Bill Gross warns on gold momentum as regional bank stocks tumble

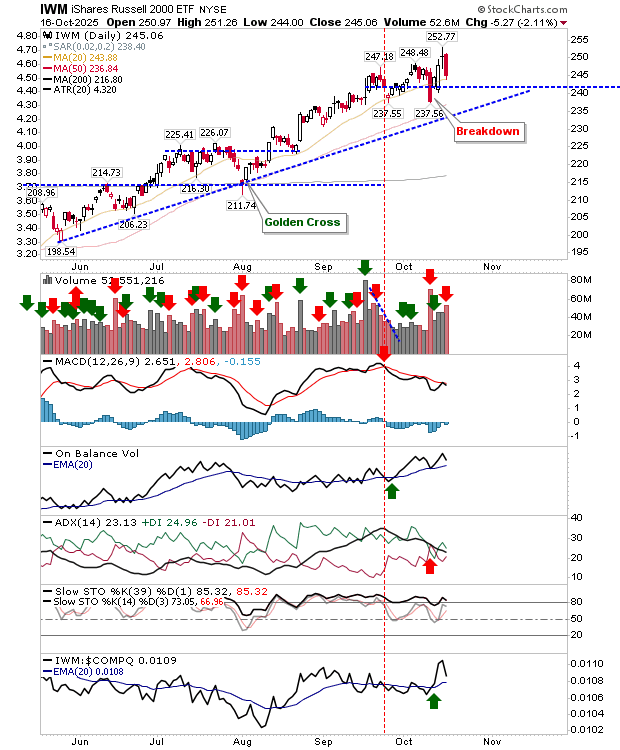

The Russell 2000 (IWM) had done well to reverse its first big red candlestick in months on a solid day of "value" buying, but struggled to build on it. Now, with bad news sweeping the regional banking sector - leading to another sizable red (selling) candlestick on confirmed distribution - it’s hard to see buyers coming in for a second bite. In percentage terms, markets are trading above summer levels, so there isn’t too much downside to take what you can now (across all asset classes), and wait it out (until the next dip below 200-day MAs).

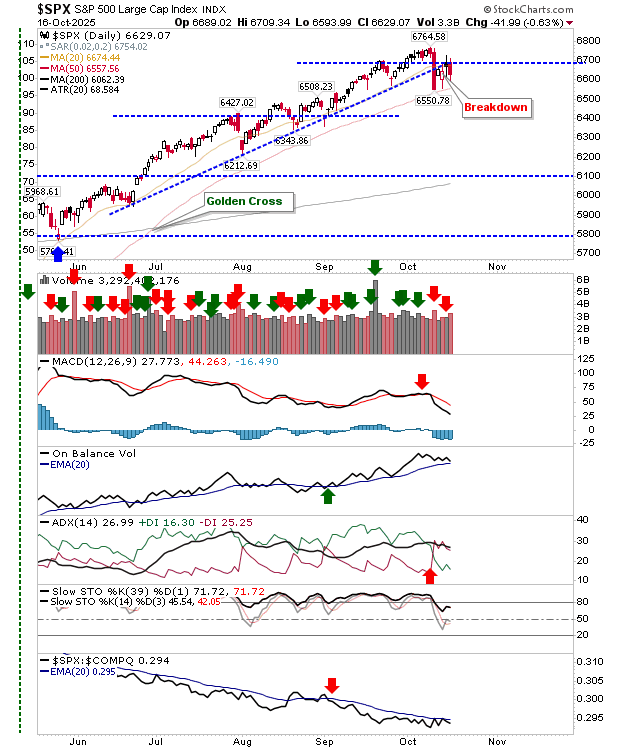

When we look at other indices, the picture looks more menancing. The S&P 500 found resistance in what could turn out to be a reversal head-and-shoulder pattern as it reversed at September’s swing high. We are seeing a degredation in the technical picture, albeit from a once strong bullish setup; for example, On-Balance-Volume is still trending higher, but is unlikely to survive a spate of distribution days. The 50-day MA is looking like a last chance saloon before we next stare at the 200-day MA far below.

