Tyson Foods to close major Nebraska beef plant amid cattle shortage - WSJ

In this Sei (SEI) price prediction 2024, 2025-2030, we will analyze the price patterns of SEI by using accurate trader-friendly technical analysis indicators and predict the future movement of the cryptocurrency.

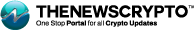

Sei (SEI) Current Market Status

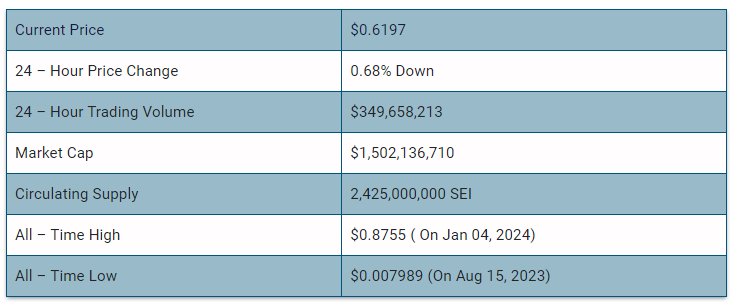

What is Sei (SEI)

Sei (SEI) stands out as a specialized Layer 1 blockchain, specifically tailored to enhance trading operations. Its primary objective is to empower exchanges with superior speed, scalability, and reliability. Positioned as a Layer 1 blockchain, Sei sets ambitious goals, targeting a high throughput of orders per second and ensuring transaction finality within an impressive 380 milliseconds. Notably, Sei prioritizes security, aiming to garner the trust of prominent institutions.

As an open-source platform, Sei incorporates features like native frontrunning protection, seamless interoperability, and advanced transaction bundling options. It is designed to adapt alongside industry developments, showcasing modularity that enables integration with emerging innovations as guided by the community. Sei’s genesis is rooted in addressing the demand for a more dependable, scalable, and swift blockchain tailored for trading, with ongoing evolution marked by environmental consciousness through proof of stake mechanisms, reflecting a commitment to minimal ecological impact.

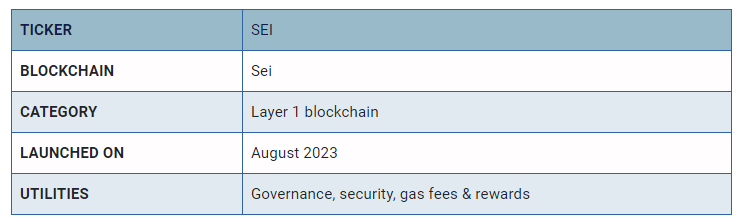

Sei 24H Technicals

Sei (SEI) Price Prediction 2024

Sei (SEI) ranks 46th on CoinMarketCap in terms of its market capitalization. The overview of the Sei price prediction for 2024 is explained below with a daily time frame.

In the above chart, Sei (SEI) laid out an Elliot Wave. Elliott Wave theory is a type of technical analysis that seeks recurring long-term price patterns associated with persistent changes in investor sentiment and psychology. According to the theory, there are impulse waves that initiate patterns and corrective waves that oppose the main trend. A fractal approach to investing is defined as one where each set of waves is nested within a bigger series of waves that follow the same impulse or corrective pattern.

At the time of analysis, the price of Sei (SEI) was recorded at $0.6484. If the pattern trend continues, then the price of SEI might reach the resistance level of $0.8649, and $1.3402. If the trend reverses, then the price of SEI may fall to the support of $0.5669, $0.3206, and $0.1317.

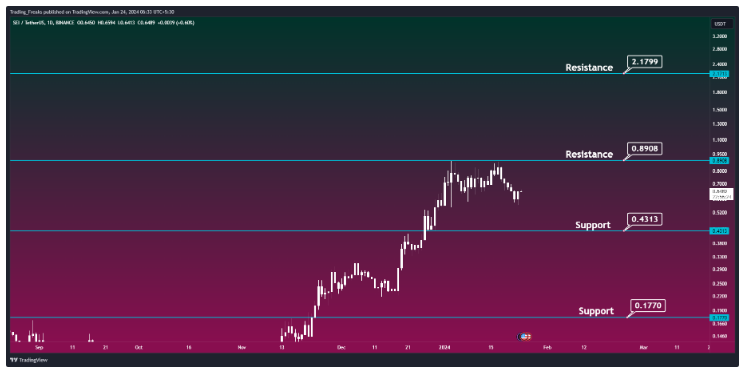

Sei (SEI) Resistance and Support Levels

The chart given below elucidates the possible resistance and support levels of Sei (SEI) in 2024.

