United Homes Group stock plunges after Nikki Haley, directors resign

- Chip stocks are facing a steep downturn amid slowing demand and growing U.S.-China rivalry

- The Philadelphia Semiconductor Index (SOX) is down about 36% for the year to date

- Texas Instruments is one of the safest bets to play this weakness

Perhaps the most important takeaway for the semiconductor market during the latest earnings season is that the anticipated broad-based demand slump has finally materialized. Therefore, a rebound may take longer than some analysts had predicted.

In fact, the downturn in personal computer and smartphone sales is much deeper than expected, while worries have grown about the markets for chips used in data centers, cars, and other applications.

On top of that, the U.S. government is cracking down even harder on semiconductor technology sold to Chinese companies, with new rules announced last month that expand on previous export controls.

With these new restrictions and possible retaliation from China, chip companies have been dragged into this geopolitical tussle with no end.

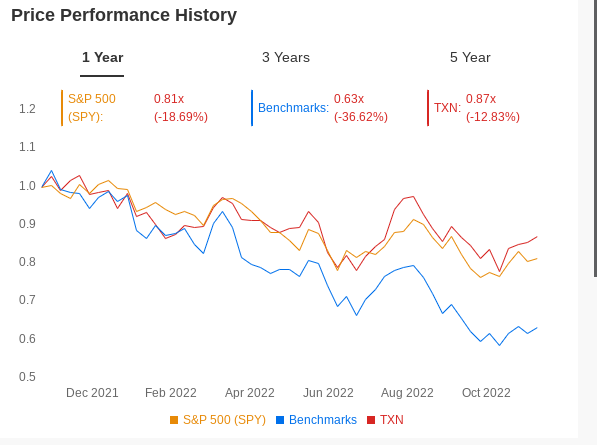

The impact of these multiple shocks has been quite devastating for chip stocks. As of Tuesday morning trading, the Philadelphia Semiconductor Index (SOX) is down about 36% year-to-date, nearly double the S&P 500’s decline.

With a current multiple of around 14 times forward earnings for the SOX, some argue that the sector may be nearing a bottom. But the wave of bad news doesn't seem to be over just yet.

Samsung Electronics (KS:005930), the world’s largest memory-chip maker and PC-processor maker Advanced Micro Devices (NASDAQ:AMD) reported results that suggested a deeper-than-feared slowdown ahead.

Intel Corporation (NASDAQ:INTC) also told investors last month that it’s slashing costs as the U.S.' largest chipmaker sees a persistent slump in computer demand. Its Chief Executive Officer Pat Gelsinger said that predicting a bottom for the market for computer chips currently would be “too presumptive.”

In this uncertain environment for chip stocks, it’s pretty hard to pick a buy-on-the-dip candidate, especially when we still don’t know how deep and widespread a slump in demand could be if the economy goes into recession. Still, painting all the industry players with the same brush isn’t such a good idea, in my view.

Why Texas Instruments Should Keep Leading the Industry

Among the largest chipmakers, I find Texas Instruments Incorporated (NASDAQ:TXN) to be one of the safest bets to play this weakness. The largest maker of analog and embedded processing chips, which go into products as varied as factory equipment and space hardware, has a very diversified product portfolio, making the company more resilient than its peers in an industry-wide downturn.

That’s the major reason its stock has outperformed its peers in this downturn by falling just 14% this year.

Source: InvestingPro

TXN’s chips generally require less advanced production than Intel processors or other digital products. That focus has allowed the company to free balance sheet space to devote cash to dividends and share buybacks.

Susquehanna, in a recent note, said that TXN stock is a great chip stock to keep in a long-term portfolio due to its durable competitive edge, which has been gained through scale, and that far outweighs the near-term challenges. The note says:

“This scale advantage helps provide unmatched analog product breadth (a catalog of 100k parts), comprehensive service and sales support, and manufacturing prowess.”

Due to TXN’s strong U.S. footprint, the Dallas-based company will be least affected by the U.S.-China’s growing rivalry than its peers.

In a recent note, Barclays upgraded Texas Instruments shares to equal weight from underweight, saying the company should benefit from Biden's CHIPS Act that seeks to boost semiconductor manufacturing in the United States.

But the biggest attraction for long-term investors is the company’s dividend program, which has been growing every year for the past 19 years. In September, the company authorized $15 billion in new share repurchases and boosted its quarterly dividend by 8% to $1.24 a share.

Through its robust share buyback program, TXN has reduced its outstanding shares by 47% since the end of 2004. With its payout ratio of around 50%, T.I. is in a comfortable position to continue to hike its dividend going forward.

Bottom Line

It’s not a good time to get bullish on semiconductor companies, as the sector faces multiple headwinds that will likely affect future sales outlook.

But TXN has a diversified product portfolio that should weather any recession better than its peers. Furthermore, its U.S. focus and solid capital return program make its stock well-positioned to weather this storm and strongly rebound once the environment turns brighter for the industry.

Disclosure: At the time of writing, the author did not have a position in stocks mentioned in this article. The views expressed in this article are solely the author’s opinion and should not be taken as investment advice.