are on the horizon. At worst, China could cut the supply chain leaving consumers scrambling.

A strategic imperative for US national security - Afghanistan could increase Chinese dominance

Rare earth metals are a strategic necessity for the US. The world’s most powerful nation is looking to develop new supply chains. Meanwhile, the US threw in the towel on a region that is rich in the elements when it departed Afghanistan in August. It took twenty years of war, four US Presidents, billions if not trillions of dollars in military expenditures, and many lives to replace the Taliban with the Taliban. As the US departed, China was licking its chops.

China is extending a cooperative hand to the Taliban. Beijing signaled the Chinese government is prepared for “friendly cooperation with Afghanistan.” On the surface, the Taliban is a valuable ally for China in Southern Asia. Below, Afghanistan is home to substantial rare earth metals reserves. Chinese expertise in mining and processing the elements will only increase the country’s dominant position in the commodities that are integral ingredients for technological advances.

REMX is a rare earth metals ETF product

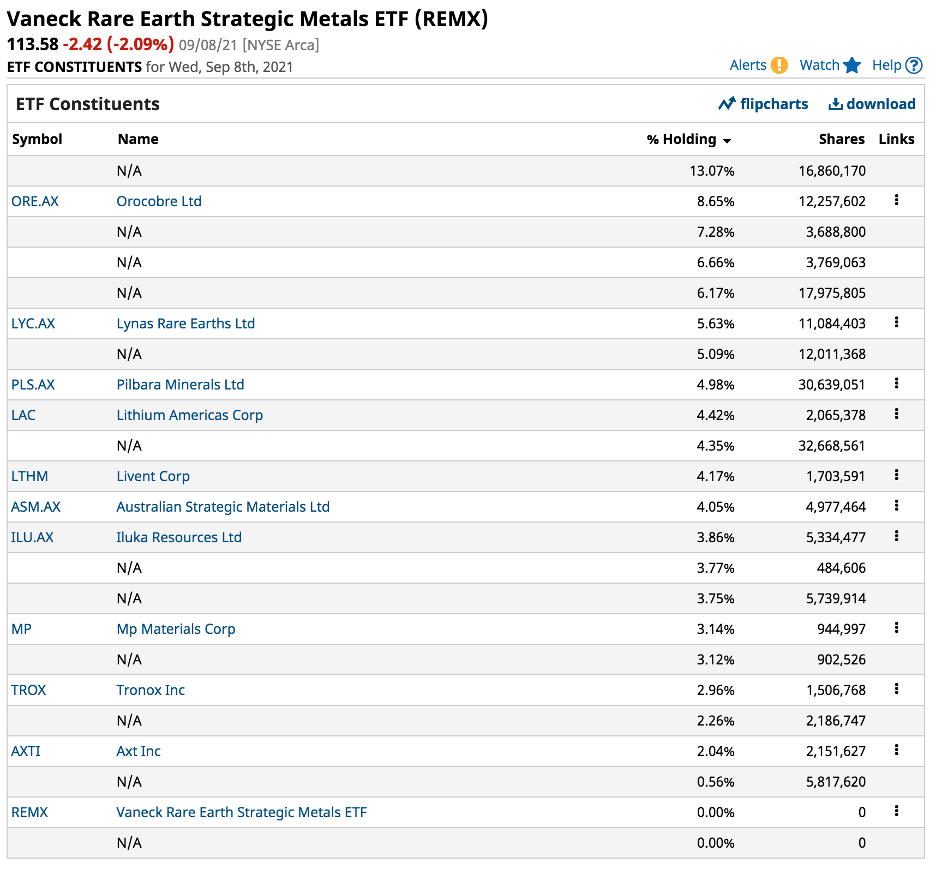

The VanEck Rare Earth/Strategic Metals ETF holds shares in companies that benefit from rising rare earth metals prices. The most recent top holdings include:

