Tyson Foods to close major Nebraska beef plant amid cattle shortage - WSJ

Gold appears to be well-positioned for a strong pump that could carry it to new all-time high prices in 2023—and beyond. As you know, I’ve been following and writing about the precious metal market for a very long time, and I see a number of unique catalysts at the moment that could contribute to higher gold prices. If you’re underexposed or have no exposure, time could be running out to get in at these prices.

Below are just three potential catalysts for stronger gold.

Emergence of a Multipolar World and Rapid De-dollarization

I’ll begin with what I believe to be the biggest risk that could be beneficial for gold prices: de-dollarization. Recently, I wrote about the end of the petrodollar and the possible emergence of a multipolar world, with the U.S. on one side and China on the other.

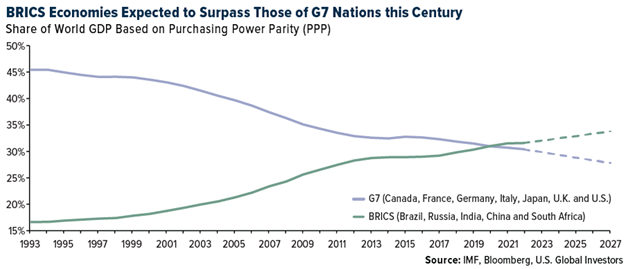

Take a look at the chart below. The purple line shows the combined economies of G7 nations (Canada, France, Germany, Italy, Japan, the U.K., and the U.S.) as a share of global GDP in purchasing parity terms. The green line shows the same, but for BRICS countries (Brazil, Russia, India, China and South Africa). As you can see, G7 economies have steadily been losing their economic dominance to the BRICS—China, and India, in particular. Today, for the first time ever, the leading developed countries contribute less to global GDP than the leading emerging countries.

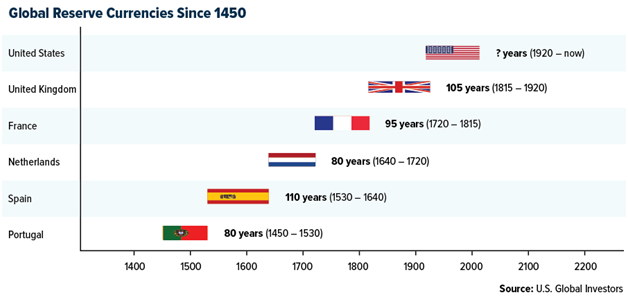

The implications of this could be multi-faceted, but for our purposes here, let’s focus just on currencies. Since the end of World War I, the U.S. dollar has served as the world’s reserve currency, and since the 1970s, crude oil and other key commodities—including gold—have traded globally in greenbacks.

That may be set to change with the rise of a multipolar world in which half of all commodities are traded in U.S. dollars, the other half in another currency—the Chinese yuan, perhaps, or a BRICS currency of some kind, or a digital currency such as Bitcoin.

An increasing share of commodities is already being settled in non-dollar currencies. Last week, China settled a liquid natural gas (LNG) trade with France in yuan for the first time ever as the Asian giant seeks to expand its economic influence around the world. Since Russia’s invasion of Ukraine last year and the international sanctions that followed, Russia’s de facto reserve currency has been the yuan, according to Kitco News.

Some economists believe the time is right for a major competitor to the dollar to step up. Jim O’Neil, the former Goldman Sachs economist who coined the acronym BRIC, wrote an essay recently urging BRICS nations to challenge the greenback’s dominance, saying that shifts in U.S. monetary policy create dramatic fluctuations in the value of the dollar that affect the rest of the world.

Gold would be a direct beneficiary of de-dollarization since it’s priced in the greenback. Gold is trading at or near all-time highs in a number of currencies right now, including the British pound, Japanese yen, Indian rupee and Australian dollar, and it would likely be hitting new highs in USD terms as well were the dollar to be devalued.

Acceleration of the Liquidity Crisis and Return of Quantitative Easing (QE)

The next potential catalyst has to do with the ongoing shakiness of certain segments of the traditional financial sector. Pressured under an estimated $620 billion in unrealized losses, the U.S. banking industry has seen the failure of two large firms this year—Silicon Valley Bank and Signature Bank—and a significant erosion in depositors’ confidence.

