Stock market today: S&P 500 ends lower as Fed rate cut, outlook meet expectations

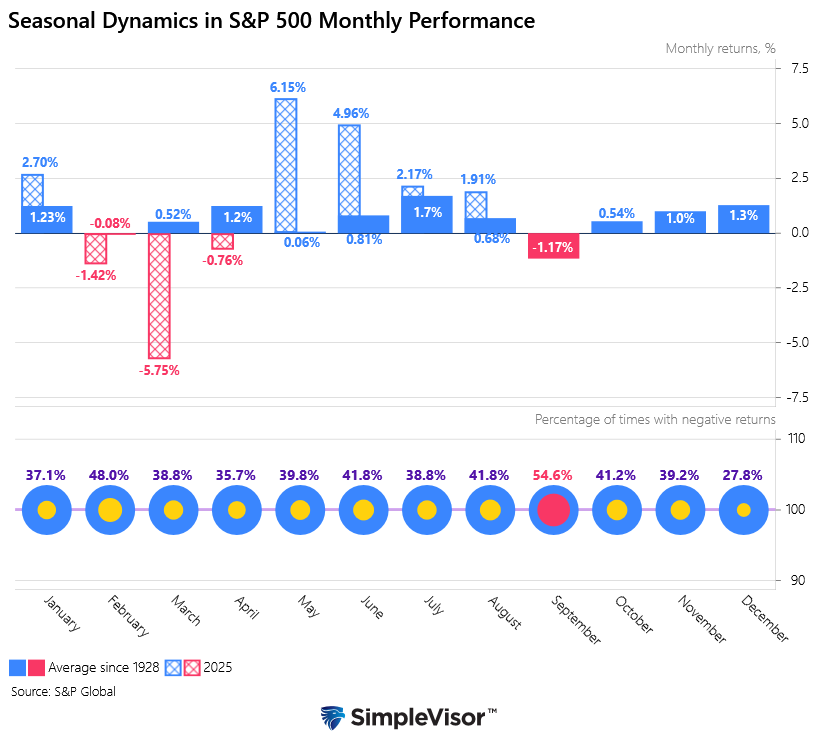

The graph below breaks down the monthly performance of the S&P 500 since 1928. As shown, September is the only month that has seen more negative monthly performances than positive ones. September’s record joins February as the only two months with a negative average, albeit February is only down 0.08%, versus the more significant 1.17% for September. However, this year’s monthly trends have not followed those of the past.

The S&P 500 has generally outperformed or underperformed the averages. The monthly trends we share argue for weakness, and there are a few dark clouds worth paying attention to this month, as follows:

- The Fed: The market thinks the Fed will cut rates on September 17th. However, if the Fed backs off on commitments to cut in the following months, its continued hawkishness could weigh on the market. Furthermore, the question of whether Lisa Cook can appeal her termination from the Fed may impact stock and bond markets.

- Government shutdown: Once again, the threat of a government shutdown looms. There is a deadline of October 1 to enact a spending bill or, at a minimum, a short-term stopgap spending bill. A bill will likely pass Congress and keep the government operating, but as always, the political threats and bickering could be problematic for the market.

- Trump tariffs: A federal appeals court ruled that most of Trump’s global tariffs, imposed under the International Emergency Economic Powers Act (IEEPA), are illegal, as they exceed presidential authority. The ruling allows tariffs to remain in place until October 14. The Supreme Court will likely hear and rule on an appeal before that day. Regardless, the federal court ruling has increased uncertainty in global bond markets, which in turn will weigh on stock prices.

Small Cap Stocks Have Their Day In The Sun

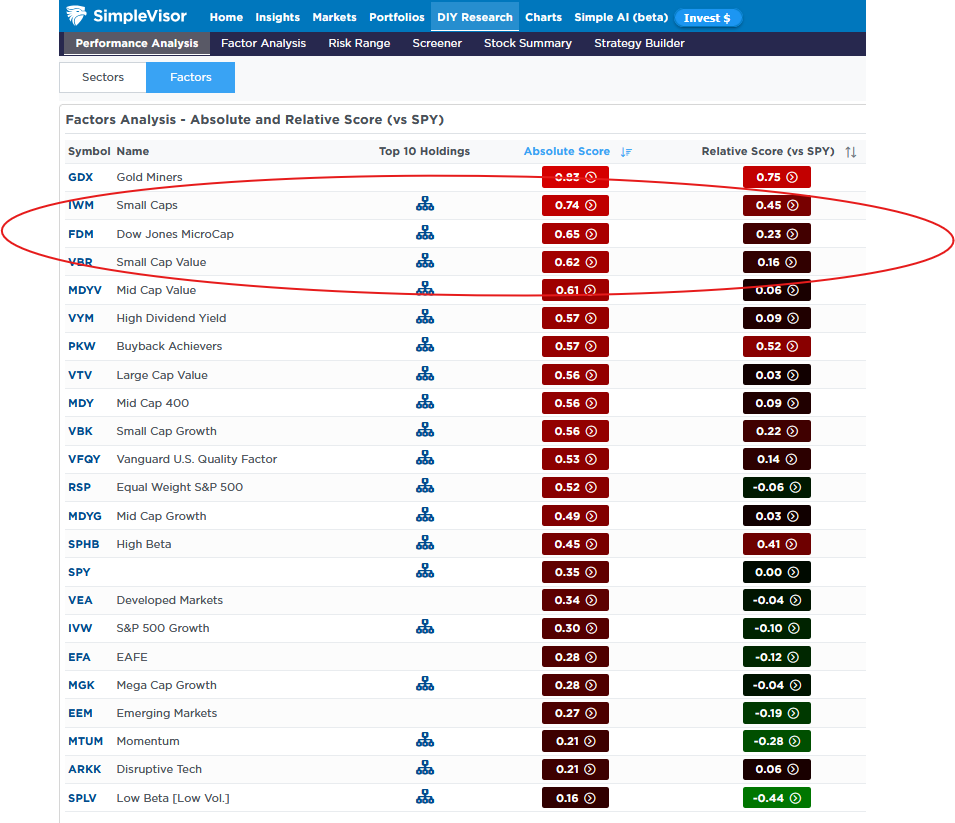

As we share in the graph below, small-cap stocks have grossly underperformed the market (S&P 500) since 2023. While that is also true this year, with the S&P 500 beating the Russell 2000 small-cap index by about 4%, small caps have recently been coming back in favor. As we share below from our relative analysis, small-cap stocks constitute three of the four most overbought stocks on an absolute basis and have some of the highest relative scores versus the S&P 500.

Small-cap companies tend to have higher borrowing costs than larger companies. Equally important, access to funding capital for smaller companies is often more difficult to attain. The budding rise of small caps versus larger-cap companies may continue if the Fed cuts rates and continues rate reductions through the fall and early winter.

However, small-cap stocks are generally more sensitive to economic conditions. Thus, the small caps may represent a double-edged sword that requires Fed rate cuts and no recession. Such an occurrence has happened, but it is very rare.

Tweet of the Day