United Homes Group stock plunges after Nikki Haley, directors resign

- US Dollar rises as geopolitical risks and oil prices drive safe-haven demand.

- Fed’s cautious stance supports dollar, but inflation and cut pressure keep outlook mixed.

- Technical resistance near 99.6 may limit DXY gains without stronger buying momentum.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

As the US attacked three Iranian nuclear sites over the weekend, global market uncertainty increased. This brought the US Dollar back into the spotlight. The US dollar started the week higher due to safe-haven demand, rising oil prices, and expectations of tighter Federal Reserve policy.

For the past two weeks, the dollar has been testing levels last seen in March 2022. Last week, the index slowed its decline as buyers stepped in, pushing it up from 97 to 99. The dollar has started the new week on a strong note and is holding around the 99 level.

These recent buying actions suggest that both political and economic events are playing a major role in shaping the dollar’s direction.

Safe Haven Demand Back With Geopolitical Tensions

The US attacks on Iran came shortly after President Trump said that “a decision will be made in two weeks.” After this statement, markets had hoped for a diplomatic solution. But since Trump is known for sudden changes in direction, the attack did not surprise many investors.

Now, investors are watching closely to see how Iran might respond—possibly by targeting US bases or blocking the Strait of Hormuz. These risks have made investors more cautious, reducing global appetite for risk. As a result, global stock markets fell, while the dollar rose, with investors turning to the greenback as a safe-haven currency.

The Federal Reserve’s hawkish tone last week, along with the idea that oil trade routes might shift to the US if Hormuz is closed, also helped support the dollar. These developments showed once again that the dollar remains one of the world’s key safe-haven assets during times of uncertainty.

Oil Rally Supports the Dollar—but for How Long?

Since the US is one of the largest exporters of oil and liquefied natural gas (LNG), rising oil prices tend to support the dollar. Higher energy prices help improve the US trade balance and increase global demand for dollars to pay for energy imports.

At the start of the week, Brent and WTI crude oil prices rose by nearly 2%. However, prices did not surge further as OPEC’s spare production capacity helped keep things stable. Still, the threat of the Strait of Hormuz being closed continues to push oil prices higher.

If this risk remains, energy-importing countries like Europe and Japan could face more pressure. That would likely increase the dollar’s appeal even further, strengthening its position in global markets.

Fed Walks Tightrope Between Inflation Risks and Cut Pressure

Rising oil prices matter not just for trade but also for US monetary policy. Since the Federal Reserve targets inflation, its response to higher energy costs will be closely watched. In a recent statement, Fed Chair Jerome Powell warned that Trump’s tariffs and climbing oil prices could push inflation higher. This suggests the Fed will stay cautious and continue to rely on data before making any policy moves.

This week, several important economic indicators will be released, including PMI figures, housing sales, and especially core PCE inflation data. These will be key to shaping the Fed’s next steps. Although interest rates were left unchanged at last week’s meeting, the Fed’s updated forecasts showed a higher inflation outlook. This makes rate cuts less likely in the short term. Still, comments from Fed official Christopher Waller—who mentioned a possible rate cut in July—stand out as a more dovish signal.

Markets will also be paying attention to global events this week. The NATO Summit in The Hague and Powell’s testimony to Congress could both influence market direction. If Trump uses the summit to strike a diplomatic tone on Iran, it might calm markets. Meanwhile, Powell’s comments in the Senate could help clarify the Fed’s position and shift market expectations on future rate cuts.

US Dollar Technical Analysis

In summary, the dollar is currently being supported by three main factors: rising geopolitical tensions, higher oil prices, and the Federal Reserve’s cautious approach. As oil prices climb, the US—being a major energy exporter—stands to benefit, which helps boost demand for the dollar. At the same time, the Fed’s tight policy stance keeps US interest rates attractive compared to other currencies.

However, these supports are not entirely stable. Iran’s potential response to the conflict could shift the outlook. On the economic side, if the Fed unexpectedly responds to pressure for a rate cut, it could change the direction of the Dollar Index (DXY). As a result, market movements remain limited and cautious.

