Toro Company vice president Amy Dahl to depart at end of September

Over many weeks we successfully tracked the highs and lows of the S&P 500 using the Elliott Wave Principle (EWP). As such, in our last update from two weeks ago -sorry there was no update last week, as I was on a break- we found,

“Ten days ago, our focus was on the $4100 region for a smaller 4th wave bottom to allow the index to rally to ideally $4260+/-10 for a minor 5th wave. On Friday, the index bottomed at $4060, and as long as that low holds, with today's rally, it appears this minor 4th wave is completed, and the 5th wave should be underway, possibly to as high as 4295+/-10."

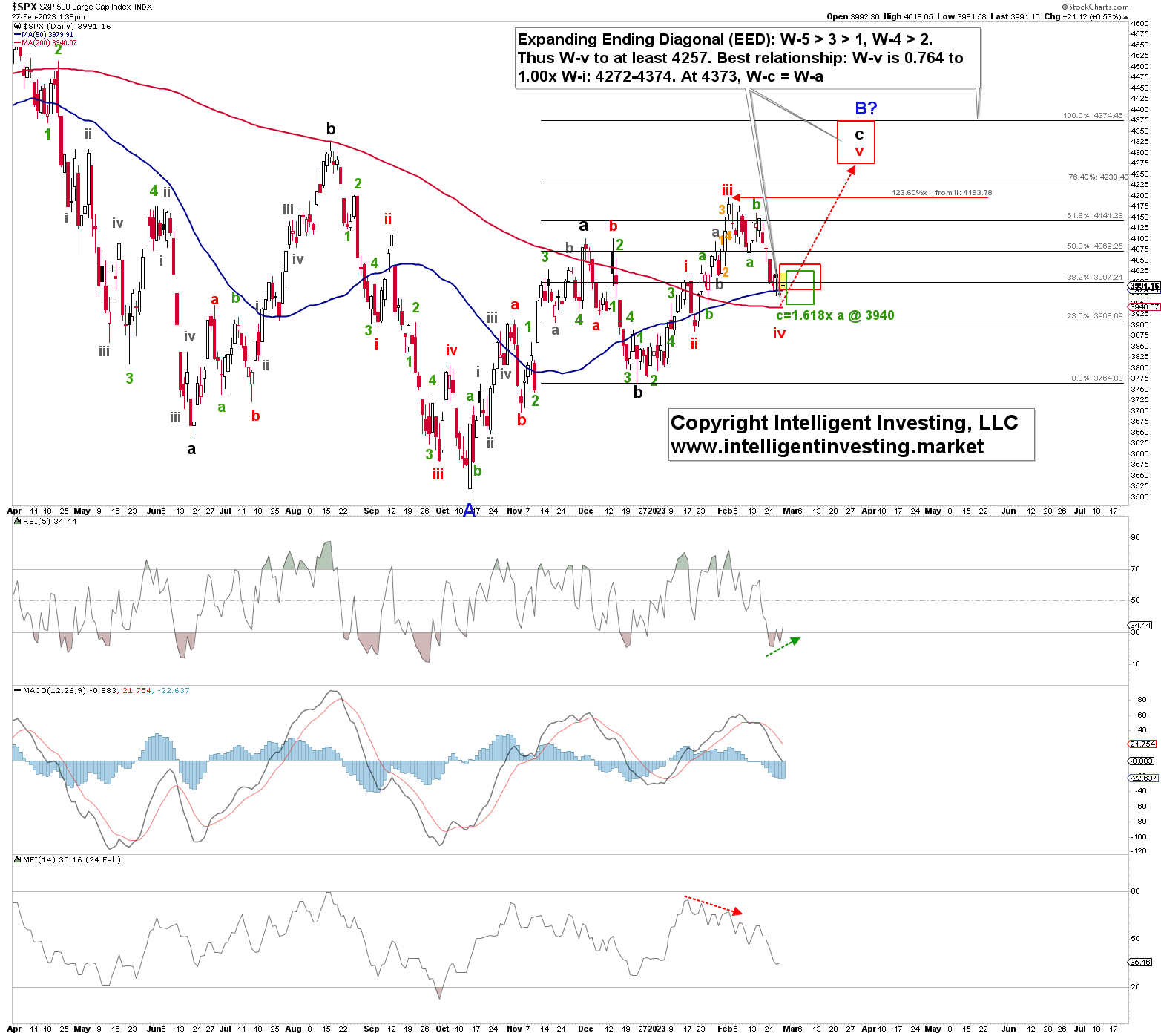

Unfortunately, the 4060 low, which could have been one’s stop loss, did not hold and the index continued to decline to last Friday’s low at 3943. Hence, albeit one can make many correct forecasts using the EWP, nobody can foresee everything all the time. That is why all we can do is “anticipate, monitor, and adjust if necessary." We anticipated 4060 to hold. We monitored and found it did not, and as such we adjust our primary expectations to the EWP count shown in Figure 1 below. Allow me to explain.

Figure 1.

The rally off the December low was not a Standard Fibonacci-based Five-waves Impulse Structure (SFFIS). Quite the contrary. Like all rallies we saw in 2022, when we anticipate a fifth wave higher, the market falters and fails to deliver. Thus, we are still dealing with (potential) a-b-c structures, which are much less reliable than the SFFIS. Welcome to a 4th wave, in this case, Super Cycle IV. Besides, if we expect a C-wave rally off the December low, it is often an SFFIS.

However, due to the recent "sell-off," which has been rather orderly and overlapping, the only way to count the rally as five waves is as an Expanding Ending Diagonal (EED) C-wave. But, Diagonals are unreliable because they do not have as clear-cut (Fib-based) rules as an SFFIS, and often move in overlapping a-b-c patterns. As long as W-3 is not the shortest and W-4 does not go below the start of W-3, which is the end of W-2, then an ED can essentially do whatever it wants to do. In the case of the EED, the EWP rules are laid out in Figure 1 above.

