Elastic launches GPU-accelerated inference service for AI workflows

Eight days after “Liberation Day”, President Donald Trump announced a reduction of reciprocal tariff rates to a 10% baseline on the 60 countries with higher tariff rates. This pause of the higher tariff rates for 90 days is to provide time for negotiations. The president also said in a social media post that he was raising the tariffs imposed on imports from China to 125% “effective immediately” due to the “lack of respect that China has shown to the world’s markets”.

Here are the good, the bad, and the ugly parts of this announcement.

THE GOOD

A Financial Crisis Is Avoided (At Least for Now)

A few hours before Trump’s reversal on tariffs, the S&P 500 was flirting with a bear market. More importantly, the US was on the edge of an emerging-market-type crisis, with bonds and dollars going down alongside the stock market.

While President Trump might not care about the stock market in the short run, it seems that the threat of a bond market crisis made him think again.

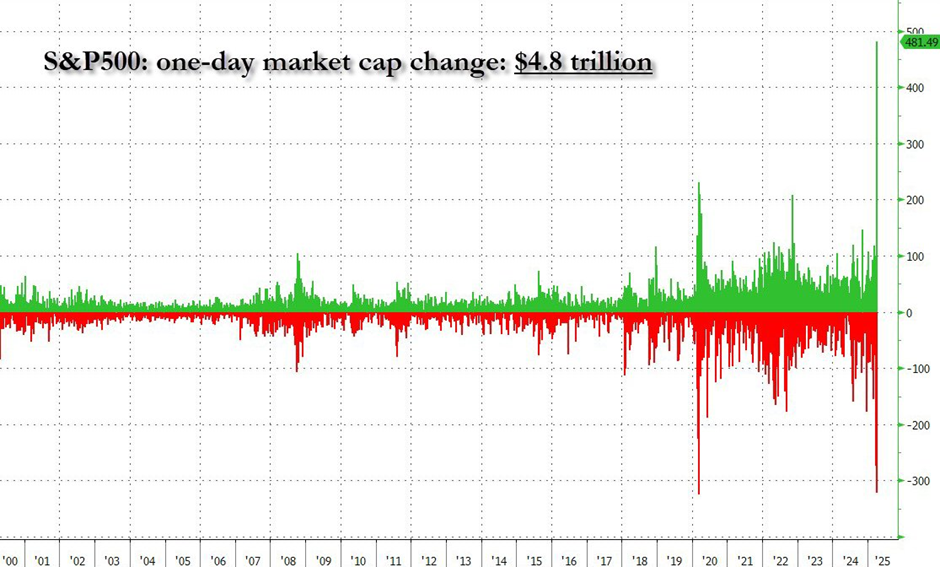

The announcement of a 90-day pause of some of his “reciprocal” tariffs on the globe triggered one of the biggest single-day stock market rallies ever. US Treasury bond yields also felt some relief.

It now seems that an Armageddon scenario of a full-blown bear market has been avoided–at least for now.

Another positive is that for now, most tariffs are back in the box. President Trump now knows that if he reopens the box, he will risk another equity and bond market crash. As a result, it seems likely that he will forget about ex-China tariffs for some time.

THE BAD

Who Can Deal With Such Volatility And Unpredictability?

Investors started the day trying to understand the risks of the “basis trade unwinding” by some multi-billion-dollar hedge funds. A few hours later, they had to handle the biggest rally for the Dow Jones in 5 years. While the “Trump pause” is a relief for investors, the technical damage is real and most likely prevents any V-shape rebound for risk assets in the short run.