From the above chart, we can analyze and identify the following as resistance and support levels of Sei (SEI) for 2024.

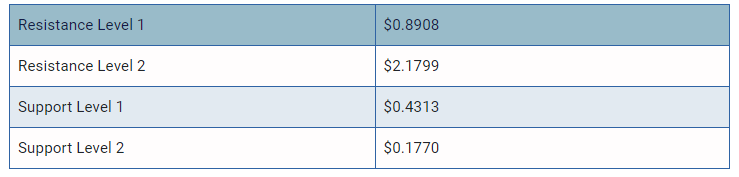

SEI Resistance & Support Levels

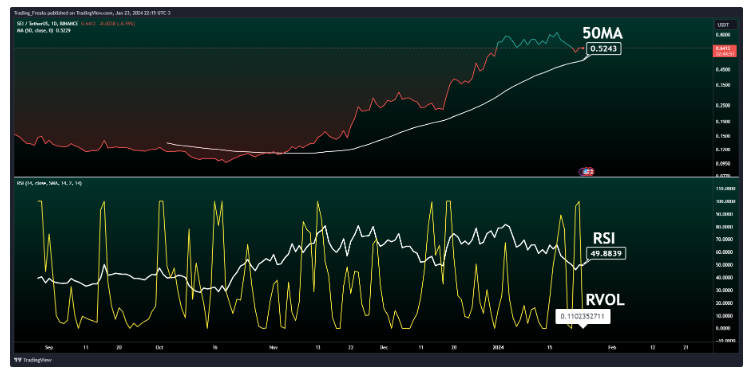

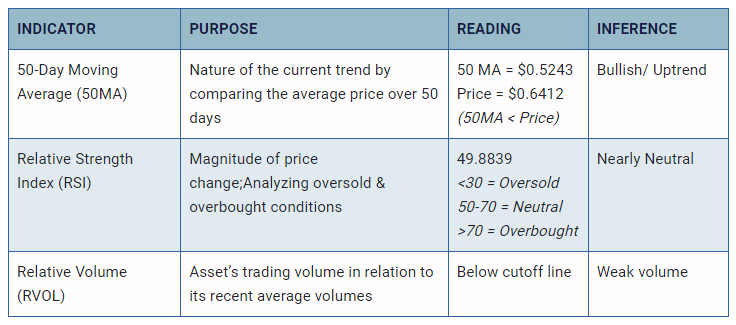

Sei (SEI) Price Prediction 2024 — RVOL, MA, and RSI

The technical analysis indicators such as Relative Volume (RVOL), Moving Average (MA), and Relative Strength Index (RSI) of Sei (SEI) are shown in the chart below.

From the readings on the chart above, we can make the following inferences regarding the current Sei (SEI) market in 2024.

