IonQ CRO Alameddine Rima sells $4.6m in shares

S&P 500 and Nasdaq 100 futures rose after the U.S. and China announced a meeting in Switzerland this week. Treasury Secretary Bessent said the talks would aim to ease tensions, not make a deal, and noted that current tariff levels can’t continue.

The US open has seen more caution, however, with the S&P 500 trading slightly lower than its high of the day around the 5667 handle.

The S&P 500 is more than 8% away from its record high notched in February, even though all indexes have recouped declines logged since Trump’s announcement of "Liberation Day" reciprocal tariffs on April 2.

On the earnings front, AMD (NASDAQ:AMD) shares rose 1.2% in premarket trading after the chipmaker predicted higher-than-expected second-quarter revenue. Disney (NYSE:DIS) shares jumped 8.4% as strong U.S. theme park spending and more streaming customers pushed its quarterly results above expectations. Uber (NYSE:UBER) shares fell 4.1% after missing revenue forecasts and warning of a 1.5% currency-related hit to second-quarter bookings growth.

Looking at the FX market, the DXY continues to struggle and seems unable to gain acceptance above the psychological 100.00 mark. This has led to gains for many currencies with the only currencies losing ground being the safe haven Japanese Yen and Swiss Franc.

Gold prices are struggling to recapture the $3400 handle as sentiment improves and haven flows continue to ebb back and forth. Gold is looking to break the $3400 handle as it trades at $3396 at the time of writing.

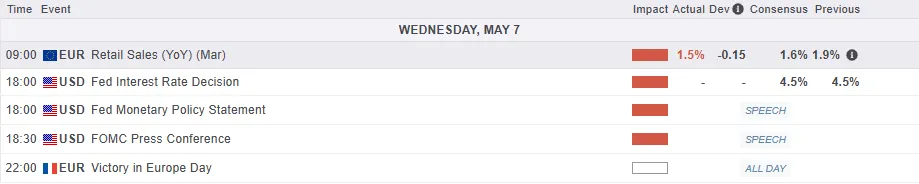

Economic Data Releases

For now, the US calendar is pretty quiet in terms of data, but we do have the Federal reserve interest rate meeting later today.

The Fed is expected to keep interest rates steady at 4.25%-4.50%. Traders will focus on Jerome Powell’s comments to see if President Trump’s policies might affect future rate cuts.

Hopes for lower rates have dropped recently due to a strong U.S. economy, especially the latest jobs report. Money markets now expect three quarter-point rate cuts this year, down from four at the start of April.

For a more comprehensive breakdown of the FOMC meeting and ways to navigate it, please read Trading the FOMC Meeting: Key Levels & Analysis for EURUSD and USDJPY.

Chart of the Day - S&P 500

From a technical standpoint, the S&P 500 had risen in early trade but does appear to have run into some resistance at the 5669 handle.

The index is looking to snap a two-day losing streak with a key area of resistance ahead at 5755, which houses the 200-day MA.

Following the trendline break on April 25, there does appear to be more scope for a move higher from a technical standpoint. However, this may only come to fruition of positive rhetoric continues on a trade deal with China.

A move beyond the 5755 handle opens up a potential run toward 5828 and 5910, respectively.

A move lower from here may find support at 5538 and 5500.

Source: TradingView.com