Is this U.S.-China selloff a buy? A top Wall Street voice weighs in

Stocks finished the day lower for a fifth straight day, with the S&P 500 down by 25 bps to close at 5,011. Today is OPEX, and with the passing of OPEX, we will see gamma levels unclench and the stickiness we have seen in the S&P 500 at the 5,000 level release. A good portion of that gamma will likely be released at the opening today, with monthly OPEX set to expire. However, 0DTE options continue trading until the end of the day.

It has been an observable and easy pattern to see how the index tends to either gap higher or move sharply higher right out of the opening and then tends to fade the rest of the day, starting mid-morning. You have to wonder at what point the market stops getting bid up in the morning, and traders just start selling from the start.

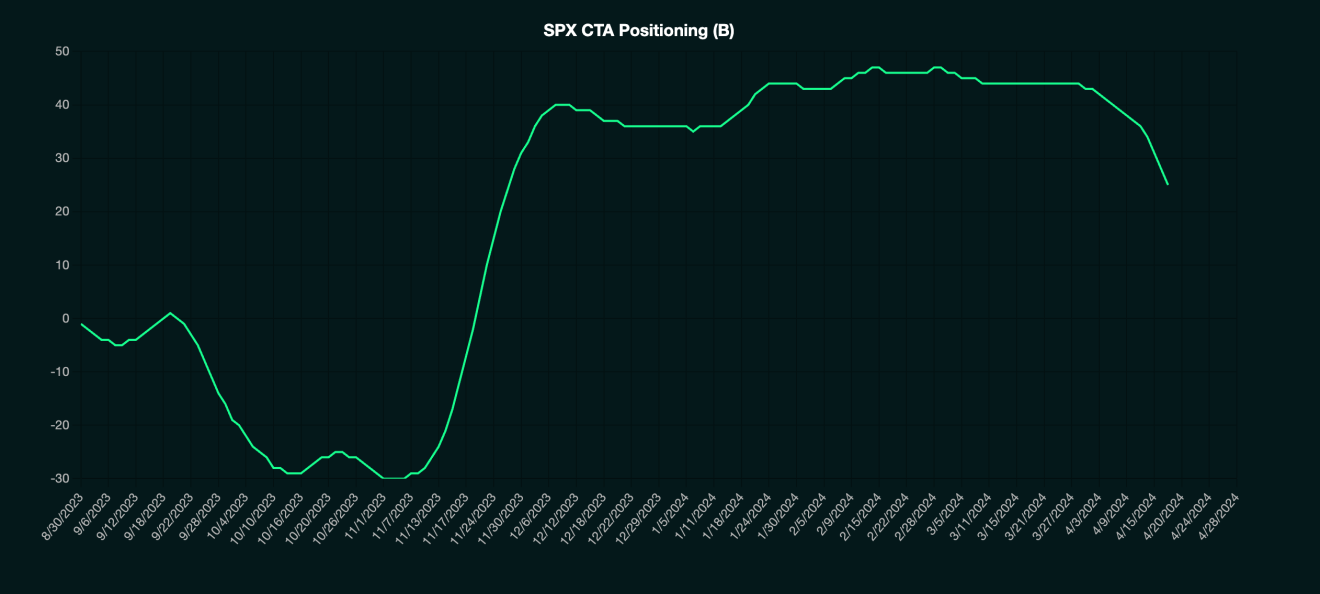

As Gammalabs shows, CTAs are now sellers of the S&P 500, which is one reason why we are seeing the early buying met by that end-of-day wave of selling.

(Gammalabs)