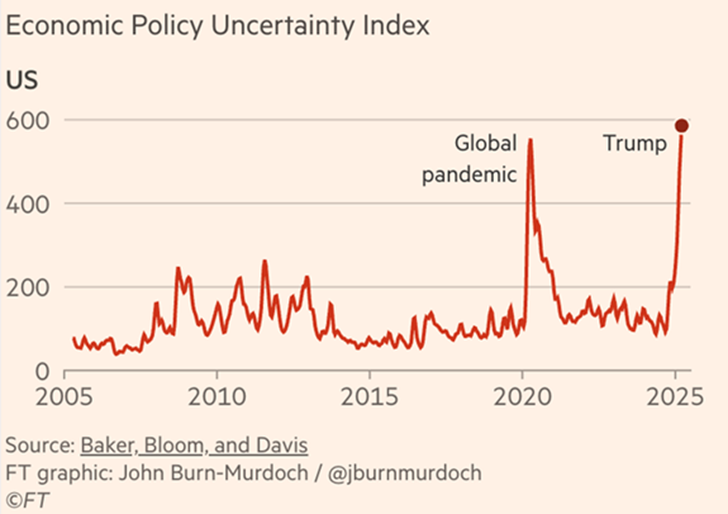

The same level of uncertainty prevails in the corporate world. For CEOs and CFOs, the level of economic uncertainty has rarely been so high. At this stage, it is impossible for them to make any plans about CapEx, hiring, or M&As. This will have consequences on the job market and global economic growth.

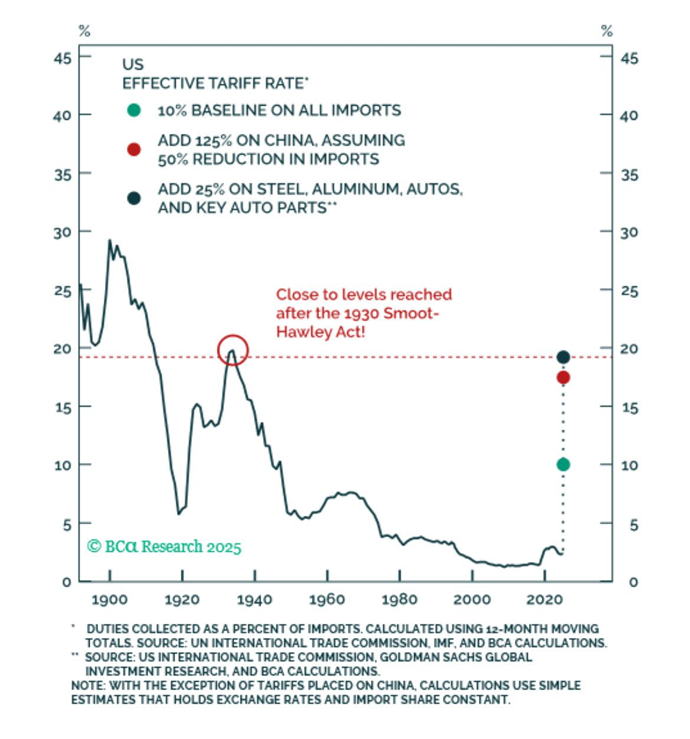

It should also be noted that despite the reversal by Trump, the tariff estimates from 2nd April have not changed considerably, sitting at around $490bn today. The reason for this is that China’s expected increase with the latest tariff rate is $275bn higher than what was released last week and offsets the $158bn of tariff reduction announced yesterday (estimates by Strategas).

The US will thus have to deal with the equivalent of the biggest tax hike over the last 50 years. While this could be neutralised by corporate and individual tax cuts, the spillover effects on the US economy remain difficult to predict.

Even after yesterday’s flip-flop, we’re still looking at the biggest tariffs since the 1930s.

While we don’t believe that the US will enter into a recession this year, a material slowdown and some upside pressure on inflation are expected.

All the above have consequences on the risk premium required by investors. While we still don’t believe in the prolonged bear market scenario, we think that markets are likely to stay volatile and that the bottoming process might take some time to unfold.

THE UGLY

It’s All About China!

In a matter of hours, the Trump administration’s stance has evolved from an all-out trade war against everyone to a concentrated trade war against China. Indeed, the 125% tariff on China while all the others drop to the 10% baseline for the next 90 days demonstrates that all of this is about China.