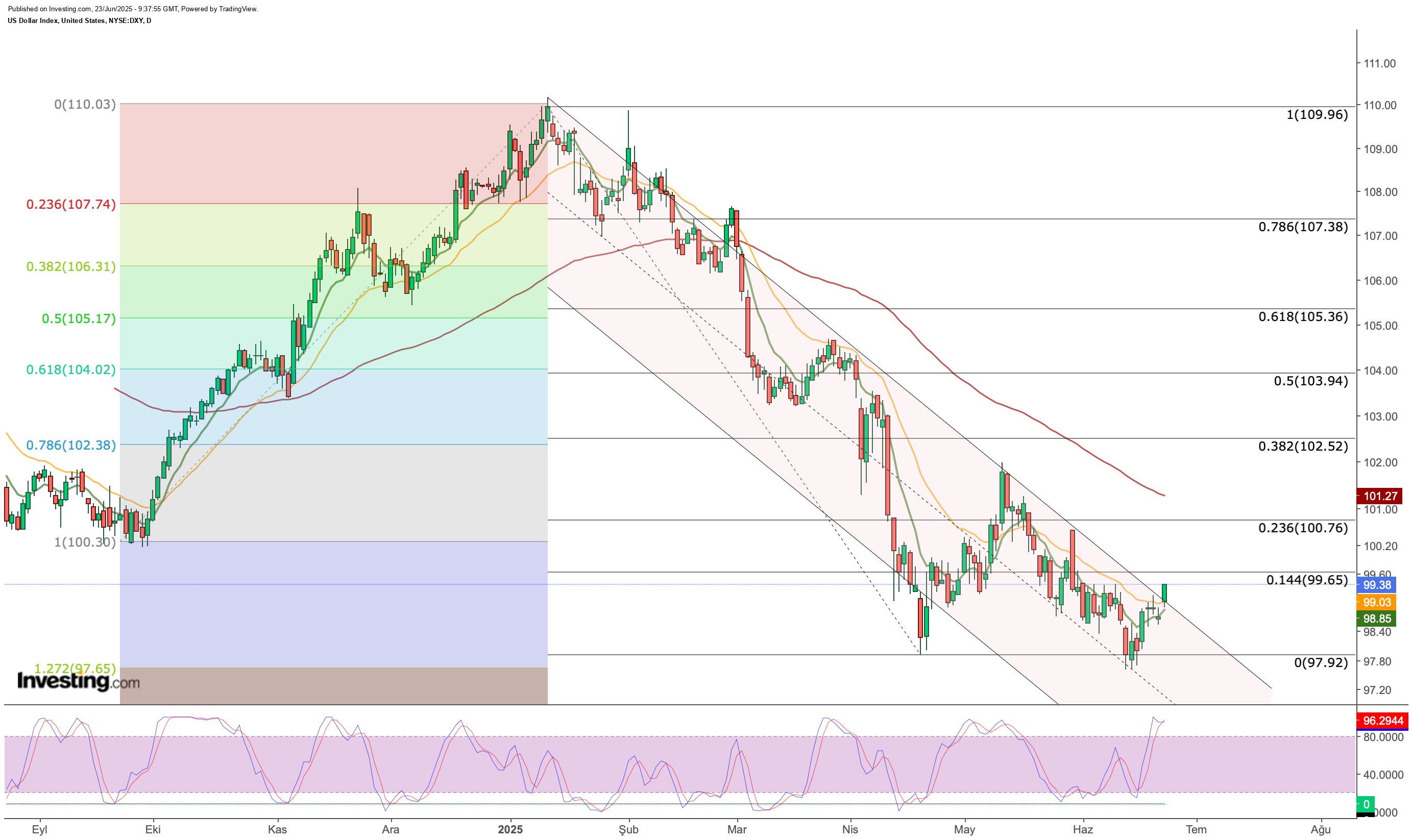

From a technical point of view, the DXY is trying to recover from its lowest levels in the past three years. It began this week by breaking out of the downward channel that has been in place since the start of the year. If this breakout holds, the first target level to watch is the Fib 0.144 mark at 99.65, which could signal the start of a trend reversal.

If the Dollar Index (DXY) manages to close above 99.65 on the daily chart, it could aim for higher levels—first around 100.75, and then 102.52. However, despite the recent pickup in dollar demand, the lack of strong buying volume suggests the recovery is still weak. This means that any negative shift in geopolitical or economic conditions could push the DXY back down toward the 99 level.

From a technical standpoint, the index appears overbought in the short term. If it fails to break through the 99.6 resistance level, there is a real chance that it could retreat and retest the 97 level, especially if momentum fades or risk sentiment improves.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with a proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belong to the investor. We also do not provide any investment advisory services.