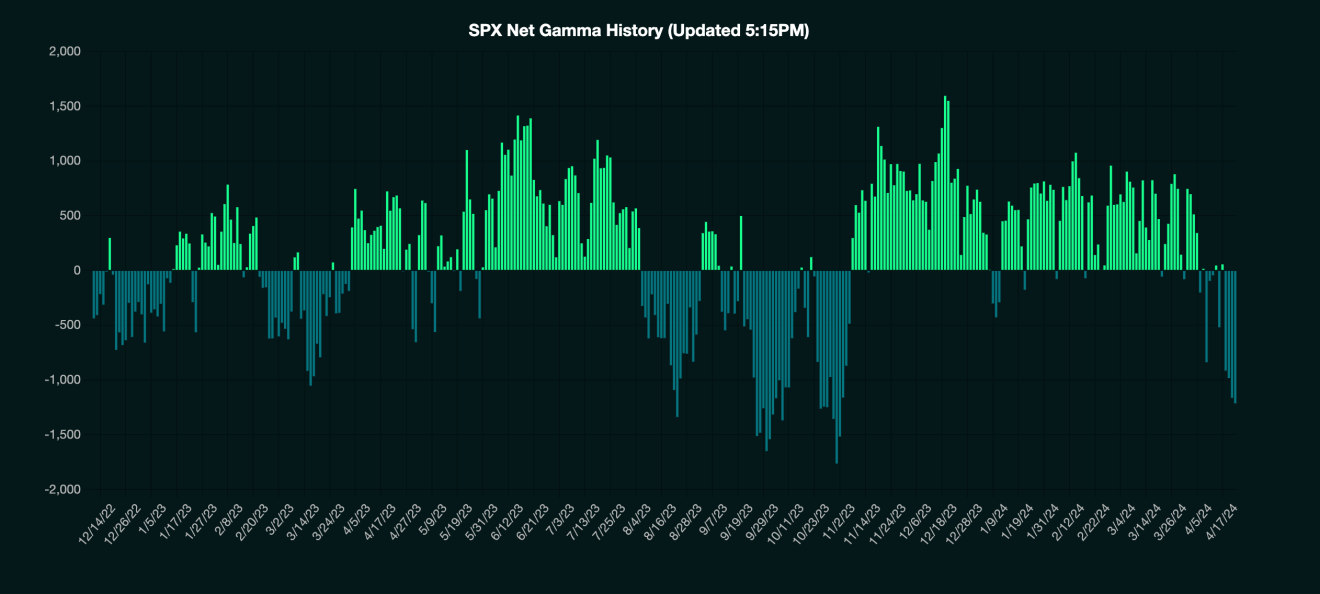

Additionally, as Gammalabs shows, the S&P 500 is also in net negative gamma, which means that the market makers are not buying the dip but following the selling CTAs are doing. In negative gamma regimes, market makers follow the trend; in positive gamma, they are sellers of strengths and buyers of weakness.

(Gammalabs)

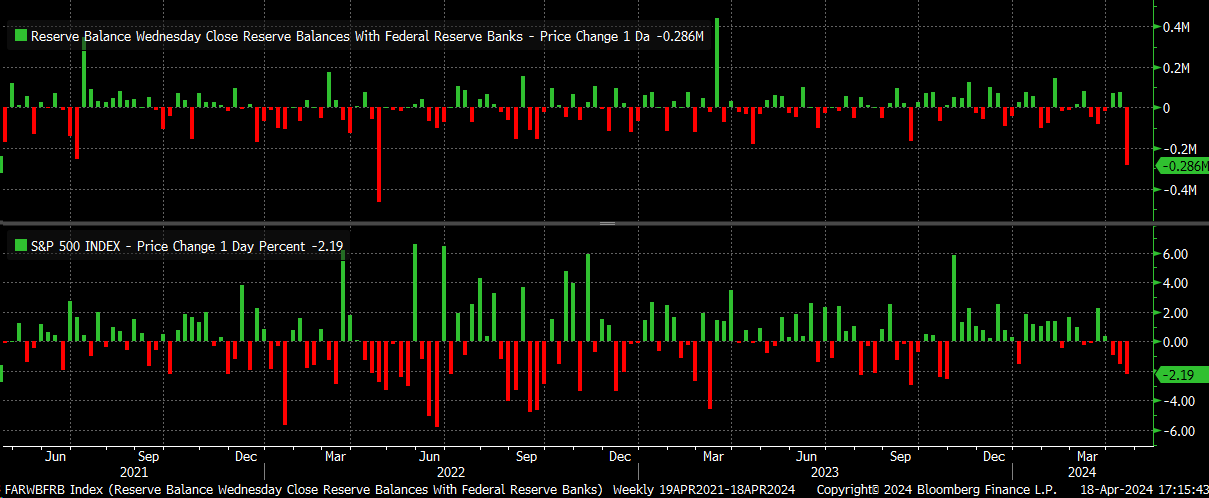

We already knew liquidity was dropping, as noted by changes in the TGA and book depth of the e-minis, but yesterday, the Fed balance sheet showed that reserve balances fell to $3.33 trillion from $3.61 trillion last week, or nearly $300 billion in one week. In April 2022, we saw reserves fall about $400 billion, which resulted in a very bad stretch for the market. This was the biggest move lower in reserves since then.

Additionally, we saw rates move higher yesterday, and the US dollar strengthened, which again is working to tigthen financial conditions in the background. At this point, we now have liquidity, systematic, and options flows working against the market. It is a period where liquidity, fundamentals, and flows all come together simultaneously, and they aren’t in favor of stocks going higher.

Netflix Reports Great Subscriber Additions

Meanwhile, Netflix (NASDAQ:NFLX) reported great subscriber additions, but the market did not care, with the stock still trading down by almost 5%. Revenue guidance for the second quarter and the full year was a bit weak, and their free cash flow for the full year was below estimates, despite the company not changing it.

Additionally, the company said starting 1Q’25 will no longer report quarterly membership numbers. Which kind of makes you wonder why? Membership growth has been a significant driver of the stock price, and the first thought is that the company doesn’t want investors to perhaps focus on slowing membership growth.

Meanwhile, the stock is trading at $582, which is an important support level that dates back to July 2020. It is also quite possible that it breaks an uptrend, which is the basis for a rising wedge pattern. If that $580 region of support breaks, the next target could be that gap fill around $493.