TSX runs higher on rate cut expectations

US stock futures climbed, and the US dollar gained after China and the US made strong progress in trade talks, fueling hope that tensions will ease.

A regional stock index rose 0.7%, with the Hang Seng Index up for the eighth straight day, marking its best streak in a year. S&P 500 futures increased 1.5%, Nasdaq 100 jumped 2%, and European futures rose 0.8%.

Global bonds fell as Treasury yields rose and European debt futures dropped. Stocks in India climbed 3%, while those in Pakistan surged 9% after the two nations agreed to a ceasefire.

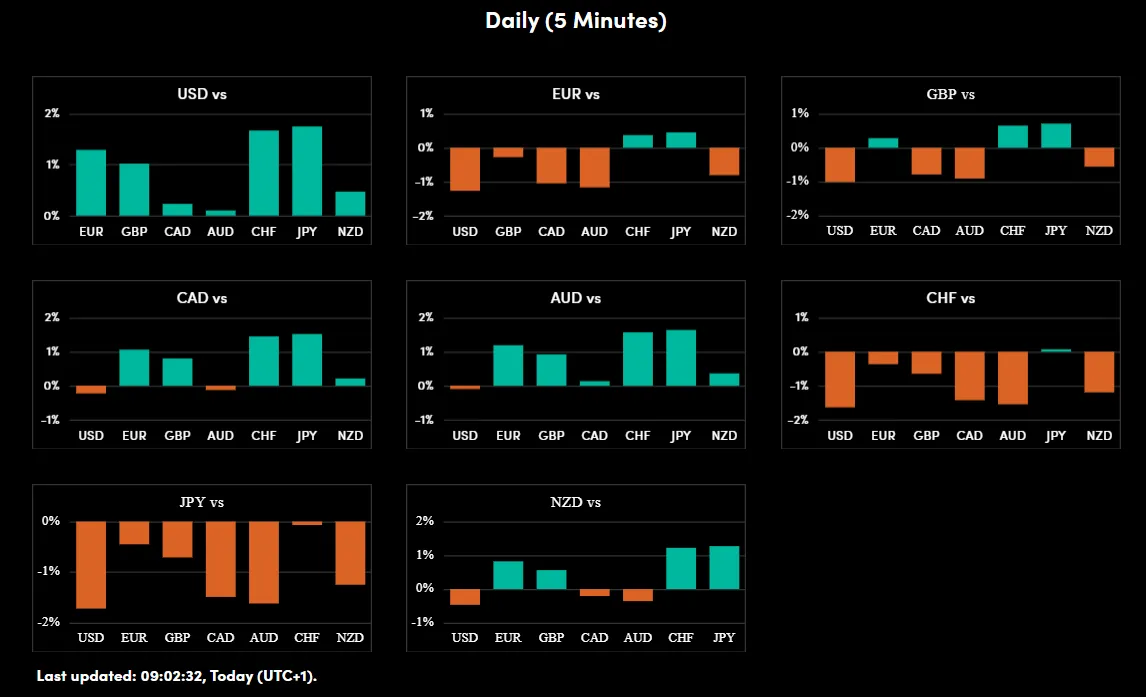

On the FX front, safe havens are struggling this morning as optimism over a trade deal fades. The dollar rose 0.4% to 145.93 yen and 0.5% to 0.8337 Swiss francs.

The dollar index stayed steady near a one-month high but remained 3.6% lower since the April 2 announcement of Trump’s "Liberation Day" tariffs.

The New Zealand dollar rose 0.3% to 0.5927, and the Australian dollar also gained 0.3% to 0.6432. Meanwhile, the euro dropped 0.2% to 1.1228, and the British pound fell 0.3% to 1.3288.

Currency Strength Chart

Source: OANDA Labs Blog

US-China Trade Talks

China’s Vice Premier He Lifeng called the weekend talks with US officials “an important first step” toward improving trade relations.

Though no specific actions were announced on Sunday, Lifeng said both sides agreed to set up a system for future discussions, to be led by US Treasury Secretary Scott Bessent and himself. Bessent promised more details and a joint statement on Monday.

Lifeng stressed that China-U.S. trade is about mutual benefits, rejecting the idea that one side must lose for the other to win. He said China is ready to work with the US to handle differences, strengthen collaboration, and “expand shared opportunities.”

Markets are likely to take cues from developments around the US-China talks and any announcements that are forthcoming. US Treasury Secretary Bessent to brief on China talks at 3 AM EST, according to U.S. officials.

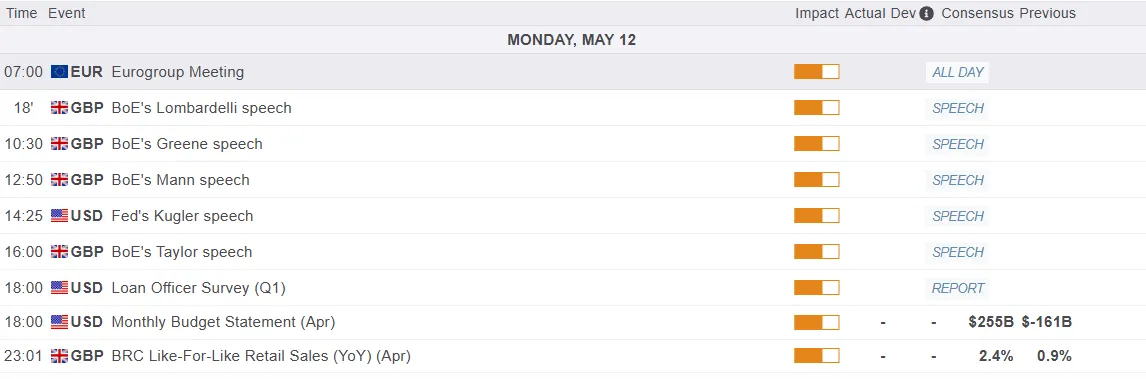

Economic Data Releases

From a data standpoint, it is a quiet start to the week. The biggest highlights will come from the Bank of England Bank Watchers conference 2025 at King’s Business School.

We will hear from BoE policymakers Lombardelli and Green, who are both speaking at the event.

Chart of the Day - DAX

From a technical standpoint, the DAX has gapped up over the weekend and pushed to within a whisker of the 24000 handle.

The DAX index has now printed all-time highs, but with a lack of historical price action, technical analysis remains somewhat of a challenge.

I will be paying attention to psychological level and round number,s which tend to illicit a response.

Resistance ahead may be found at 24250 and 24500.

Immediate support rests at 23471 and 23212, respectively.

DAX Daily Chart, May 12, 2025

Source: TradingView.com