Bitcoin price today: dips to $92k as Fed cut doubts spark risk-off mood

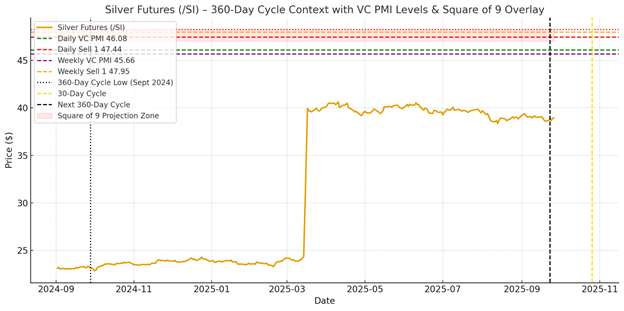

Silver has entered a critical juncture as it trades at $46.36, gaining nearly 2.8% on strong momentum. This rally reflects a decisive mean-reversion breakout, as the market reclaimed both the daily VC PMI mean ($46.08) and the weekly mean ($45.66). Crossing these benchmarks signals a shift in sentiment from consolidation to expansion, with the probabilities now skewed toward higher resistance objectives.

From a daily perspective, the structure is bullish. Support rests at Daily Buy 1 ($45.38) and Daily Buy 2 ($44.04), forming a demand cluster. Meanwhile, upside targets are defined at Daily Sell 1 ($47.44) and Daily Sell 2 ($48.22). With price already probing above $46.90 intraday, Silver is testing the boundaries of its Sell 1 zone. A confirmed breakout could accelerate momentum toward the $48.22 extension.

On the weekly cycle, the picture complements the daily setup. The weekly mean ($45.66) has been decisively surpassed, turning it into a key pivot support. This level aligns with the 30-day cycle, which suggests an intermediate-term reversion point near $45.50. As long as Silver sustains closes above this zone, the path of least resistance remains toward the Weekly Sell 1 ($47.95), a level harmonically aligned with the Square of 9 at 180° from the last 360-day cycle low.

The 360-day cycle remains the dominant long-term driver. The most recent cycle low, around $23–24 (Sept 2022), and the projected low retested in Sept 2024 at $22–23 create a foundational time/price symmetry. From this pivot, the Square of 9 spiral projects harmonics near $47–$48, coinciding precisely with the upside targets.

This convergence strengthens the case that Silver is approaching a climactic resistance zone defined by both time cycles and geometry. A successful breakout above $48.22 could ignite an extension to $50 and beyond, setting the stage for a structural bull leg.

Momentum indicators support the bullish stance. The MACD has turned positive (0.0953) after a strong upward cross, while rising volume over Thursday and Friday confirms institutional accumulation. These signals, paired with the technical alignment of daily, weekly, and long-term cycles, reinforce the high-probability setup.

In conclusion, Silver has transitioned from consolidation into a mean-reversion breakout phase, with strong alignment between VC PMI levels, cycle counts, and Square of 9 harmonics. The immediate focus is on the $47.44–$48.22 resistance band. A sustained breakout above this zone would likely confirm the bullish extension into the next higher square of 9 coordinates, opening the path toward $50–52 over the coming cycle window.

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.