Intellia presents positive data for hereditary angioedema treatment

President Donald Trump’s announcement last Wednesday of a new trade agreement with China is the kind of headline that gives markets a sense of relief. As I overheard at Wealth Management’s EDGE conference, which I attended in Boca Raton, Florida, we may have dodged a recession.

Beyond that, I think Trump’s announcement provides investors with a fresh incentive to turn their attention to global trade, particularly the shipping industry.

According to the president’s statement on Truth Social, the deal is “done,” pending final approval from both him and President Xi Jinping. The terms include a commitment from China to supply rare earth metals, while the U.S. maintains significantly higher tariffs on Chinese imports—reportedly 55% compared to China’s 10%.

I think most people would agree that, after months of tariff turmoil, this is a constructive step toward stability and, indeed, fairness. For shipping, that matters more than you might think.

Shipping Activity Rebounds as Tariff Pause Boosts Imports

As everyone recalls, the White House imposed an eye-popping 145% tariff on Chinese imports in April, sending shockwaves through global supply chains and capital markets. Retailers hit the brakes. Orders were delayed or canceled, and ocean freight volumes plunged.

But just a few weeks later, the administration announced a 90-day pause and slashed tariffs to 30%. “Reciprocal” tariffs with other trading partners were also temporarily frozen.

During that window, we’ve seen a surge of renewed shipping activity.

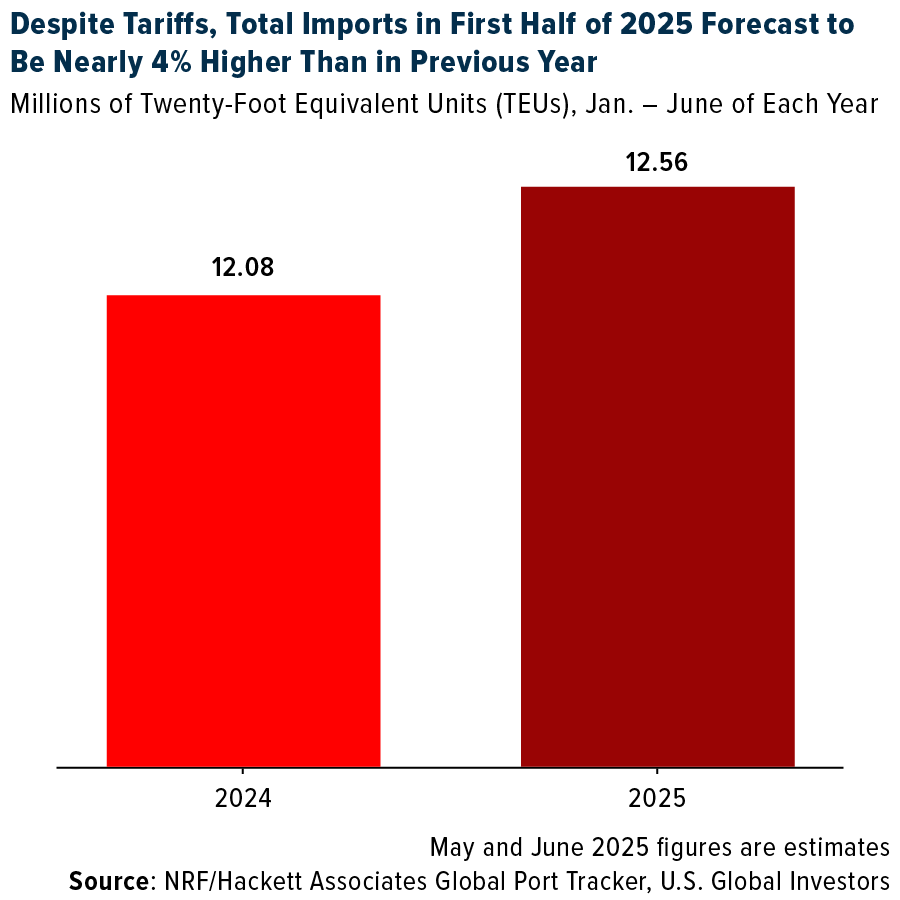

The National Retail Federation (NRF) reported last week that container imports at U.S. ports are now expected to climb 3.7% year-over-year for the first half of 2025. That’s better than forecasts before the pause. Shipping volume from China jumped 9% in the first week of June alone, according to Goldman Sachs data.