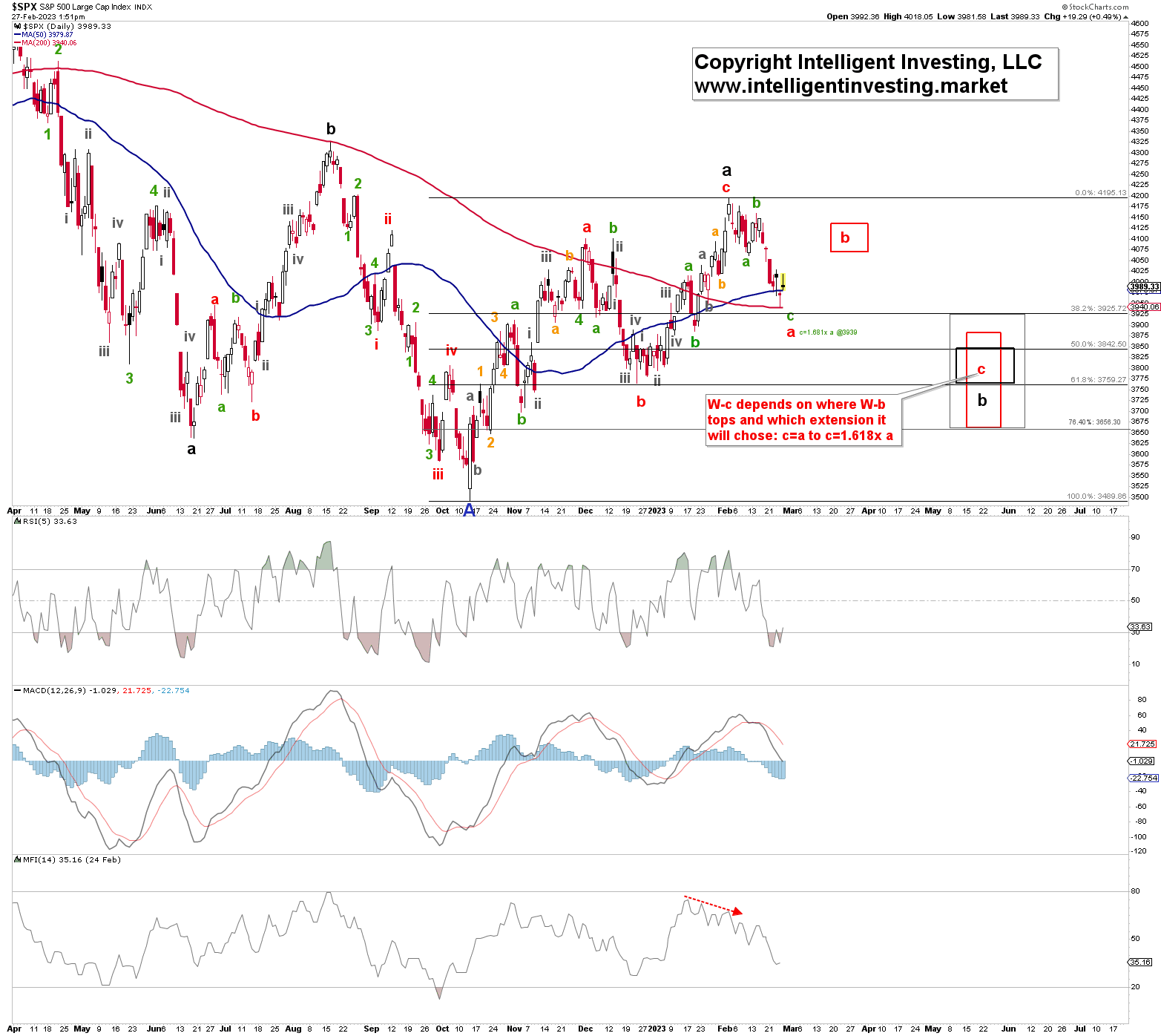

Thus, unfortunately, with last week's continued move into the lower end of support, we are left with two less-than-ideal counts since the December lows: an EED vs. a larger a-b-c. See figure 2 below for the alternate a-b-c. Both EWP counts have their issues and are far from ideal. Unfortunately, this makes it difficult to give a high degree of confidence as to our primary expectation. Not my fault. That is just the environment we are in.

Figure 2.

For that reason, and those stated above, we need to remain extra vigilant and nimble. Remember that because we are likely dealing with an EED, we may not see an SFFIS move for the last W-v to ideally 4273-4374. Instead, we should expect more a-b-c's. Besides, since Diagonals are less reliable than SFFISs, we gave it more wiggle room. Despite a breakdown below 3980 but holding 3940 and given the positive divergences developing on the shorter time frame technical indicators.

If the index continues below 3940, we must concede and anticipate a three-wave move down to 3700-3800. In that case, even a strong rebound, a B-wave counter-trend rally (see Figure 2 above), should be expected at any moment because the downside looks relatively complete. The first order for the Bulls is a move above the last Thursday's 4028 high, followed by a break back over the February 17 high at 4081.

Bottom line

Financial markets move between “clear and relatively easy to forecast” to “less clear, and harder to forecast.” That is the reality we have to deal with and currently the market is, unfortunately, in the latter phase. However, it will soon enough move back to the former and thanks to the EWP we know 4060 had to hold or we would see lower prices. The index broke below 4060 and traveled to the lower end of its next support zone.

Potential positive divergence is developing on several indicators and as long as last week’s 3943 low holds we should expect a rally. Our primary expectation is for a three-wave move to ideally 4272-4374, but we must now be cognizant of the fact that the index could stall out at around $4100+/-50 before heading down to 3700-3800. For now, that is our alternative and it will serve us well once that region has been reached as one can raise stops and/or take (partial) profits.

Because, as I remind my premium members frequently; please understand the environment we are in. A bear market, and please adjust accordingly because Bear markets wreck both bulls and bears. Their entire MO is to destroy wealth. Don't hold losers for too long. Cut them short quickly. Trade smaller, trade quicker (only hold for a few days), and use tighter stops. All facilitate safe trading and prevent havoc on one’s portfolio.