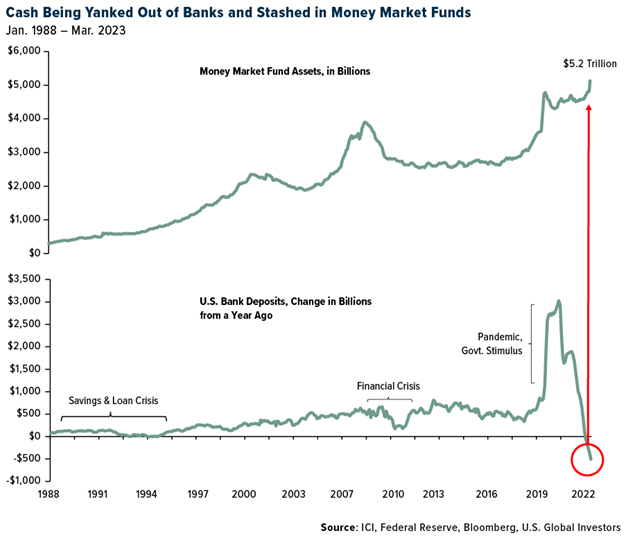

As a result of these failures, people and companies have withdrawn tens of billions of dollars from banks. In March, bank deposits were down more than $500 billion compared to the same month in 2022, a more dramatic year-over-year change than the savings and loan crisis in the 1980s and 1990s and the financial crisis.

Where is all this capital going? Money market funds, which are perceived to be safer and, in many cases, deliver higher yields than savings accounts right now. A record $5.2 trillion now sit in these funds, according to the Investment Company Institute (ICI), and the stockpile is expected to get much higher.

Many regional and community banks were already facing a liquidity crunch due to massive unrealized losses, and the sudden withdrawals will only amplify things. As reserves drop, banks will become less and less willing to lend to households and businesses, slowing the economy even more than the Federal Reserve’s rate hikes.

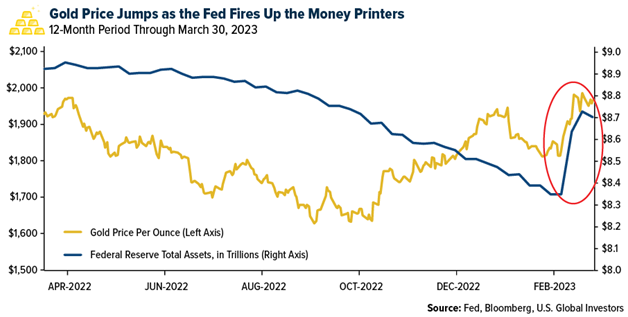

In the event that the liquidity crisis expands into a full-blown recession, the Fed will have no other choice than to pivot and begin another cycle of quantitative easing (QE). The central bank has been trying to unwind its balance sheet, but in an effort to stabilize the banking sector, it added nearly $400 billion in the two weeks ended March 22. Over the same period, the price of gold jumped 8.6%, reversing its 2023 losses.

Two Cold Wars

The final catalyst on my list involves worsening diplomacy between the U.S. and its allies and Russia and China. Relations between the West and the East are about as bad as I remember them ever being, and they could get way worse before they get better.

In recent interviews and webcasts, I’ve been saying that the U.S. is facing two Cold Wars right now with Russia and China. I hope that these conflicts remain “cold,” but there’s always the possibility that they become something more—in which case, I would want to have exposure to gold.

I won’t spend a whole lot of time on this topic, but I want to point you to a recent article that appeared in Foreign Affairs. According to the article’s two contributors, Chinese Leader Xi Jinping appears to be shoring up his country’s military readiness by increasing the defense budget and building new air-raid shelters in key cities and “National Defense Mobilization” offices. “Something has changed in Beijing that policymakers and business leaders worldwide cannot afford to ignore,” the piece reads.

Whether the military build-up is, a precursor to an invasion of Taiwan or something else remains to be seen.

I know that investors have put their trust in gold in times of geopolitical risk and uncertainty. I’ve always advocated for the 10% Golden Rule, with 5% in physical gold (bars and coins) and the other 5% in high-quality gold mining stocks, mutual funds, and ETFs.

***

Disclaimer: All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.