Oil prices fall as key Russian port resumes loadings, easing supply risks

- Corporate executives are shifting from optics to outcomes when it comes to ESG

-

Public sentiment is important, and new regulations are vital to reshape sustainability’s growth

-

Investors demand tangible results over rhetoric and marketing labels

The Environmental, Social, and Corporate Governance (ESG) movement has faded somewhat from the headlines in recent years, but it hasn’t gone away. Earlier this month, TMX DatalinxⓇ hosted its Data Minds webinar, which brought together ESG economics experts to highlight the key themes emerging in sustainable investing today.

Their commentaries and outlooks were enlightening. The upshot was that the view of the panel was ESG is evolving, not disappearing. Today’s investor and C-suite executives embrace a quieter, more enduring, and tactical approach to the once-hot trend, but there are volatile political waters that must be navigated, according to the participants.

As Lenka Martinek, Managing Partner at Sustainable Market Strategies and Nordis Capital, called out, “There has been a very marked shift in the US away from ESG.” But that may be in name only. The Great ESG Rebrand involves ditching the branding altogether. Indeed, the panel suggested ESG as a label is not the optimal approach. Rather, focusing on investing trends that do good and are good is more effective.

Martinek described a recent development in Texas in which, despite anti-ESG rhetoric, the state reversed course and re-allowed pension funds to invest with BlackRock—once criticized for being too ESG-forward—because the asset manager had become “sufficiently non-ESG,” as she dubbed it. That could be the future direction: The work is still being done, just more quietly.

Substance Over Style

Saurabh Srivastava, Head of Data and Rating and Managing Director at Inrate, added to the discussion by highlighting a turning point in ESG’s evolution. “ESG is maturing… moving from expansion to simplification and optimization. It’s also moving towards more output-based versus optics-based investing.” Put another way, ESG is no longer merely a marketing tactic—it appears to be becoming a central and measurable piece of risk management for corporate executives. What’s more, the rebrand is more of a zoom-in rather than a catch-all attempt. That can be a natural and healthy part of any long-term theme.

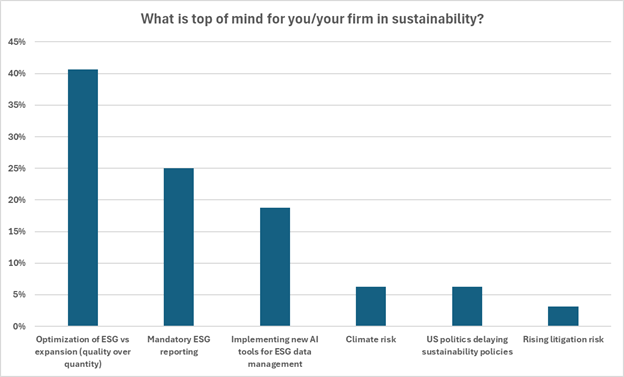

Interestingly, a live poll conducted during the event buttressed that suggestion. An overwhelming majority cited “optimization of ESG versus expansion” as their preferred approach. The last five-plus years have made it clear that ESG initiatives should not be treated as some box-checking step a multinational corporation must take. It appears today’s investors demand substance, or they’re out.

So, maybe the most essential aspect of the rebrand is to turn down the volume and ratchet up the output.

Sentiment Is Important, But So Too Is Regulation

There’s clearly a balancing act here. Srivastava made the analogy that “sentiment really drives the packaging, but regulation still drives the plumbing of it.” In other words, how ESG is framed may change based on the political winds, but long-term capital decisions from CEOs and CFOs, along with where individual and institutional investors allocate their funds, will likely be made as a result of the nuts and bolts of policy, risk, and regulation.

In Europe, regulations are being streamlined to foster growth in ESG through the recent EU Omnibus legislation. The goal of this legislation is to simplify sustainability reporting and ensure greater alliance between sustainability laws while maintaining rigorous standards. While this legislation is still being discussed, the intentions to streamline reporting could show that the “plumbing” is getting stronger.

Standardized reporting may be key to the success of ESG 2.0, and ESG as a practice is increasingly embedded in the global financial system, according to the panelists.

It’s a Show-Me Story, Not a Hear-Me Story

There must be public buy-in for it all to work. Corporate “green-hushing” has become a thing according to panelists —it’s the trend of companies continuing their sustainability efforts but deliberately not publicizing it to avoid political blowback. Dodging backlash, including negative news stories and social media posts that go viral for all the wrong reasons, may result in ESG taking a step back rather than moving forward. As discussed by the panel, this rebrand must be on its front foot, so to speak, and that means simply rolling up its proverbial sleeves. ESG must earn credit and be known by its works.

Call it a pragmatic shift. Rather than shouting sustainability from the HQ rooftops, firms look to be folding ESG into operational goals, product development, long-term planning, and even just everyday tasks. The hope here is that the public can see it but doesn’t get bombarded with it on every earnings call and press release.

Market Results and Share-Price Returns Are Still There

As long as the results and data support it, ESG can thrive. Srivastava presented evidence that companies that integrate ESG well tend to outperform, citing the S&P 500® ESG Index and the MSCI ESG Index. Alpha in share-price returns is, of course, never guaranteed. Still, firms like Microsoft (NASDAQ:MSFT), Ørsted, and Schneider Electric (EPA:SCHN) are cases in point, noted by Srivastava, for embedding sustainability into their core business models.

Martinek added that these companies tie in their revenue alignment with powerful sustainability themes and strong corporate governance, which helps to remove reputational risk.

A Heated Political Climate

As noted by the panel, the elephant in the room is the current state of the US political landscape. ESG will undoubtedly be a hot-button issue as we exit one election cycle and enter the next. Amid the intense rhetoric, sustainable investing does not look to be stalled.

A reshaping appears to be underway, one that embraces new strategies, fresh voices, and enduring corporate policies that benefit as many stakeholders as possible. The culture war will persist—the panel was not Pollyanna about that—but the infrastructure supporting sustainable investing continues to evolve and deepen.

The Bottom Line

The “Great ESG Rebrand” doesn’t ditch what took years to build. The goals of the 2010s endure, and the recalibration taking place now may be poised to gradually reshape how corporate executives make decisions.

The panel was direct: sustainable investing cannot be done in a vacuum, and looking beyond the labels to see what the data actually shows is key. True practitioners of sustainable investing and ESG know that only progress matters, according to the panel, not labels and acronyms.