Walmart halts H-1B visa offers amid Trump’s $100,000 fee increase - Bloomberg

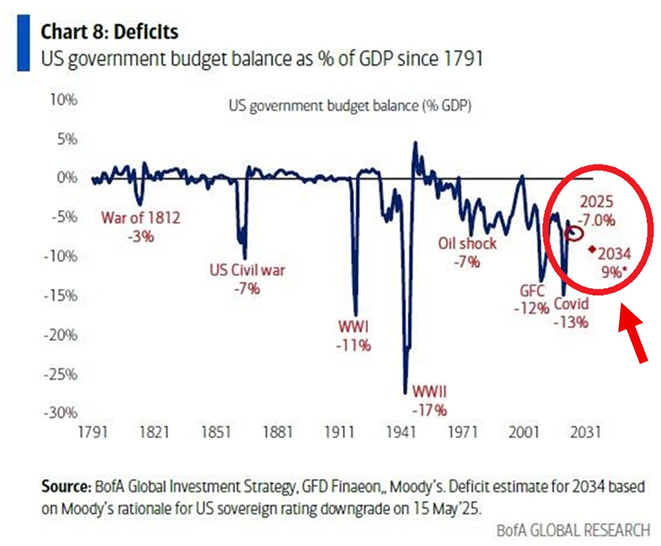

Such levels of deficit are unprecedented outside of significant crises or wartime periods.

This forecast further relies on the absence of a recession and on interest rates declining from their present levels

Source: BofA, Global Markets Investor, CBO

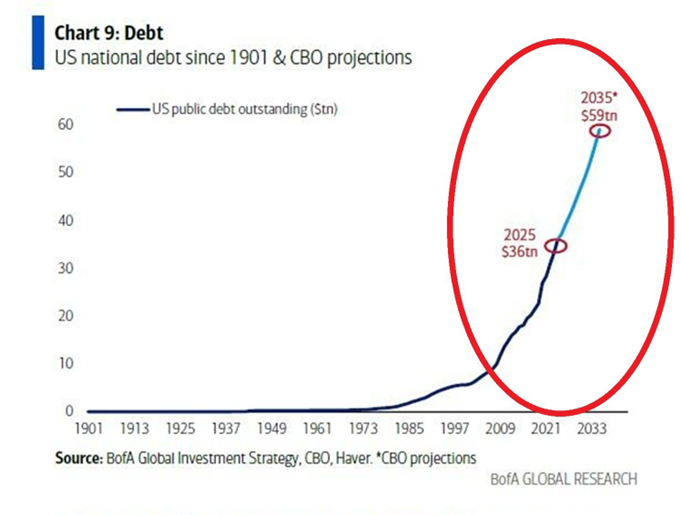

5. The US National Debt Is Expected to Reach a MASSIVE $59 TRILLION Over the Next (LON:NXT) 10 Years

That would represent a doubling of the 2021 level. This projection excludes the impact of a potential recession, which could further accelerate the rise in public debt.

Source: CBO, BofA, Global Markets Investor

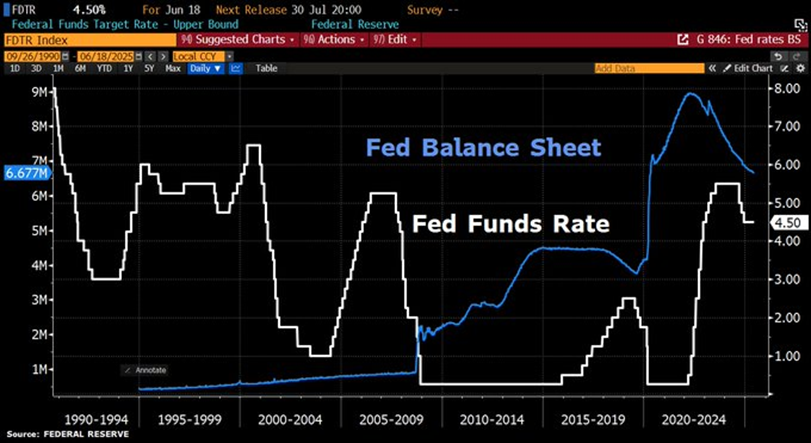

The Fed Holds Rates Again in 4.25-4.5% Target (NYSE:TGT) Range, Still Sees 2 Cuts by Year End

As expected, the Federal Reserve kept its benchmark interest rate unchanged at 4.25-4.5%. This decision aligns well with the latest US economic indicators. Inflationary pressures remain elevated and may intensify, depending on the scope and consequences of the widely anticipated increases in import tariffs currently under negotiation between the US and its trading partners.

