Eos Energy stock falls after Fuzzy Panda issues short report

Silver has once again demonstrated the classic violent character of a market that remains structurally undervalued but passionately sought after when fear shifts into demand. The recent decline into the $45.50 low has completed a synchronized cycle cluster — the 30-, 60-, and 90-day timing structures all converging into the same price region as the Daily Buy 2 and Weekly Buy 2 VC PMI statistical support levels. When price, time, and probability land on the same square… the market has no choice but to respond. And respond, it has.

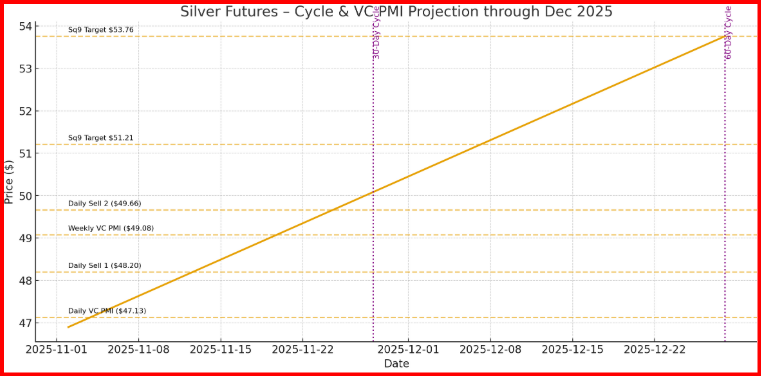

The first evidence of this shift comes from the 30-day cycle’s turn, creating the springboard for the current rally back toward the Daily VC PMI at $47.13. That level is now the immediate battleground between continuation of the downtrend and confirmation of a fresh leg higher. Above it, the path reopens toward the first supply walls: Daily Sell 1 at $48.20 and Daily Sell 2 at $49.66. These aren’t random numbers — these are price harmonics defined by fractal math and observed behavior.

The 60-day cycle brings even bigger implications. It projects a swing recovery into late December, where weekly VC PMI resistance aligns with major overhead supply: $50.10, $51.21, and $51.34. Should silver advance into that region, the bear trend narrative that has dominated the past month will fully unravel. Bulls will reclaim control of momentum — and they know it.

But the most powerful layer here is the 90-day cycle, the quarterly expansion wave. This cycle has inverted bullishly, meaning silver carved its low ahead of schedule. Early-cycle lows are the fingerprints of accumulation — strong hands stepping in where weak hands tap out. This behavior aligns directly with the Square of 9 geometric projections. The $45.51 anchor low radiates precise harmonic price targets: $47.12, $49.66, $51.21, and ultimately $53.76. That last number — $53.76 — is the 216° rotational level, historically associated with dynamic breakouts and hyperspeed rallies.

If silver clears $51.21 decisively, the 90-day cycle projects a move into that parabolic zone by mid-January. Volatility would expand. Shorts would scramble. A trade becomes a move; a move becomes a campaign.

This is where the VC PMI excels — bringing disciplined probability structure to a market known for chaos. The next few sessions will determine whether this bounce is simply mean reversion or the ignition of something far more powerful. Silver has loaded the slingshot. The target is defined. Now we let the cycles speak.

***

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.