Moody’s downgrades Senegal to Caa1 amid rising debt concerns

President Trump’s 100th day doesn’t come until April 29. It feels like it’s been more like 1,000 days. If you feel utterly confused and have no idea what’s going on, know that you’re not alone. Luckily, the markets can tell us a lot of information even when they are in a state of massive confusion.

What is clear is that the S&P 500 does not like the 5,450 level. There have now been four attempts to break out that have failed. There is nothing that stands out as special about that area from a technical standpoint, that I can tell, and I’ve tried looking at and measuring it from a few different angles.

The other thing it tells me is that my view that another leg lower started seems to be wrong, at least for now. However, the fact that 5,450 has been tested a few times and remains a wall is not a good sign for where the market is heading next.

Now that we have two lower gaps, I would guess that we fill the lower gap at 5,260.

What is also probably not a good sign is that the 10-year Treasury finished the day down just two bps. It was like the little engine that could, and kept working all day long to pull itself up the hill, after it fell 15 basis points to start the day. That is quite the feat, and more impressively, it seems that many sellers prefer the 4.25% region.

A lot has been thrown at this bond market – the kind of stuff that should send rates lower, too – yet they won’t drop. I hate to say it, but that probably means rates are going to be heading much, much higher.

There could be a good reason for that, according to S&P Global, the US Flash PMI yesterday noted that input costs in the manufacturing sector increased at the fastest rate since August 2022.

In the meantime, reverse repo activity has been picking up as expected, rising to $171 billion yesterday. Meanwhile, the TGA as of April 22 was at $606 billion. That would mean the TGA is down about $30 billion compared to last week’s $638 billion, while the Reverse Repo Facility is up by around $120 billion, from last week’s $54.7 billion.

So I would guess that reserve balances are probably down about $90 billion this week, to about $3.2 trillion from last week’s $3.28 trillion.

A significant amount of liquidity has been removed from reserves over the past two weeks.

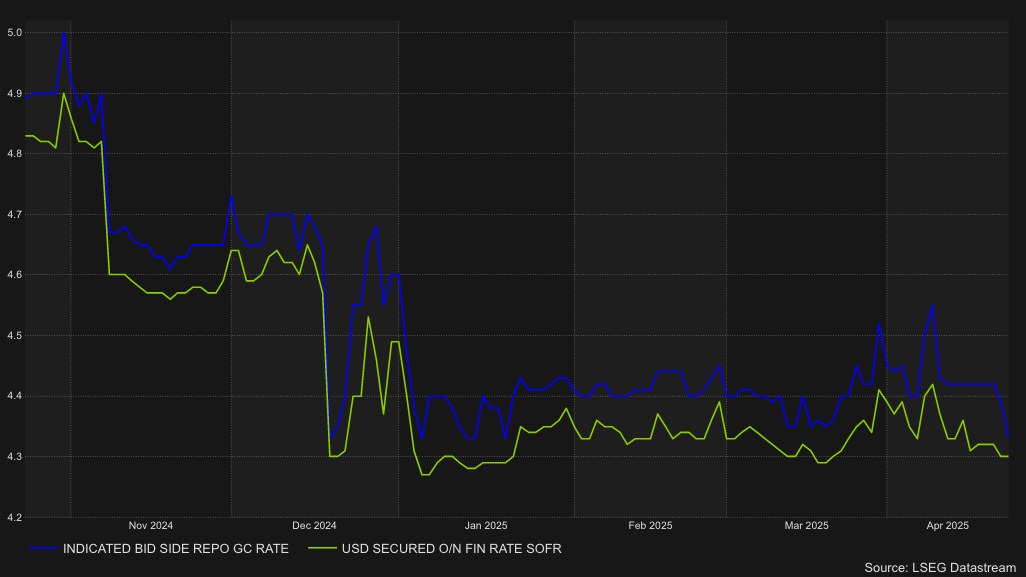

We tend to see general collateral rates fall this time of the month, and then begin to tighten up again by the end of the month. We saw the same thing heading into the end of March. But there are fewer reserves available yesterday than there were a month ago, so I will keep an eye on SOFR in the mornings. The higher it goes, the tighter the liquidity conditions in the market. Things have been fairly loose the last couple of days.