Over the last few decades, there was a strong geopolitical equilibrium: China was exporting cheap goods to the US (keeping inflation low) and was recycling their dollars into US Treasuries (keeping yields low). This equilibrium was already cracking and is now broken for good, with neither side having any political incentive to restore it.

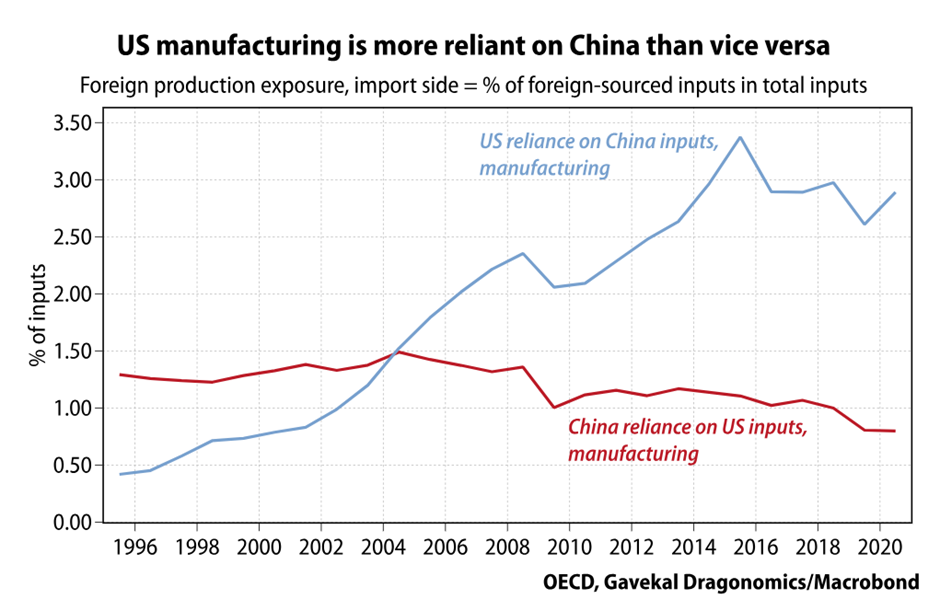

This is bad news for China. The numbers don't lie: China's $300B trade surplus with the US is about to become their biggest weakness. The death of US-China trade will likely mean a hit of between -1% and -2% for China’s GDP (source: Gavekal). Beijing will now have to step on the gas to compensate for this loss, which has already begun.

The US will also be hit hard, as their manufacturing industry is more reliant on China than vice-versa.

Investment Conclusions

Trump is pursuing a shock therapy for the US economy. It all started with an economic detox: halt the US government fiscal stimulus, reduce budget deficits, and impose deregulation across a number of sectors (healthcare, finance and housing).

Now, he aims to balance trade deficit—all of this is part of a broader, strategic shift.

The US is no longer shaping policy purely for economic growth but for geopolitical leverage, particularly in its rivalry with China.

Through tariffs, trade threats, and pressure on allies, the US is forcing global alignment: “us or them”. It’s a deliberate campaign to weaponise America's role as the world's top consumer.

This shift creates deep market uncertainty. The issue isn’t just interest rates or inflation — it’s that the rules of the game are changing, and investors can’t model what comes next.

The market is working exactly as it should: pricing in regime risk, not just economic risk.

Until there’s clarity — a deal with China or a defined US strategy — volatility will dominate. This isn’t a cycle. It’s a regime change. And for now, it’s not a market to trade, but to survive.

Once the dust settles, there will be plenty of opportunities. Recent market developments like DeepSeek, the fiscal boost in Europe and China, and reciprocal tariffs have highlighted the necessity of having broadly diversified portfolios. The new paradigm should also be favourable to stock pickers. For instance, it is key to identify more defensive business models but also companies with localised businesses.