Rates Are Moving Higher

The container shipping industry has always been cyclical and sensitive to geopolitical events, and this year has been no exception. After bottoming in 2023, rates have rebounded sharply, driven not only by tariff uncertainty but also by persistent global disruptions, such as the Red Sea crisis.

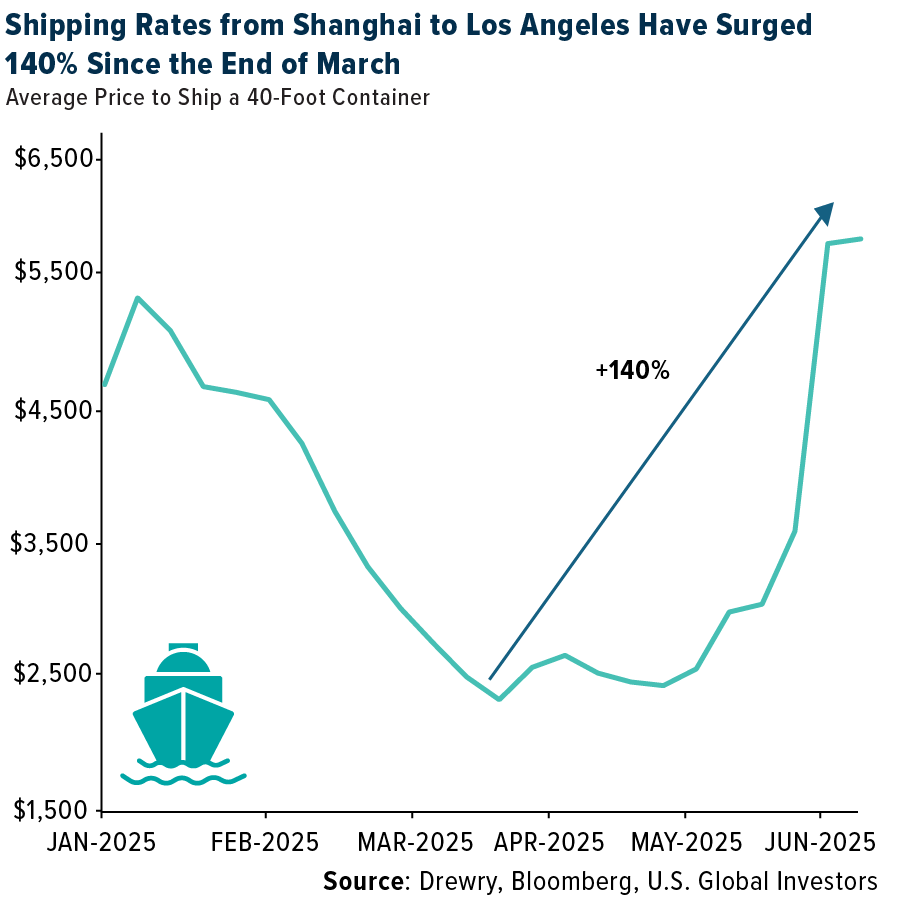

Drewry’s World Container Index showed a 70% spike in just four weeks, with freight costs from Shanghai to Los Angeles up nearly 140% since the end of March. That said, prices remain well below the COVID-era highs, when rates surpassed $10,000 per 40-foot container.

For context, today’s rates are closer to $5,800—a historically elevated level, but not unsustainable. Importers are moving fast to restock while the policy window is open. That activity is supporting not only shipping volumes but also company earnings.

More Shipping Companies Joining the $10 Billion+ Market Cap Club

In the first quarter of 2025, the global container shipping industry posted nearly $10 billion in profit. That’s a drop from the $15.6 billion earned in Q4 of last year, but it’s also 83% higher than the same period in 2024.

