Bitcoin price today: tumbles below $90k as Fed cut doubts spark risk-off mood

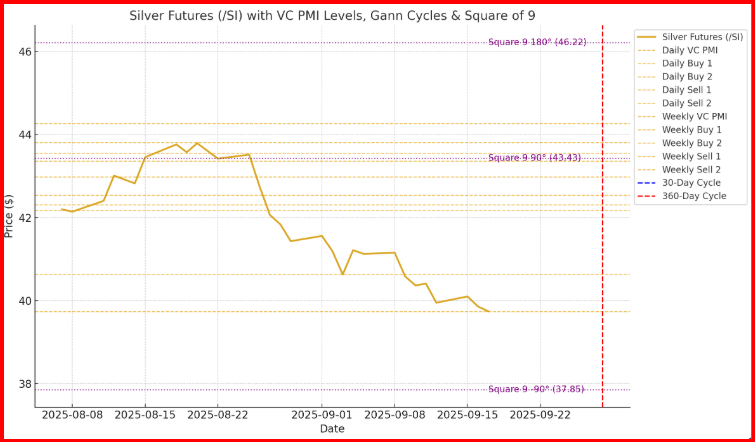

Silver Futures are once again proving the timeless principle that markets rotate around equilibrium, vibrating through cycles of time and price. With today’s action at $42.29, the market is sitting almost exactly on the Weekly VC PMI mean ($42.31)—a classic inflection level that reflects a balance between buyers and sellers. From this pivot, the market often decides whether to revert higher toward premium supply zones or extend lower into discounted demand zones.

The 30-day Gann cycle highlights a rhythm of recurring monthly turning points. The last 30-day cycle low printed in the $40.60–$40.80 range, aligning with the Weekly Buy 1 ($40.64). The recovery that followed pushed prices into the Daily Sell 1 ($43.36) and Sell 2 ($43.81) zones before today’s reversal. This confirms the cycle vibration is active, with the market now testing support as it sets up for the next leg. Traders should track the upcoming cycle date around September 28, which harmonizes with a broader 360-day cycle turning point—a vibration window where major lows or highs often crystallize.

The 360-day cycle, a cornerstone of Gann analysis, aligns long-term energy with today’s shorter swings. Each year, silver echoes this master cycle, often marking pivotal reversals within days of its anniversary. The fact that we are approaching both a 30-day vibration and a 360-day master cycle suggests a powerful confluence ahead. These time harmonics often act like tuning forks for the market, drawing price toward major balance points.

The Square of 9 geometry sharpens this roadmap further. The recent swing high at $43.43 corresponds closely to a 90° rotation from the $40.64 base. This quarter-turn resistance amplified selling pressure and drove today’s decline. The next harmonic step projects downside magnets at $41.62 (78.6% retracement) and $41.12, which align with Fibonacci retracements and VC PMI demand zones. These geometric overlays reinforce the idea that silver is correcting toward a mean reversion window.

Trading Strategy

- For swing traders, the $42.17–$41.62 zone is the critical demand band to watch. A reversal here would confirm cycle alignment into late September.

- A decisive close above $42.98 reopens the path to retest $43.36–$43.81.

- Long-term investors should focus on the 360-day cycle low window later this month as a potential major entry point for the next bullish leg.

Silver sits at a crossroads of price and time, where VC PMI, Gann cycles, and the Square of 9 converge. Discipline now means waiting for the vibration window to confirm direction, then positioning with conviction.

***

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.