Intel closes 23% higher after Nvidia takes $5B stake

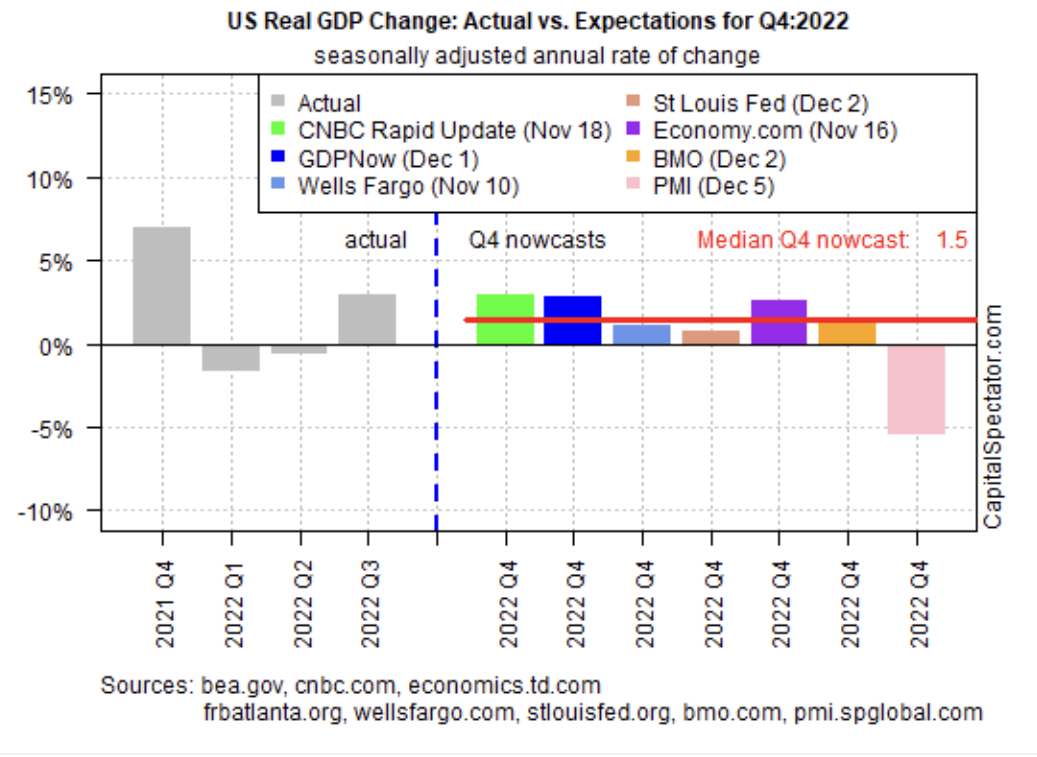

The nowcast offers a bright note amid swirling recession forecasts, but business-cycle indicators suggest that the Q4 GDP estimate will fade as new economic reports are published in the weeks ahead.

Today’s Q4 estimate indicates a modest 1.5% increase in Q4 GDP (seasonally adjusted annual rate). The nowcast reflects a substantial downshift from Q3’s 2.9% increase. The official Q4 data from the Bureau of Economic Research is scheduled for release on Jan. 26.