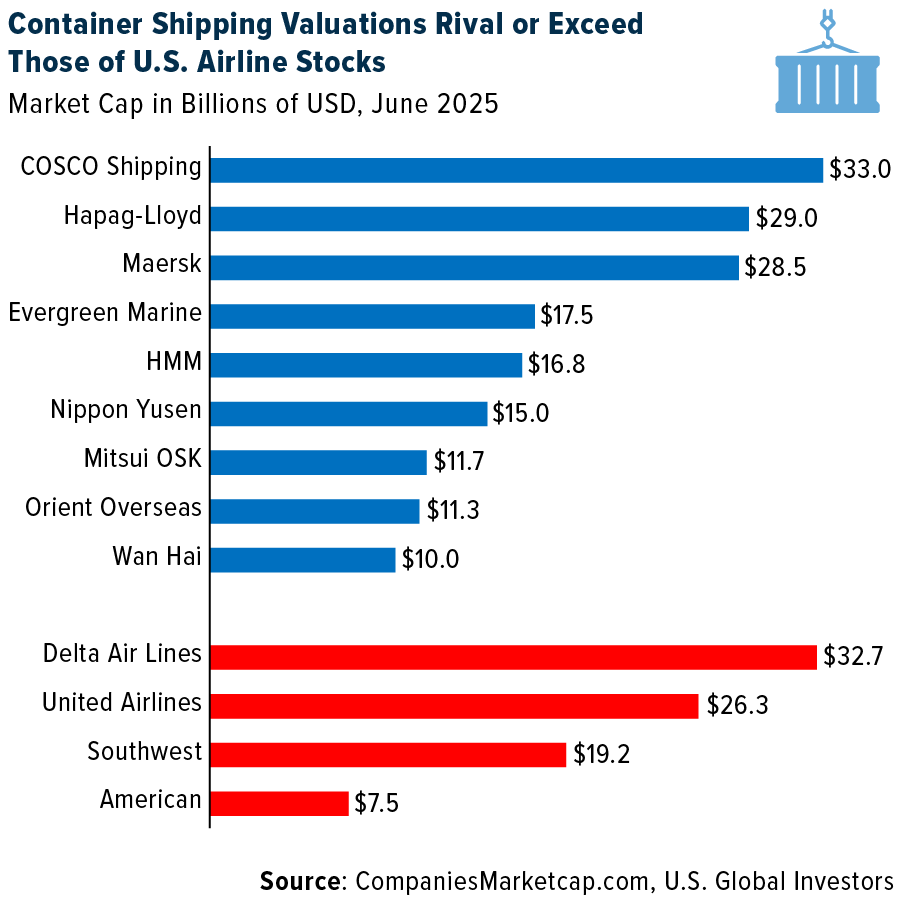

The market has begun to take notice. As of this month, I count nine publicly traded container carriers with a market capitalization of at least $10 billion. This includes names like Maersk (CSE:MAERSKb) and Hapag Lloyd AG (ETR:HLAG), along with rapidly growing Asian players such as Wan Wan Hai Lines Ltd (TW:2615). These companies now rival or surpass familiar, investable U.S. airline stocks in terms of valuation.

This tells me that institutional investors see the potential in global shipping.

Granted, it’s not all smooth sailing. A recent survey by Freightos of more than 100 small-to-midsize importers paints a picture of anxiety beneath the surface. Even with the pause in place, 80% of respondents said they’re as or more worried than they were in April. Nearly half gave the situation a “perfect 10” on the disruption scale. Full disclosure, this survey was taken before the U.S.-China trade deal was announced.

Reshoring—or the practice of shifting production back to the U.S.—remains a possibility for companies that have moved overseas, but only 6% of companies have done so, according to Freightos.

World Bank Backs Trump’s Push for Fairer Global Trade Practices

You may have seen headlines that the World Bank revised its global growth forecast downward to 2.3% for 2025, marking the slowest non-recessionary year since 2008. Trade frictions, including those stemming from tariff uncertainty, are among the top culprits.

But there’s more to the story. The same World Bank report echoed Trump’s longstanding complaint that the U.S. faces unfairly high trade barriers abroad. The Washington, D.C.-based organization calls for a broad reduction in global tariffs, suggesting growing recognition of the problem and, perhaps, momentum for reform.

If that happens, and the world moves toward more equitable trade terms, shipping could be a key beneficiary. More open markets mean more trade, and more trade means more cargo.

Shipping companies are coming off a strong earnings season. Rates are elevated but not extreme. Inventories are being replenished. And long-term, the world will still need ships to move the goods that power our economies.

****

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.