Tyson Foods to close major Nebraska beef plant amid cattle shortage - WSJ

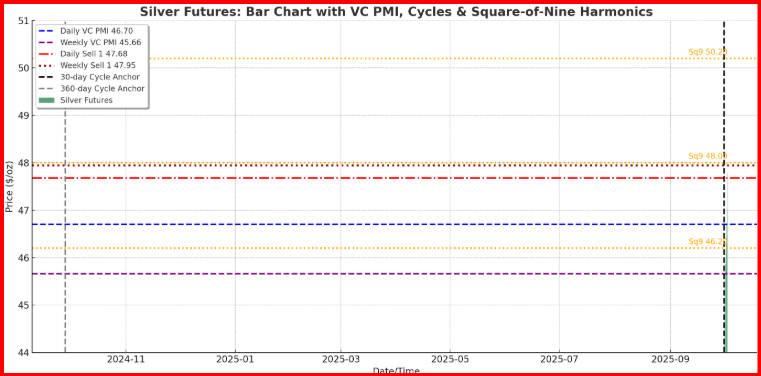

The silver market has just delivered one of the most dramatic short-term moves in recent memory, advancing $4 in only two trading sessions. From lows anchored around $44, futures surged to test the Weekly Sell 1 ($47.95) and Daily Sell 1 ($47.68) zones, touching as high as $48.01 before consolidating. This kind of volatility is not a random occurrence—it marks the emergence of a new volatility regime and signals “escape velocity,” where price momentum transcends normal gravitational pull of equilibrium levels.

VC PMI Structure

The Variable Price Momentum Indicator (VC PMI) mapped out the critical benchmarks:

- Weekly VC PMI: $45.66

- Daily VC PMI: $46.70

- Daily Sell 1: $47.68

- Weekly Sell 1: $47.95

Holding firmly above the weekly equilibrium ($45.66) activated a bullish bias. Once price cleared the daily pivot ($46.70), momentum accelerated rapidly, confirming algorithmic buying pressure. The test and breakout of the Sell 1 levels further validated a transition toward the upper band of volatility.

Cycle Convergence

Green bars → Hourly silver futures movement ($44 → $48).

Blue & Purple dashed lines → Daily & Weekly VC PMI pivots.

Red dash-dot & Dark Red dotted lines → Daily & Weekly Sell 1 levels.

Orange dotted lines with labels → Square-of-Nine harmonics ($46.20, $48.00, $50.20).

Black & Grey vertical lines → 30-day and 360-day cycle anchors.

The 30-day cycle due in early October aligned with this surge, producing a time-price synergy. Meanwhile, the broader 360-day cycle anchored on September 28, 2024, continues to project higher price windows into 2025, reinforcing the likelihood that silver is building toward a longer-term bull phase. When short-term cycles synchronize with annual cycles, markets often demonstrate outsized volatility—exactly what we are now witnessing.

Square-of-Nine Harmonics

On the Square-of-Nine, the $48 level harmonically aligns with the $50 resistance arc, a psychologically powerful number. A sustained breakout above $48.01 projects the next resistance vectors around $50.20–$50.60, while support harmonics pull back toward $46.00–$46.20. These levels will likely serve as high-probability reversion zones for traders managing risk.

Implications

The velocity of this move suggests silver is no longer constrained to $1–$2 daily ranges. Instead, we are likely transitioning into a phase where $2–$4 daily moves become the new normal. Traders must recalibrate risk management and position sizing accordingly.

If silver sustains above $47.68–$47.95, the probability increases of a parabolic advance to $50+. A failure to hold this zone would likely invite mean reversion toward the $46.70 VC PMI pivot before reloading higher.

***

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.