Novo Nordisk, Eli Lilly fall after Trump comments on weight loss drug pricing

A split on the FOMC, Powell’s uncertain future, and technical breaks across the dollar complex are unsettling the recent rally. Is the DXY about to resume the 2025 bear trend?

- Waller supports 25bp cut at July FOMC

- Rate cut pricing lifts, denting USD rebound

- DXY breaks uptrend from July 1 low

- EUR/USD clears downtrend, signals bullish tilt

USD Outlook Summary

The expected near-term path for US interest rates continues to influence the performance of the US dollar, with the recent unwind of dovish market pricing likely playing a large role in the corrective rally seen in July.

However, with a clear split emerging within the FOMC on the inflationary impact of import tariffs—seeing members like Governor Christopher Waller publicly advocate for a rate cut next week—dovish pricing is starting to build again.

With technicals also warning of dollar weakness, we may be witnessing the early stages of a resumption of the broader bear trend established earlier this year.

Short-End Rates Driving FX Universe

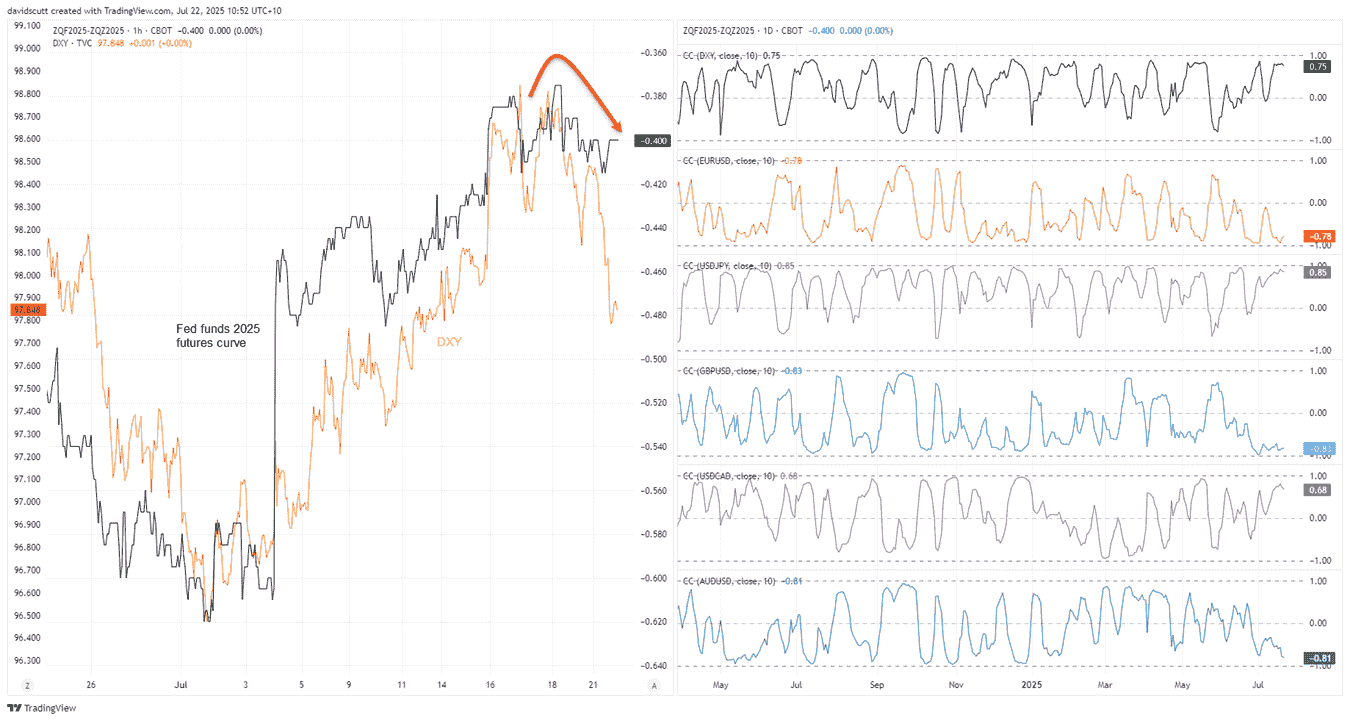

The next chart shows the rolling correlation coefficient scores between the shape of the Fed funds futures curve for 2025 and major G10 pairs over the past fortnight, revealing a strong relationship with most over this period.

Source: TradingView

While a high correlation doesn’t imply causation, as covered in a separate note last week, it’s clear that as U.S. economic data improved from late June, it helped drive a rebound in the U.S. dollar as rate cut expectations faded.

However, that unwind stalled late last week after Governor Waller confirmed he will vote for a 25-basis point reduction at the July FOMC meeting. While he’s only one voting member, along with uncertainty over whether Jerome Powell will be allowed to serve out his full term as Fed Chair, it’s helped lift rate cut pricing, taking the air out of the dollar’s rally.

DXY Breaks July Uptrend

Not only that, as seen in the next chart, it’s also caused some technical damage to the narrow US dollar index (DXY), with the price breaking beneath uptrend support from the July 1 lows.

Following repeated failures to clear the 50-day moving average last week, and with RSI (14) and MACD flashing neutral-to-bearish momentum signals, it feels like the DXY may be resuming the broader bear trend seen through much of 2025.

