Street Calls of the Week

- Trump’s firing of the BLS chief and Fed vacancy raise concerns over institutional independence.

- Markets now price in 60 bps of Fed rate cuts, reflecting weakening economic momentum.

- Political interference and tariff-linked voter payouts deepen pressure on US dollar’s safe-haven credibility.

- Looking for actionable trade ideas? Subscribe now to unlock access to InvestingPro’s AI-selected stock winners for up 50% off amid the summer sale!

Immediately after the release of the jobs data, President Donald Trump dismissed Erika McEntarfer, the head of the Bureau of Labor Statistics (BLS) responsible for employment statistics.

"Today’s employment data was rigged to make Republicans and me look bad, " Trump said, citing "manipulation of the data" as justification.

This outburst called into question not only institutional independence but also the accuracy of the data. The political questioning of official data in a country like the US risks undermining the US dollar’s global safe-haven credentials.

On the other hand, Moody’s Analytics Chief Economist Mark Zandi states that the US is on the brink of recession. According to Zandi, consumer spending is stagnating, while the construction and manufacturing sectors are contracting. While the labor market is weakening, the employment of new graduates is also declining. At the root of all this, Zandi says, are Washington’s choices, especially its trade and immigration policies.

Trump Escalates Political Pressure on US Institutions

In the immediate aftermath of the jobs report, Trump abruptly dismissed Erika McEntarfer, head of the Bureau of Labor Statistics, accusing her of manipulating the data. “Today’s employment data was rigged to make Republicans and me look bad,” Trump claimed, alleging political bias behind the weak numbers.

The move raised alarms over the independence of US institutions and cast doubt on the credibility of official statistics. For global investors, political interference of this nature risks eroding trust in US data and weakening the US dollar’s position as a safe-haven currency.

Separately, Moody’s Analytics Chief Economist Mark Zandi has warned that the US may be edging toward a recession. Consumer spending has plateaued, while both the construction and manufacturing sectors are showing signs of contraction. Zandi also pointed to a slowdown in hiring among new graduates—a sign that labor market softness is beginning to affect younger cohorts. At the core of the downturn, he argues, are policy missteps in Washington, particularly around trade and immigration.

The unexpected resignation of Fed Governor Adriana Kugler has added to mounting concerns over the politicization of key US institutions. Kugler, who will step down on August 8, leaves a vacant seat that Trump could soon fill. Market chatter points to Kevin Hassett—a longtime Trump ally and former White House economic adviser—as a possible replacement.

The prospect of Hassett joining the Fed is being viewed as a troubling signal for the US dollar. Investors fear that a shift in the Fed’s composition toward politically aligned figures could undermine the central bank’s independence and cloud its policy outlook. Coming on the heels of Trump’s public attack on the Bureau of Labor Statistics, Kugler’s exit is seen as another step in reshaping institutions once considered immune to political pressure.

Pressure Increases on Fed

Following the weak jobs report, markets have sharply raised their bets on rate cuts. A 25 basis point cut at the Federal Reserve’s September meeting is now priced in with a 90% probability. Traders are also anticipating a total of 60 basis points in cuts by year-end—nearly double the 33 basis points expected just weeks ago.

Meanwhile, trade tensions are flaring once again. Trump last week signed a new decree introducing a reciprocity-based tariff framework. As part of the move, tariffs on Canadian imports were increased from 25% to 35%. There is speculation that similar hikes could be extended to other key partners, including the European Union and Mexico, adding another layer of uncertainty for global markets.

Trump has also floated the idea of redirecting tariff revenues into direct payments to select voter groups—a move critics say is more about politics than policy. The plan reportedly includes issuing checks signed by Trump himself, echoing the pandemic-era stimulus checks of 2020. While the proposal has no formal structure yet, it is widely seen as a campaign-driven gesture rather than a measure grounded in economic strategy.

Adding to the uncertainty, the US Court of Appeals has reopened the case challenging the legality of Trump-era tariffs. A ruling against the tariffs could force the Treasury to refund years’ worth of collected duties—an outcome that would introduce significant fiscal strain at a time when budget pressures are already mounting.