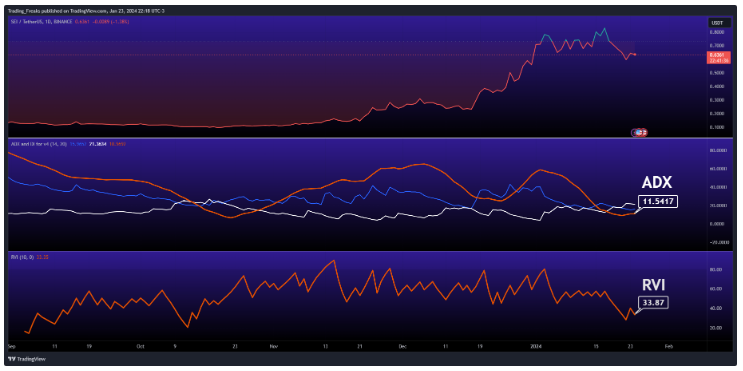

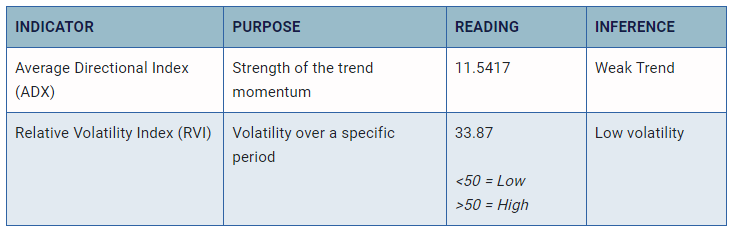

Sei (SEI) Price Prediction 2024 — ADX, RVI

In the below chart, we analyze the strength and volatility of Sei (SEI) using the following technical analysis indicators — Average Directional Index (ADX) and Relative Volatility Index (RVI).

From the readings on the chart above, we can make the following inferences regarding the price momentum of Sei (SEI).

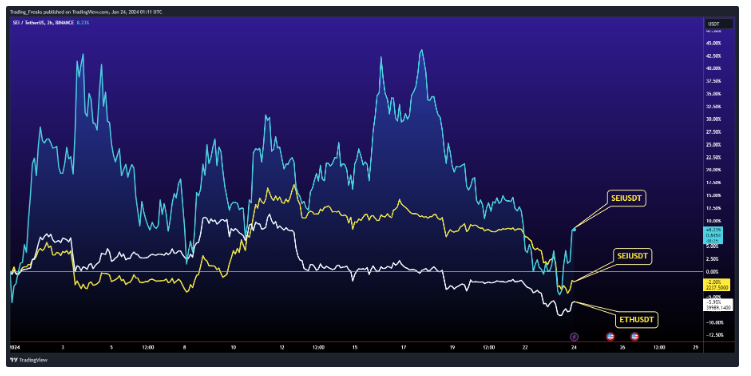

Comparison of SEI with BTC, ETH

Let us now compare the price movements of Sei (SEI) with that of Bitcoin (BTC), and Ethereum (ETH).

From the above chart, we can interpret that the price action of SEI is similar to that of BTC and ETH. That is, when the price of BTC and ETH increases or decreases, the price of SEI also increases or decreases respectively.

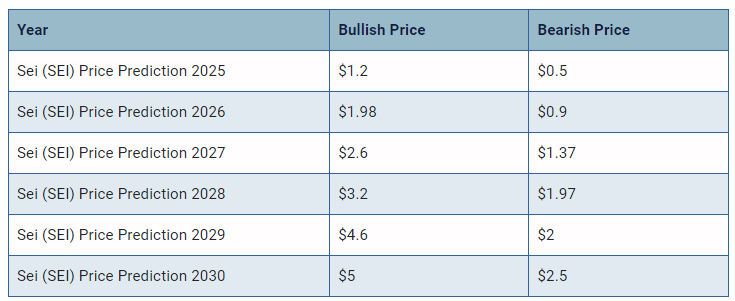

Sei (SEI) Price Prediction 2024, 2025 – 2030

With the help of the aforementioned technical analysis indicators and trend patterns, let us predict the price of Sei (SEI) between 2025, 2026, 2027, 2028, 2029 and 2030.

Conclusion

If Sei (SEI) establishes itself as a good investment in 2024, this year would be favorable to the cryptocurrency. In conclusion, the bullish Sei (SEI) price prediction for 2024 is $2.1799. Comparatively, if unfavorable sentiment is triggered, the bearish Sei (SEI) price prediction for 2024 is $0.1770.

If the market momentum and investors’ sentiment positively elevate, then Sei (SEI) might hit $1. Furthermore, with future upgrades and advancements in the Sei ecosystem, SEI might surpass its current all-time high (ATH) of $9.18 and mark its new ATH.

This content was originally published by our partners at The News Crypto.