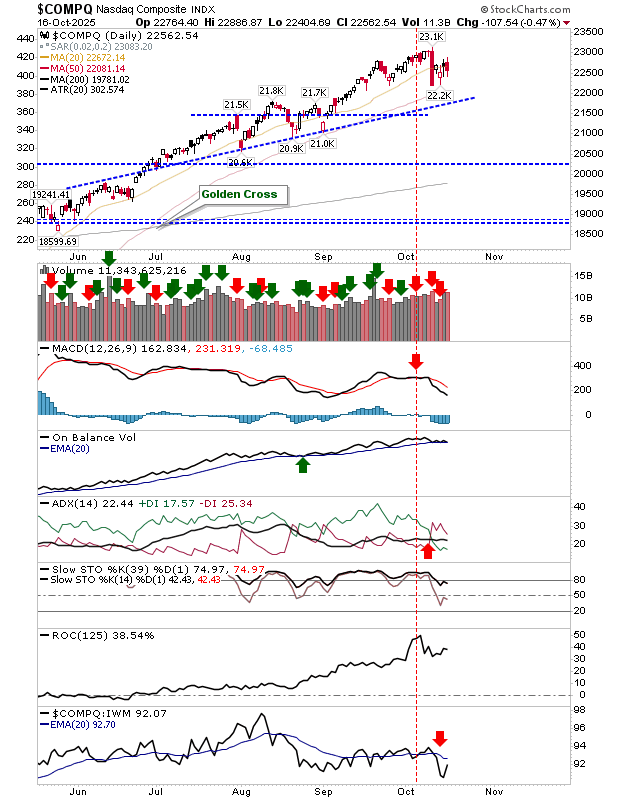

The Nasdaq has rallied at a more modest rate than the S&P 500, so while it has a bearish setup similar to the S&P 500, it has more support to work with, and the 200-day MA isn’t as far away in relative terms. It’s on the verge of a ’sell’ trigger in On-Balance-Volume, likely to occur today based on Futures action. I would still take profits, but whatever comes next may not be as damaging as some of the negative news around AI investment suggests will happen.

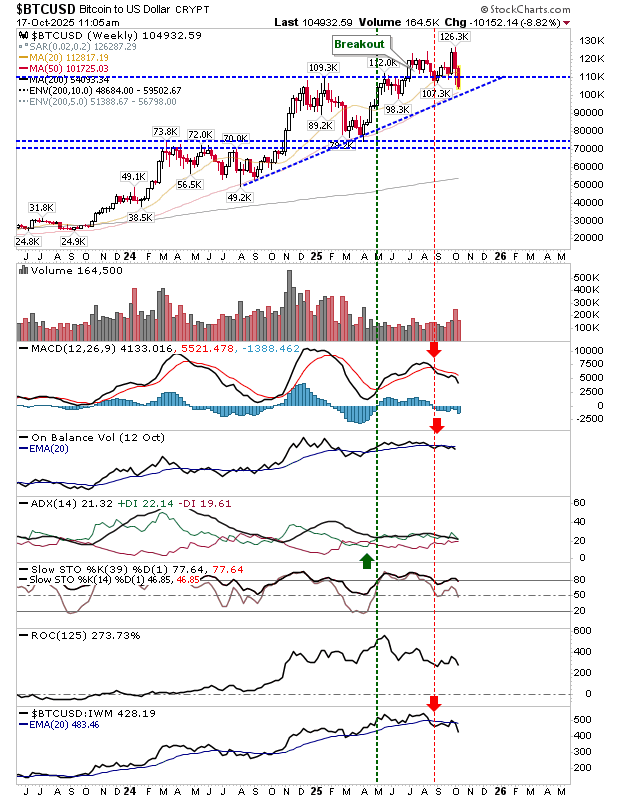

What may be more interesting is what’s happening with Bitcoin. The selling its suffering, albeit on light volume, has it very much aligned as a "tech" index, rather than an alternative safe haven to gold. It will be interesting to see how much ’tech bros’ will be willing to defend this (by buying the dip), or will they let it revert to its prior wild mood swings.

Going forward, it’s going to get messy. Any expansion of this sell-off will first ask the question, "is this a new trading range?", depending on where the initial downleg settles. Next will come a study on the veracity of the bounce and where it may stall out. Then, off the stalled bounce, will that reversal kick-start a new downwards trend. As for action, I have sold some covered calls in my ROTH, but holding my pension position. You don’t want to trade (if able to) your pension account. Lighten up on the non-pension investment account so you can be a buyer on the next undercut of the 200-day MA; April 2025 was the last such signal, so don’t expect the next one to happen until sometime in 2026.