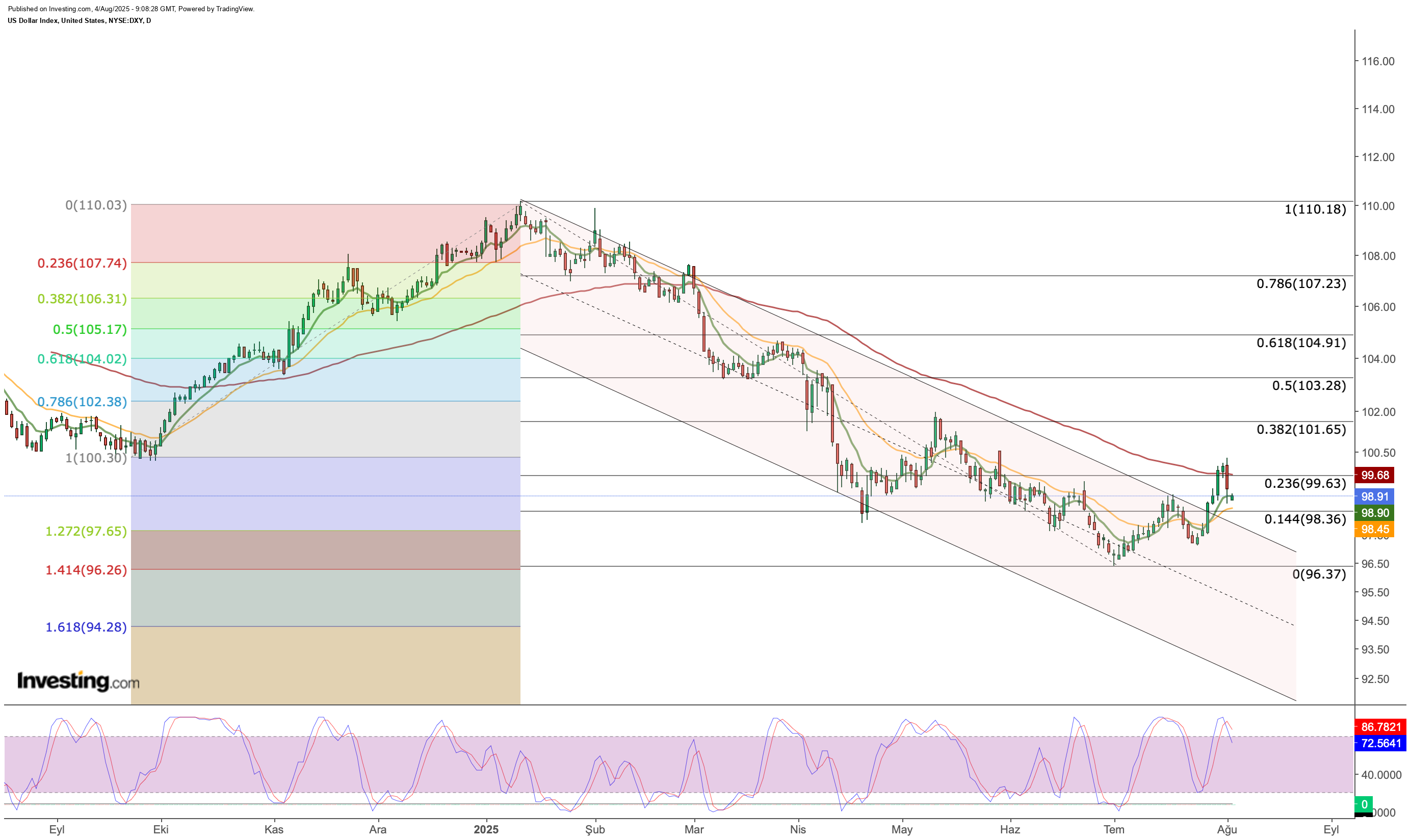

US Dollar Technical Outlook

The US dollar index (DXY) climbed earlier last week but reversed sharply on Friday following the weak jobs report and renewed political turbulence. After briefly testing the 100 mark, the index fell swiftly and ended the week at 98.61.

At the start of the new week, DXY is attempting a modest recovery toward 99, though the broader trend remains fragile. The 98.60–100 range continues to act as a key resistance zone, while 98.30 serves as the immediate support. A decisive break below that could open the way toward the 96 level, extending the downward momentum.

Recent data has confirmed a clear cooling in the US economy. Yet, market reactions have been shaped not just by macro signals but also by intensifying political noise. Trump’s interventions—rhetorical and institutional—are increasingly influencing the US dollar’s direction. In the near term, the DXY appears exposed not only to Fed rate policy but also to the unpredictable dynamics emerging from the White House.

Throughout the month, markets will closely track not just employment and inflation data but also every move and statement from Trump. The upcoming Fed appointment and key macro releases ahead of the September policy meeting are expected to be the primary drivers of the US dollar index. Together, these factors will likely shape the next leg of the DXY’s trajectory.

****

Be sure to check out all the market-beating features InvestingPro offers.

InvestingPro members can unlock a powerful suite of tools designed to support smarter, faster investing decisions, like the following:

- ProPicks AI

Built on 25+ years of financial data, ProPicks AI uses a machine-learning model to spot high-potential stocks using every industry-recognized metric known to the big funds and professional investors. Updated monthly, each pick includes a clear rationale.

- Fair Value Score

The InvestingPro Fair Value model gives you a clear, data-backed answer. By combining insights from up to 15 industry-recognized valuation models, it delivers a professional-grade estimate of what any stock is truly worth.

- WarrenAI

WarrenAI is our generative AI trained specifically for the financial markets. As a Pro user, you get 500 prompts each month. Free users get 10 prompts.

- Financial Health Score

The Financial Health Score is a single, data-driven number that reflects a company’s overall financial strength.

- Market’s Top Stock Screener

The advanced stock screener features 167 customized metrics to find precisely what you’re looking for, plus pre-defined screens like Dividend Champions and Blue-Chip Bargains.

Each of these tools is designed to save you time and improve your investing edge.

Not a Pro member yet? Check out our plans here or by clicking on the banner below. InvestingPro is currently available at up to 50% off amid the limited-time summer sale.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk rests with the investor. We also do not provide any investment advisory services.