Gold prices rise on weaker dollar, Fed easing bets; holds long-term appeal

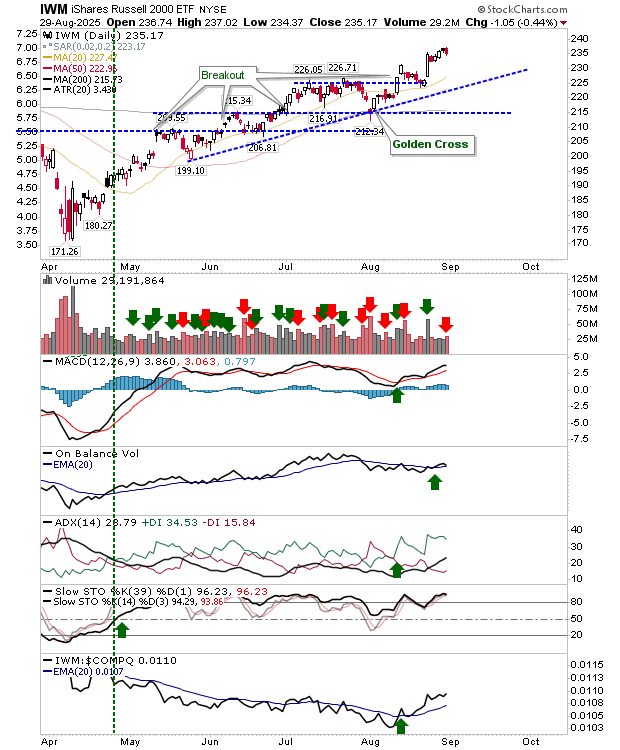

The Russell 2000 (IWM) holds its breakout advance with a small loss on confirmed distribution. Technials are net positive as relative performance continues its push higher.

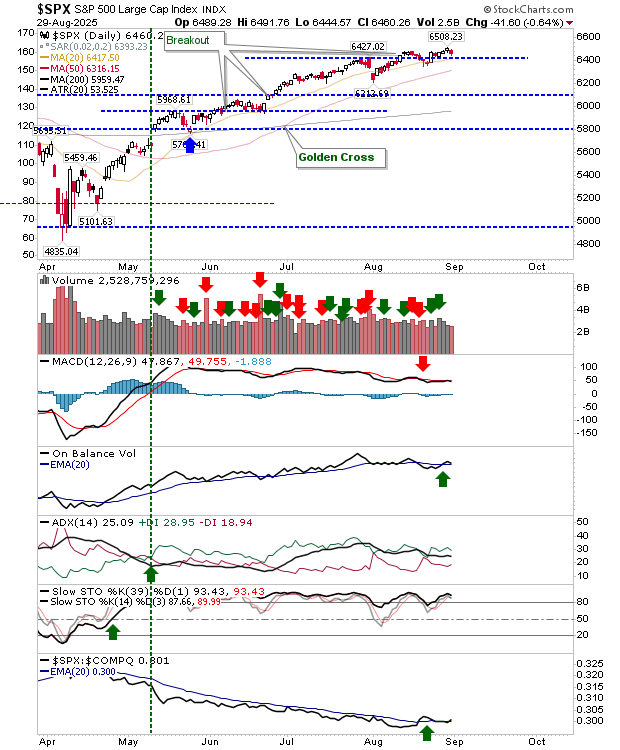

The loss in the S&P 500 tagged breakout support, but managed to eat back some of those losses before the close. Volume was down on the previous day, so no technical distribution. The index is still awaiting a new MACD ’buy’.

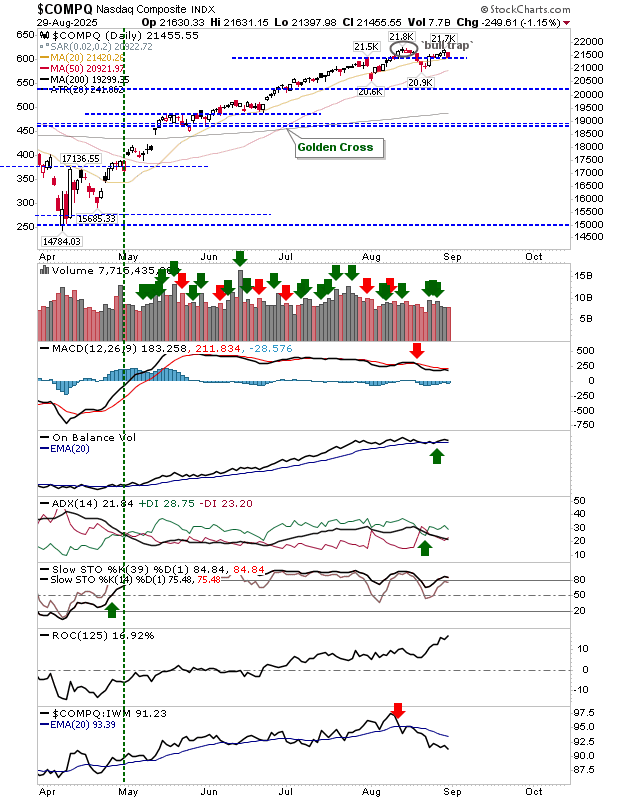

The Nasdaq lost just over 1%, and finished the week on breakout support. Like the S&P 500, it has a MACD trigger ’sell’ still to work off as other technicals remain bullish. When trading resumes next week, buyers will need to step up quick if this action isn’t to revert to a trading range.

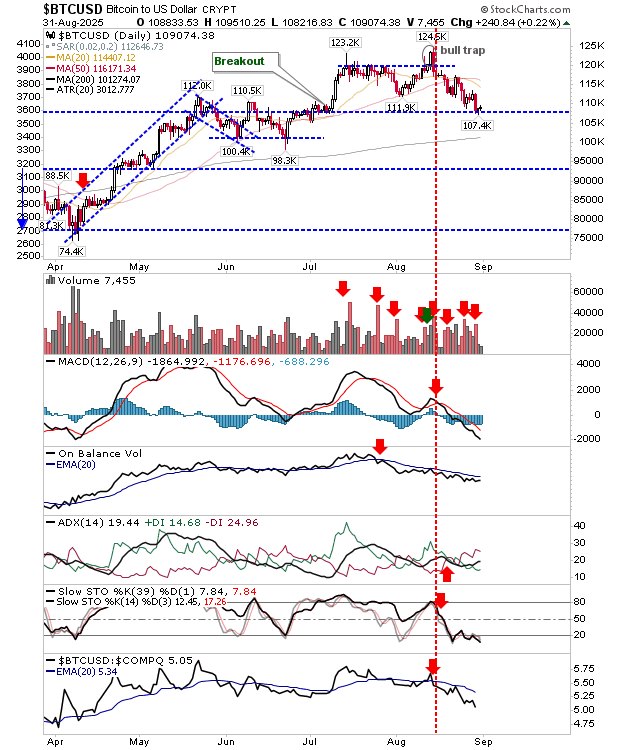

This week is also a big week for Bitcoin ($BTCUSD). There may be an aggressive ’buy’ here as it sits on support, but an undercut of $107K is likely to lead to a test of the 200-day MA. Technicals are strongly bearish and oversold.

While the Russell 2000 ($IWM) has already banked its breakout day, we still wait for a similar move for the S&P 500 and Nasdaq. Meanwhile, Bitcoin ($BTCUSD), while trading at support, looks more likely to test its 200-day MA.