U.S. stocks edge lower; consolidating ahead of a slew of Fed speeches

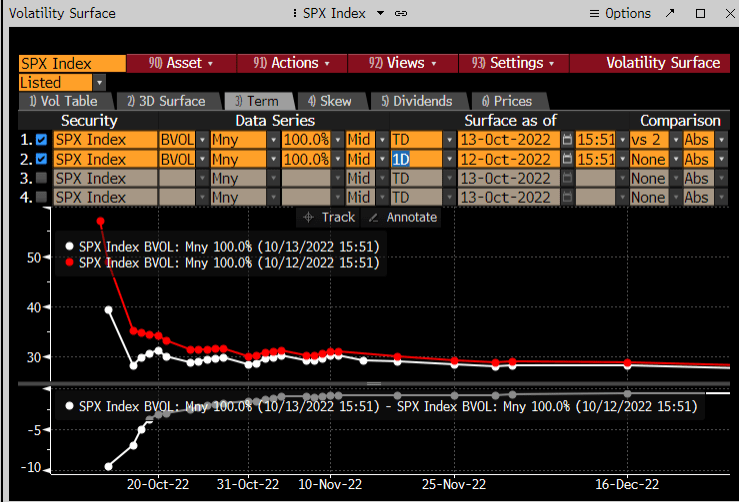

Stocks had a hectic day, dropping lower, hitting the 3,500 area, and bouncing hard. It looked like a classic Vanna rally after a news event, not all that dissimilar to what we have seen following some Fed meetings. Going into today, Implied Volatility (IV) for the S&P 500 was over 50%. Once the market opened, IV started dropping as investors sold in-the-money puts, leading to market makers buying back hedges.

By the end of the Day, IV was back to 40%, and by tomorrow it is expected to be back to 27%. This is the same type of event that we typically see following a Fed meeting.

The rally today, was a mechanical bull ride in my opinion, and I would be surprised if lasts.

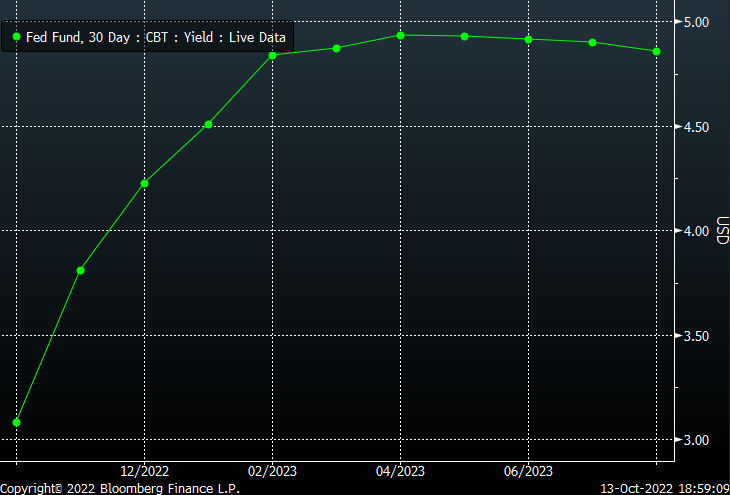

All you have to do to understand the impact of the CPI report again is look to bonds; there is nothing magical about it. Fed Funds futures are now pricing in rates to hit nearly 4.95% by April and are probably heading higher and past 5%.

Meanwhile, the 2-Yr rate jumped to more than 4.45%.

So I would be surprised if the equity market was cool with a Fed Funds terminal rate heading to 5% by the spring of next year. Nobody ever said the equity market was the sharpest tool in the shed.

The S&P 500 fell right into that 3500 to 3520 range I was looking for and bounced. That was the level with the most significant amount of put gamma, likely triggering a wave of put selling, given the IV melt in the above chart. The index reached 3,670, which had been a resistance level before today.

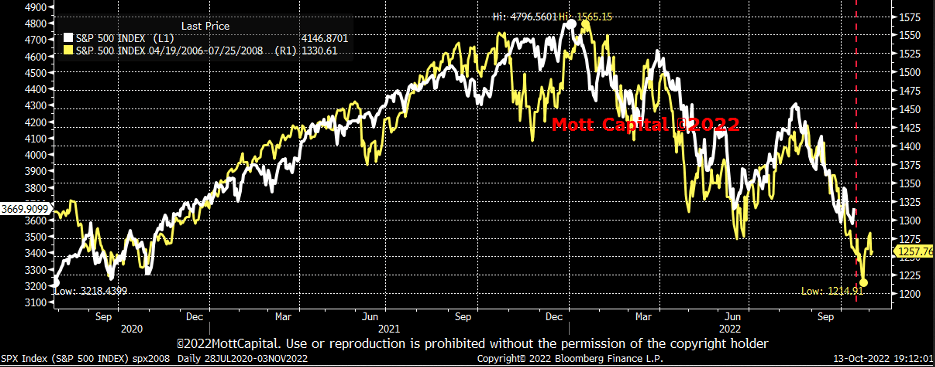

We could call this pattern a cup with a rising handle, a bearish reversal pattern. A cup and handle pattern is bullish when the handle is flat or falling, but when it is rising, it is bearish. Or you can say this is a rising flag and a bearish pattern. Both of these patterns suggest the market gives back the entire rally.

I hate to say it, but based on the 2008 analog, today’s rally came right on time. We will see; one way or another, we are getting closer to a short-term bottom.

Good luck today.