Chairman Powell acknowledged that although some uncertainty surrounding trade tensions has eased, ongoing instability in the Middle East could temporarily push energy prices higher. Nonetheless, he downplayed the likely fiscal impact of the forthcoming "Big Beautiful Bill," suggesting that its relevance for the Federal Open Market Committee’s (FOMC) forecasts is limited, given the scale of the US economy. Powell also described the current policy rate as "modestly restrictive" in view of the strong economic performance.

The most notable development from the FOMC’s meeting emerged in the Summary of Economic Projections (SEP). In March, the median forecast pointed to two rate cuts, though with a cautious tone, as four members projected no cuts for the year. Since then, this cautious stance has become more pronounced, with seven members now anticipating no reductions in 2025, a significant shift reflecting a more hawkish outlook among some FOMC participants regarding the future path of interest rates.

Additional changes appeared in the projections for 2026 and 2027, where policymakers now foresee only one rate cut in each year, a reduction from the two cuts previously expected for both years. At the same time, growth forecasts for 2025 and 2026 have been slightly downgraded, while the inflation outlook (measured by PCE) for 2025 has been revised upward, consistent with the committee’s updated rate expectations.

Investors found reassurance in the clear message, both directly and implicitly, that the Federal Reserve and the FOMC are striving to maintain their independence and remain insulated from domestic political pressures calling for premature rate cuts.

Source: HolgerZ, Bloomberg

SNB Has Cut Rates by 25bps, Bringing “Zero” Back Into the Rates Lexicon

As anticipated, the Swiss National Bank (SNB) proceeded with another rate cut, bringing the Swiss policy rate down to zero. While now approaching negative territory once again, the SNB has avoided reintroducing this frequently criticised measure so far.

Despite the cut, the central bank sharply revised its inflation projections downward, with inflation now nearing the lower end of its 0%-2% target range. This indicates that the decision may have been a close call for the SNB committee.

The Federal Reserve’s decision the previous day to maintain its interest rates provided some leeway for the SNB to slightly narrow the interest rate gap, thereby reducing the Swiss franc’s relative appeal compared to the US dollar. Nonetheless, much like the Fed, the SNB underlined the heightened uncertainty facing the global economy.

During the press conference, SNB Chairman Schlegel also pointed out the negative consequences associated with negative interest rates, emphasising the difficulties they create for many participants in the economy. This careful approach, aligning with the SNB’s previous reservations about sub-zero rates, implies that such a step would only be considered if the inflation outlook deteriorates significantly.

Given the current situation, we expect the SNB to maintain the policy rate at zero for the remainder of the year, with no further cuts anticipated. We concur with Federal Reserve Chairman Jerome Powell’s assessment that various global risks, such as tensions in the Middle East or ongoing trade conflicts involving the US, could exert upward pressure on inflation.

Therefore, at this stage, lowering key rates into negative territory would seem unwarranted.

