Walmart halts H-1B visa offers amid Trump’s $100,000 fee increase - Bloomberg

The greenback is back in the game again! Since the end of February, the US dollar has been gaining against a basket of major currencies, like the euro, British pound and Japanese yen. As of March 9, 2021, the dollar index is up 0.4%, reaching a 14-week high at 92.34. This has been due to several positive developments, indicating a stronger and faster US economic recovery from the pandemic in the near future.

- Robust jobs data: The US economy added 379,000 jobs in February 2021, following an upwardly revised 166,000 job additions in January. This was against market expectations of 182,000.

- The $1.9 Trillion Stimulus Package: On March 6, the US Senate finally passed the $1.9 trillion stimulus package, to provide aid for economic recovery and unemployment benefits.

- Surging Vaccine Doses: Over 92 million doses had been administered in the United States as of March 9, 2021, according to the US CDC. In the absence of unexpected developments, the country is expected to inoculate every American by the summer of 2021.

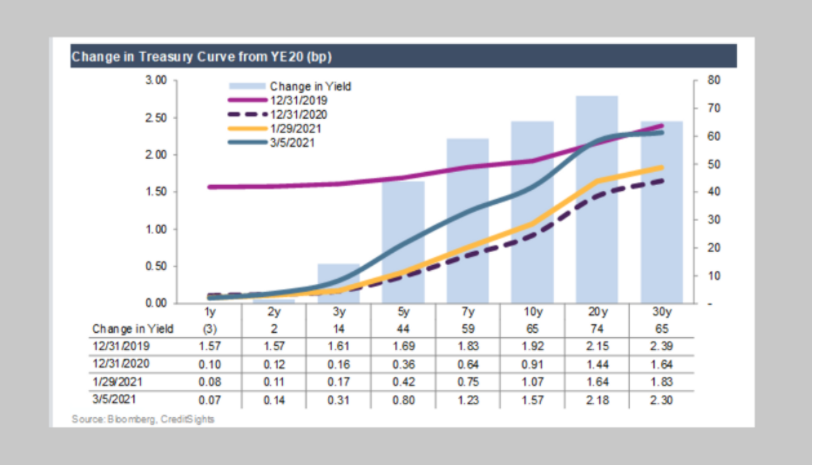

In the meantime, the US 10-2 Year Treasury Yield yield stayed at a 13-month high of 1.599% as of March 8, 2021, after the Senate passed the stimulus bill. The yield on the 30-year bond climbed to 2.323%; leading to an increase above 65 basis points as of March 8. This is close to the pre-pandemic levels seen in December 2019.

Inflation Woes for the US Economy – How High will Treasury Yields Go?

Treasury yields have been rapidly climbing recently, amid hopes of faster economic recovery and concerns about rise in inflation. This trend is expected to continue. Investors have already started to price in a sooner-than-expected tightening of the Fed monetary policy. In early January 2021, Atlanta Federal Reserve President Raphael Bostic, predicted that interest rates might be hiked by mid-2022 or early 2023.

Companies have also started to excessively borrow from the corporate bond market to remain ahead of potentially higher rates. Rising treasury yields have led to a steep rise in 30-year mortgage rates, hitting a 7-month high of 3.02% in early March 2021. The ICE (NYSE:ICE) BofA US Corporate Index Effective Yield increased from 1.79% on January 4 to 2.20% on March 5, 2021.

Image Source: Federal Reserve Bank of St. Louis

Goldman Sachs (NYSE:GS) predicts that the 10-year breakeven rate would reach 2.45%, from the current 2.2%. The bank further predicts that the 10-year Treasury yield will rise up to 1.9% by the end of 2021, against the background of strong economic data. Given the market’s high inflation expectation, there is plenty of room for the yields to climb.

These conditions indicate a bullish dollar in the future.

A Bullish Dollar Outlook

Rise in yields leads to a rising dollar. More than the actual bond yield, it is the difference between two countries’ bond yields that impacts currency pairs. Elsewhere in the world, bond yields are low right now. As of March 9, 2021, Germany’s 10-year bond yield is in the negative zone, at -0.302%, Japan’s 10-year yield is at 0.130% and the UK’s 10-year is at 0.733%.