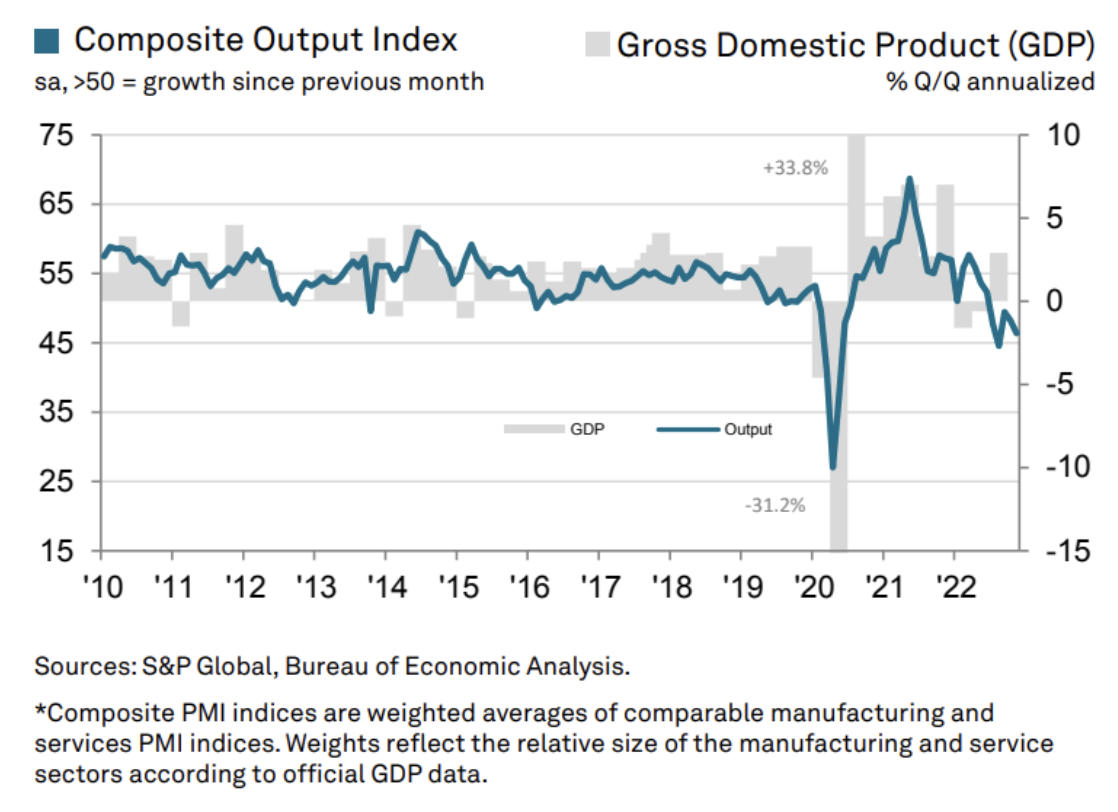

Today’s outlook offers a comparatively upbeat counterpoint to recession forecasts, but there are signs that economic activity may deteriorate as new numbers are published. One warning is found in the latest PMI survey data for November. The US Composite PMI Output Index, a GDP proxy, fell to 46.4 last month, which is well below the neutral 50 mark. The current reading equates with “a solid decline in private sector business activity,” advises S&P Global. “The fall in output was driven by a faster decrease in service sector activity and a renewed downturn in manufacturing production.”

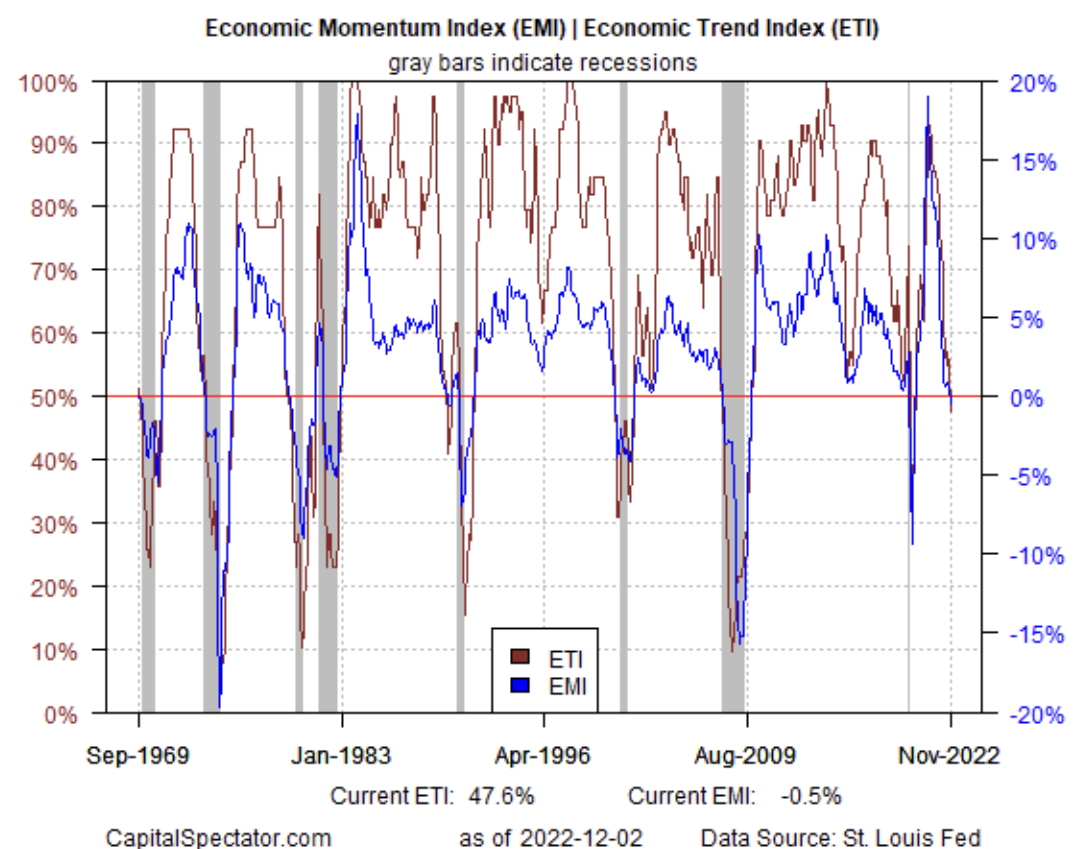

Meanwhile, this week’s edition of The US Business Cycle Risk Report indicates that a mild NBER-defined recession started in November, based on current estimates for the Economic Trend Index (ETI) and Economic Momentum Index (EMI). Both indicators fell below their respective tipping points that signal recessionary conditions.

There’s still a case for a “soft landing” for the economy as the Federal Reserve continues to raise interest rates, or so large bets on Wall Street suggest. Bloomberg reports that big money favors cyclical shares, which implies high confidence that the central bank will be able to tame inflation without triggering a recession.

The incoming numbers in the next several weeks could provide decisive evidence in one way or another. Meanwhile, a broad reading on economic and financial indicators suggests the die is cast, and economic activity, if it isn’t already contracting, will soon begin to.