Asahi shares mark weekly slide after cyberattack halts production

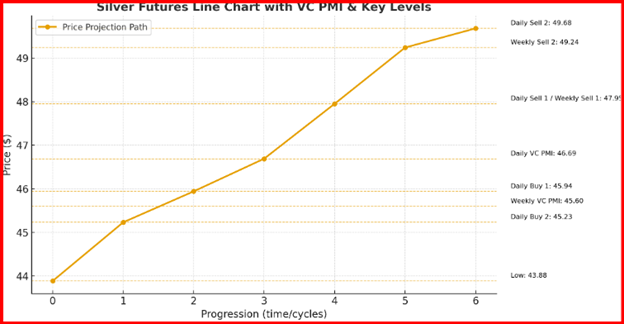

Silver futures have entered a critical juncture as they consolidate below the $48.00 threshold, with the market displaying both structural bullishness and the presence of near-term resistance. Since bottoming at $43.885, silver has staged a sharp rally, climbing steadily through Fibonacci retracement zones and reclaiming the weekly VC PMI pivot at $45.66.

This recovery confirmed a shift in momentum, aligning price action above both daily and weekly pivots, which strengthens the case for higher levels in the short to intermediate term.

From a VC PMI perspective, silver remains supported by multiple layers of buy levels. The Daily VC PMI pivot at $46.66 is acting as an anchor, while Buy 1 ($45.94) and Buy 2 ($45.23) coincide with the broader weekly Buy 1 level at $44.37. Together, this forms a substantial accumulation zone where buying interest has consistently emerged.

The resistance band between $47.95 (Daily/Weekly Sell 1) and $49.24–$49.68 (Weekly Sell 2/Fibonacci 161.8%) now becomes the immediate upside challenge. A breakout above $47.95 would confirm momentum acceleration, with $49.68 as the natural extension target.

Overlaying the Gann cycle framework, we observe that silver is moving in alignment with the 30-day cycle, which began at the September 28th cycle low around $43.88. This cycle projects strength into late October, with upward momentum expected until the cycle completes its turn.

The rally into current levels confirms that silver is adhering to the bullish phase of this cycle, suggesting that pullbacks should remain corrective as long as the $45.00–$46.00 pivot cluster holds.

The 360-day cycle, anchored on September 28, 2024, reinforces this broader bullish backdrop. That cycle low represented a major turning point in silver’s long-term rhythm, and the current rally is its first expansion leg. Historically, the early phase of a 360-day cycle often produces powerful rallies as accumulation builds for months ahead.

This implies that the current resistance at $47.95–$49.68, while significant, may ultimately yield to longer-term bullish pressure as silver trends toward higher harmonic targets over the coming quarters.

The MACD indicator supports this cyclical interpretation, holding positive momentum above the zero line and confirming accumulation since the September low. Volume has also expanded on rallies, underscoring the conviction of buyers.

In summary, silver futures are in the early stages of a potentially powerful advance. The 30-day cycle suggests strength into late October, while the 360-day cycle confirms a longer-term bullish trajectory. As long as $45.23–$45.94 support holds, the market is positioned to challenge $47.95 resistance and extend toward the $49.68 target, marking a decisive test of silver’s capacity to transition into a sustained bullish phase.

***

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.