Source: TradingView

For now, the DXY has found support at the July 16 low of 97.70. However, if that gives way, the probability of a deeper unwind improves, putting a potential retest of the July 1 low of 96.40 on the table.

EUR/USD Eyes 2025 Highs

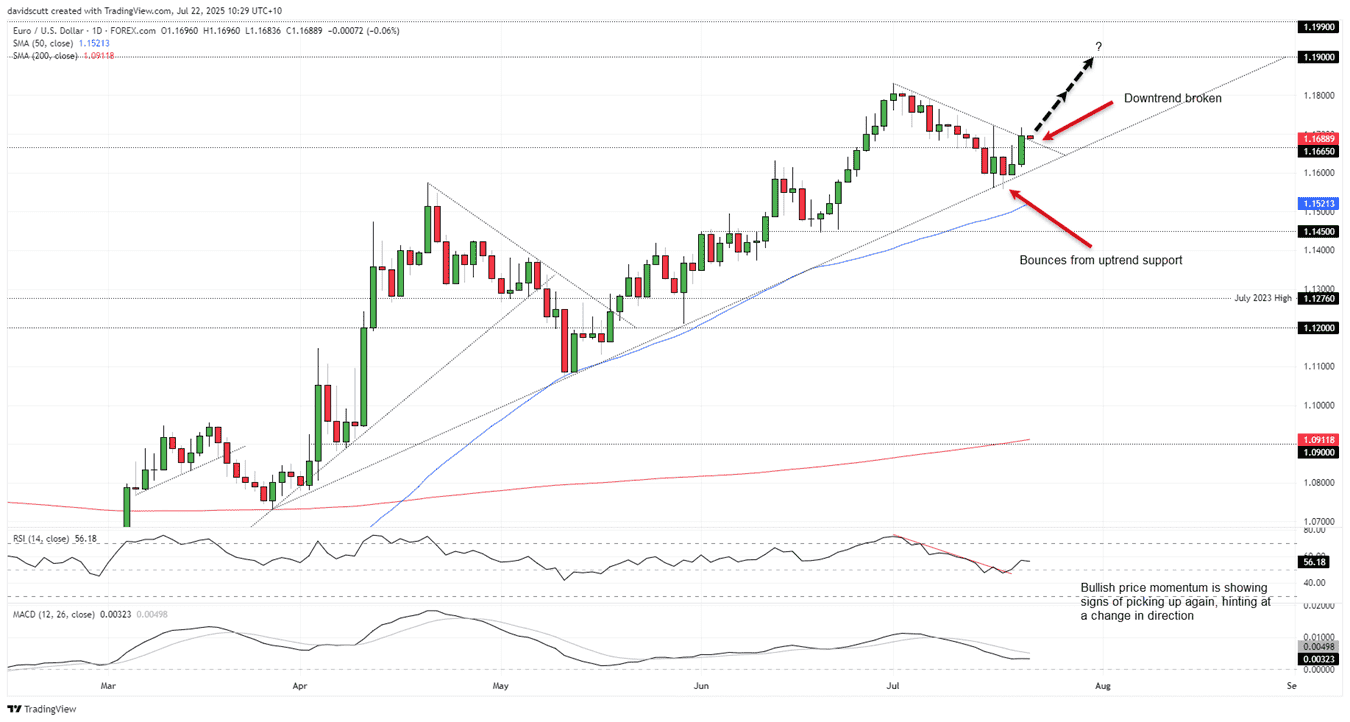

As the DXY is not readily traded, for more concrete clues on directional risks for the dollar, it’s always useful to look at the technical picture for the largest component in the DXY, the EUR.

As seen in the EUR/USD daily chart below, having tested and bounced from uptrend support on two occasions last week, the bulls regained control either side of the weekend, seeing the pair not only clear horizontal resistance at 1.1665 but also the downtrend it had been trading over July.

With RSI (14) breaking its downtrend and pushing higher, and with MACD starting to curl back towards the signal line while remaining in positive territory, it suggests near-term directional risks may be skewing higher again.

Source: TradingView

If EUR/USD can push and hold above the July 16 high at 1.1720, it may encourage other bulls off the sidelines seeking a retest of the July 1 high of 1.1830.

Alternatively, with the pair down marginally in early Asian trade on Tuesday, a bounce off the former downtrend may also be enough to spark renewed interest from the long side, creating a setup where bullish positions could be established with a stop beneath 1.1665 for protection.

ECB Tops Event Risk

With FOMC members in a media blackout and little top-tier economic data due in the U.S. or Europe this week, the key risk event for traders will be the European Central Bank’s (ECB) policy meeting on Thursday.

With only the statement and post-meeting press conference from President Christine Lagarde to digest, it comes down to what the bank signals on the policy outlook, unless the ECB stuns markets with a surprise rate cut.

Given the stronger euro and the downside risks to activity posed by new U.S. tariffs on E.U. goods, traders already expect the ECB to cut the deposit rate by a further 25bps by December to 1.75%, with a meaningful risk of an earlier move.

For EUR/USD to see meaningful downside, the ECB may need to outdo the doves. Maybe, but given the uncertainty that remains and the easing already delivered, that seems unlikely.