United Homes Group stock plunges after Nikki Haley, directors resign

Markets are understandably skittish about the health of the financial sector, which allows bonds to act as a safe haven. We would be wary of acting on large market moves ahead of a week heavy in event risks – but investors being sidelined might be just what causes such moves

A lot of reasons for bonds to rally, but no coherent narrative

The reasons for this week’s bond rally are manifold, but they don’t really add up to a coherent change in the macro narrative. Spanish PPI turning negative on both a monthly and annual basis caught markets off guard, just as Schnabel signalled a 50bp hike is on the table the evening before. A couple of more moderate views from Philip Lane and Francois Villeroy helped temper hawkish momentum, but we also think a return of banking worries put investors on alert for a repeat of the bond rally that took place after the Silicon Valley Bank (SVB) failure.

A return of banking worries put investors on alert for a repeat of the bond rally that took place after the SVB failure

Despite a further sell-off in First Republic Bank (NYSE:FRC) shares after its results were published, it is European financials that dragged their domestic equity indices down and provoked a further move to safe havens. This negative correlation between bonds and stock prices – long the norm, though all but vanished in 2022 – probably warrants an explanation. A slowing economy and inflation probably helped on that front. Still, we think it is the growing concern over trouble in the financial sector spilling into the real economy that is allowing investors to give bonds some of their safety value back.

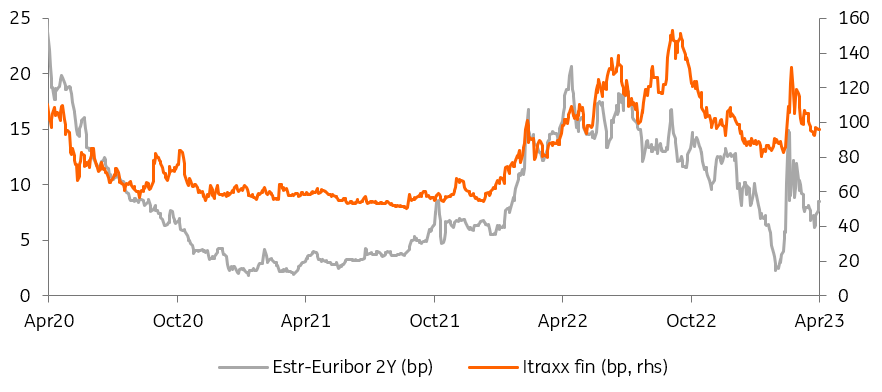

For now, however, systemic stress indicators remain at manageable levels. Estr basis and financial CDS indices have ticked up but remain well below stressed levels.

- Systemic risk indicators have ticked up this week, but remain below stressed levels

Source: Refinitiv, ING

Sidelined investors, and a sizeable short base

As always, market context matters. We’ve flagged recently that yields were approaching the top of their post-SVB range, which may well have provided a signal for dip-buyers to emerge. It should be said at this point that with a lot of event risks on the horizon, including inflation measures, central bank meetings, and banking sector surveys, many investors are probably sidelined. It is likely a reluctance to fade moves, and a willingness to keep their powder dry, that magnifies this sort of move.

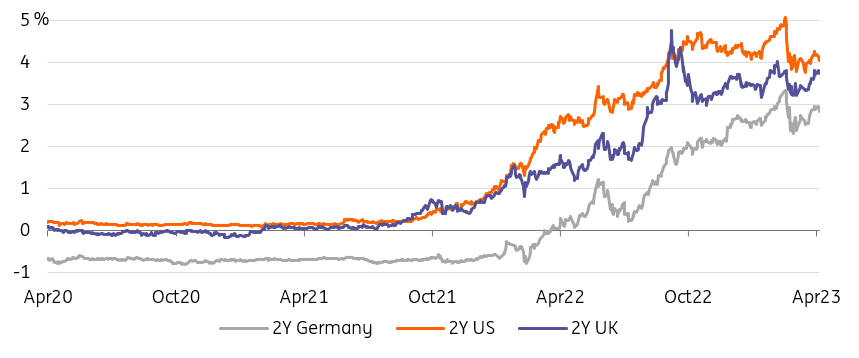

The large short base in treasury futures is another fact that is reminiscent of early March

Although the data come with many caveats – the main one being that not all bond future shorts are directional bets – the large short base in treasury futures is another fact that is reminiscent of early March, before 2Y rallied over 125bp in the space of two weeks. We would expect that post-SVB, appetite for directional rates has ebbed, but data contradicts this view. For what it’s worth, we agree with the direction of the move over the medium term as it is consistent with our view that inflation rates will converge with central bank targets – and there is some way to go before bond yields touch the bottom of their recent range.

- March rally in 2Y bonds should have dampened appetite for short positions but data suggests otherwise

Source: Refinitiv, ING

Today’s events and market view

Today the Riksbank concludes one of its five annual policy meetings, caught between high core inflation and a falling currency and housing market. We expect a 50bp hike and the door to remain open to more tightening.

Germany comes back to primary markets just one day after selling 2Y and 10Y debt. Today, the focus will be on the 15Y area, with two bonds on offer in the sector.

US economic releases consist of trade balance, inventories, and durable goods orders.

US durable goods orders stand the best chance of moving rates markets today but we suspect short term direction will be dictated by sentiment towards the financial sector (see above). It is not our base case but recent history has shown that these can spill over quickly into broader markets. Absent further contagion, the default mode for government bonds should be to reverse of some of yesterday's gains, reflattening yield curves as a result.

***

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more