Capital flows are attracted to higher yielding currencies, in this case, the greenback. Moreover, the cost to own lower-yielding currencies will increase, as the bond yield differential moves in the direction favouring the currency that is shorted. So, for a trader, the cost to go short on USD/JPY pair has increased with the US long term yield increasing compared to Japan.

Considering that the US long term treasury yield is projected to rise further, traders could find more reasons to own the US dollar and short other currencies. This will fuel USD value higher.

Rising treasury yields also make it difficult to invest in the stock market. The risk-free rate is becoming competitive. On March 3, rising treasury yields offset all optimism around the stimulus package, leading to major stock indices trading lower. The S&P 500 declined 0.11%, while the Nasdaq Composite was down 0.02%.

The pressure is especially high on tech-heavy indices like the Nasdaq 100, which was down again by 0.7% in the early afternoon on March 8, 2021. Valuations of tech stocks are heavily linked to current discount rates for long term cash flows. There is already a market perception of stretched equity valuations, with predictions for equity corrections in the near future. It remains to be seen whether this low-risk appetite continues for long, but the outlook for the US economy is strong, which could further push risk tolerance up.

The US Fed is Not Worried About Inflation

Despite a bright economic outlook, there is little reason for the Fed to tighten its monetary policy. The response of the central bank has been positive regarding the rise in yield, which it considers a sign of a stronger economy. It has also changed its policy stance recently, steering towards an average inflation rate over time. This means that the Fed will allow the inflation rate to rise above 2% before hiking interest rates.

US Fed Chair Jerome Powell made this clear in his speech to the Economic Club of New York on February 10, 2021. The central bank chief downplayed inflation worries, citing that unemployment is a greater cause for concern for the bank now. According to Powell, inflation has been stable for the past 3 decades and even after the pandemic, the Fed expects it to accelerate in a sustainable manner.

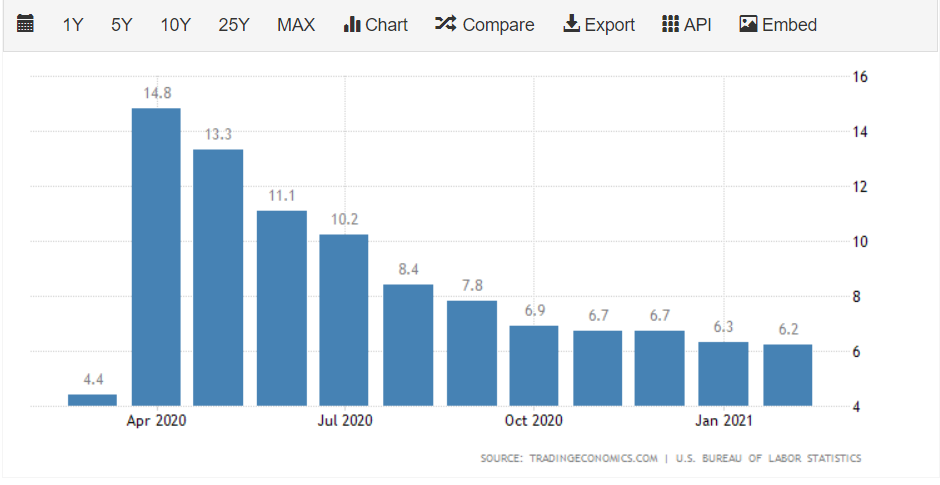

The unemployment rate declined to 6.2%, with positive jobs data for February 2021. However, the figure is still extremely high, compared to the 4.4% in the pre-pandemic times.

These are indications that the US Fed will follow an accommodative monetary policy in the foreseeable future. This could put downward pressure on the US dollar.

Going forward, the Fed is likely to act only if rising yields lead to market disruption. But, inflation is also not expected to cause trouble due to the slack in the labour market, driven by the pandemic. The outlook for the US dollar remains bullish.

For now, it’s a wait and watch game, as other central banks respond to this rise in yields. For instance, the Bank of Canada and the European Central Bank are expected to declare their interest rate decisions by March 10, 2021. Their actions could cause volatility in pairs such as the EUR/USD and CAD/USD.