Source: Barchart

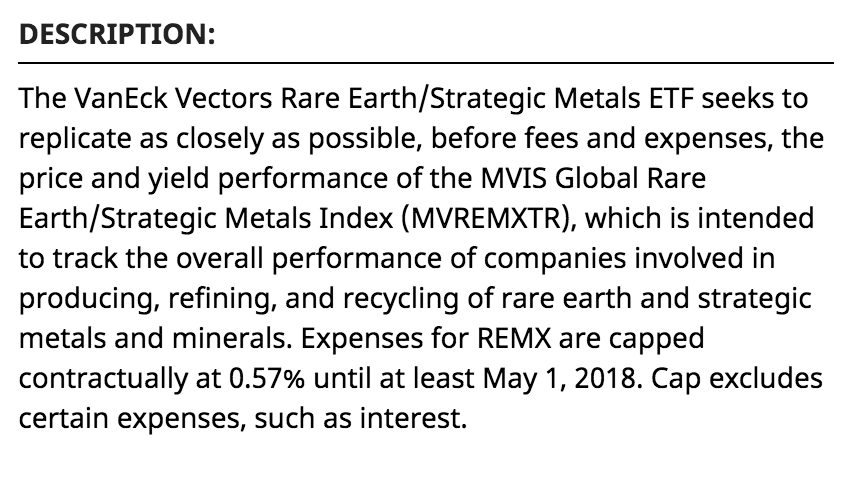

At the $113.58 per share level on Sept. 8, REMX had $1.054 billion in assets under management. The ETF trades an average of 208,589 shares each day and charges a 0.59% management fee. The fund summary states:

Source: Barchart

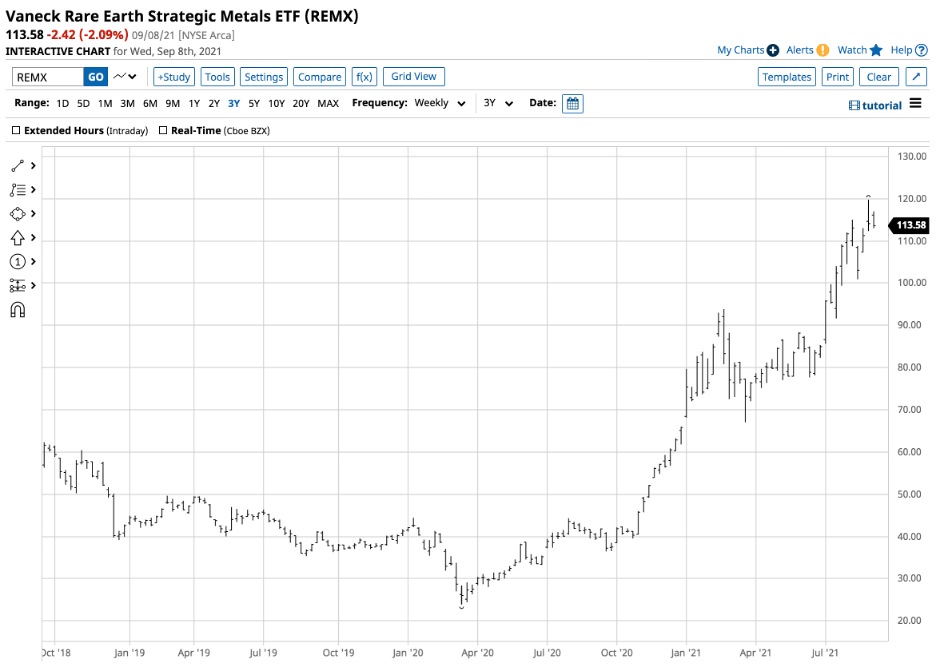

Since March 2020, when commodity prices reached bottoms during the height of risk-off selling at the beginning of the spread of the coronavirus pandemic, REMX exploded to the upside.

Source: Barchart

The chart highlights the rise from $23.91 per share on Mar. 16, 2020, to the most recent high at $119.76 on Aug. 31. The over 400% gain over the past seventeen months is a sign that the rare earth metal’s squeeze is in full force as China extracts the majority of supplies from the earth’s crust and extracts the highest possible price from consumers worldwide.

With China in control, and the prospects of even more supplies from Afghanistan under its umbrella, the bullish trend is likely to continue.