NVIDIA expands Microsoft partnership with Blackwell GPUs for AI infrastructure

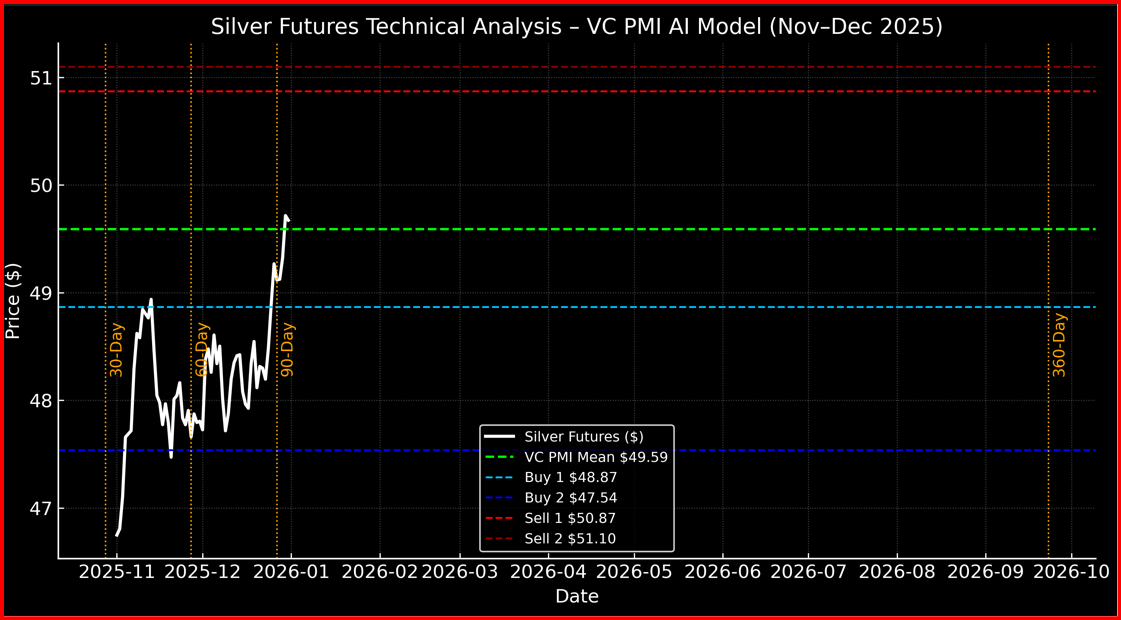

Silver futures are trading at $50.69, up 0.75%, marking a continuation of the bullish momentum that began from the cyclical low of $46.52 earlier in the week. The market’s structure shows a strong vertical advance, establishing a new high at $51.10, precisely aligning with the Daily Sell 1 level, confirming the accuracy of the VC PMI AI predictive model. The current price behavior suggests that silver is in a short-term consolidation phase after a steep five-day advance within an expanding upward channel.

From a technical perspective, the market remains in a confirmed bullish trend above both the daily and weekly VC PMI means. The Daily VC PMI is positioned at $49.68, serving as the equilibrium point or mean. As long as silver holds above this level, the probability favors a continuation of the advance. The Daily Buy 1 and Buy 2 levels are at $48.87 and $47.44, respectively, offering strategic entry zones for traders looking to buy corrections within this bullish cycle. On the upper end, resistance is identified at $50.87–$51.10, near the 61.8% Fibonacci retracement level, which may act as a short-term ceiling before the next breakout.

The weekly structure reinforces this bullish setup, with the Weekly VC PMI at $47.83 and upper targets at $49.15 (Sell 1) and $50.15 (Sell 2) already achieved. The market’s ability to trade and close above $50.15 confirms strong momentum and signals a potential extension toward the next measured Fibonacci target around $52.50–$54.00. The MACD (14,3,3) indicator shows a positive crossover with upward momentum, though slightly overbought conditions could trigger brief profit-taking near current resistance.

From a cyclical standpoint, the advance corresponds to the mid-phase of a 30–60–90-day cycle window that began with the September 28, 2025, low. Silver appears to be in the acceleration phase of this cycle, with the next 30-day peak expected by mid-November. This period could mark the culmination of the current rally before a controlled correction develops into early December.

In summary, the technical and cyclical evidence remains strongly bullish for silver as long as prices sustain above $49.59. A breakout and daily close above $51.10 would confirm an extension toward $52.80–$54.00, while a reversal below $49.59 could trigger mean reversion toward $48.87–$47.54. Traders are advised to manage risk accordingly, maintaining trailing stops and scaling into strength.

***

Disclosure: This report is based on the VC PMI AI algorithm integrating Fibonacci ratios, Gann time cycles, and mean reversion principles. It is intended for educational purposes only. Trading futures involves significant risk and may not be suitable for all investors.