Source: HolgerZ, Bloomberg

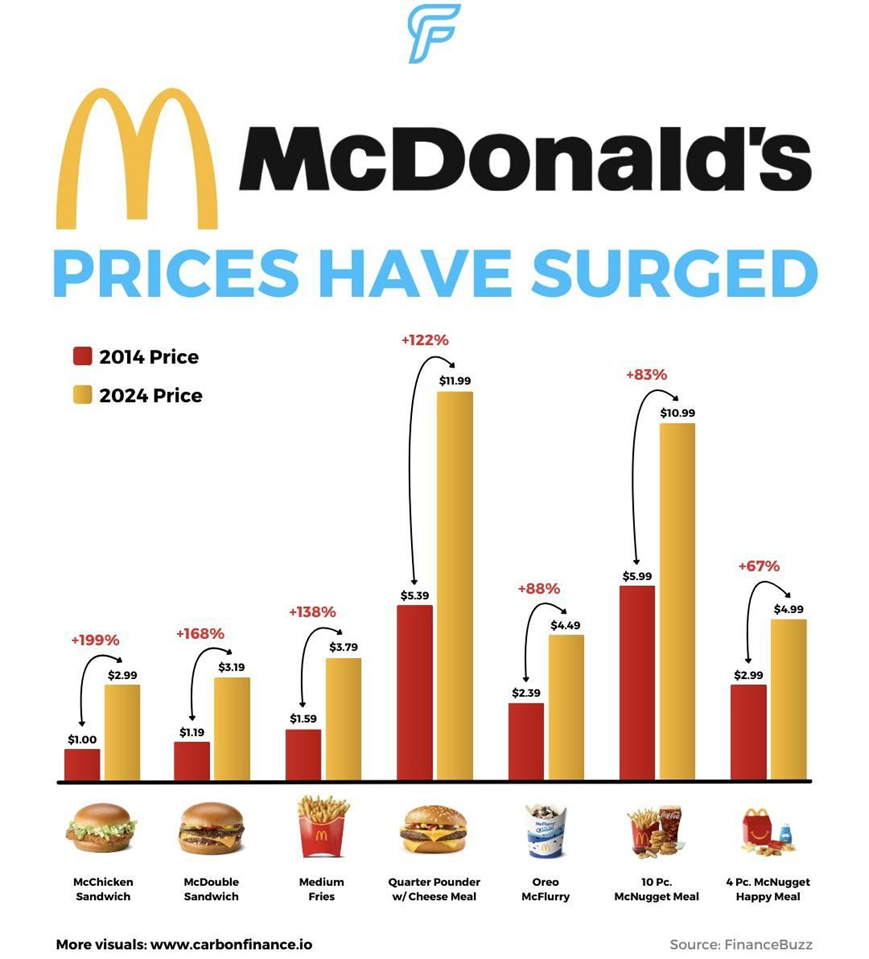

McDonald’s Prices in the US Have Surged Over the Last 10 Years...

The “McDonald” (NYSE:MCD) price index tells the real story...

Source: www.carbonfinance.io

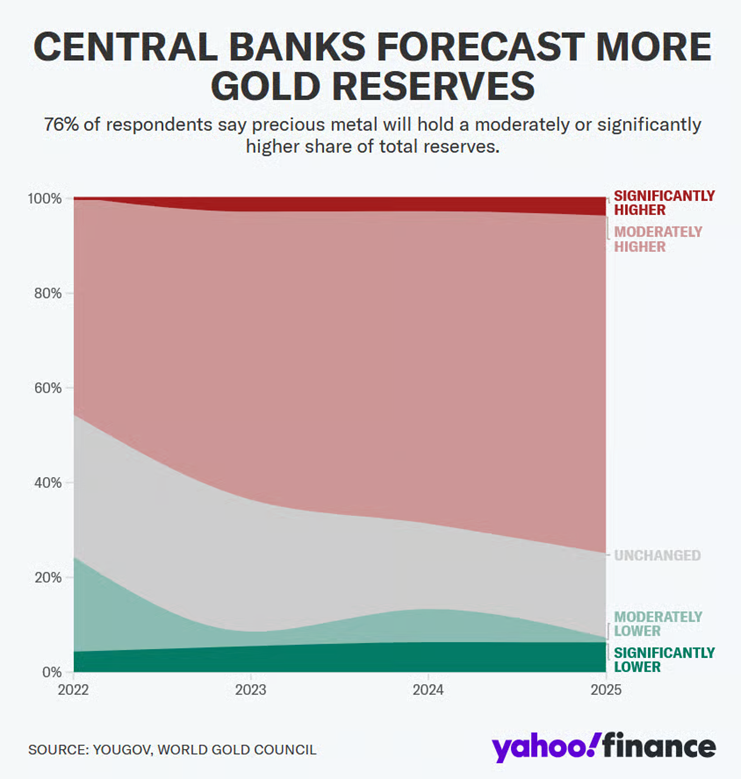

Central Banks Continue to DUMP the US Dollar for Gold:

According to a survey by the World Gold Council, 95% of central banks anticipate an increase in global gold reserves over the coming year.

A record-high 43% intend to increase their own gold holdings.

Meanwhile, 73% expect US dollar reserves to decrease over the next five years.

Source: Yahoo Finance