Gold prices slid below $4,000/oz amid profit-taking on Gaza ceasefire

The August playbook for USD/JPY has been simple: buy dips below 147, sell rallies above 148. Without a surprise from Powell or politics, that looks set to continue this week.

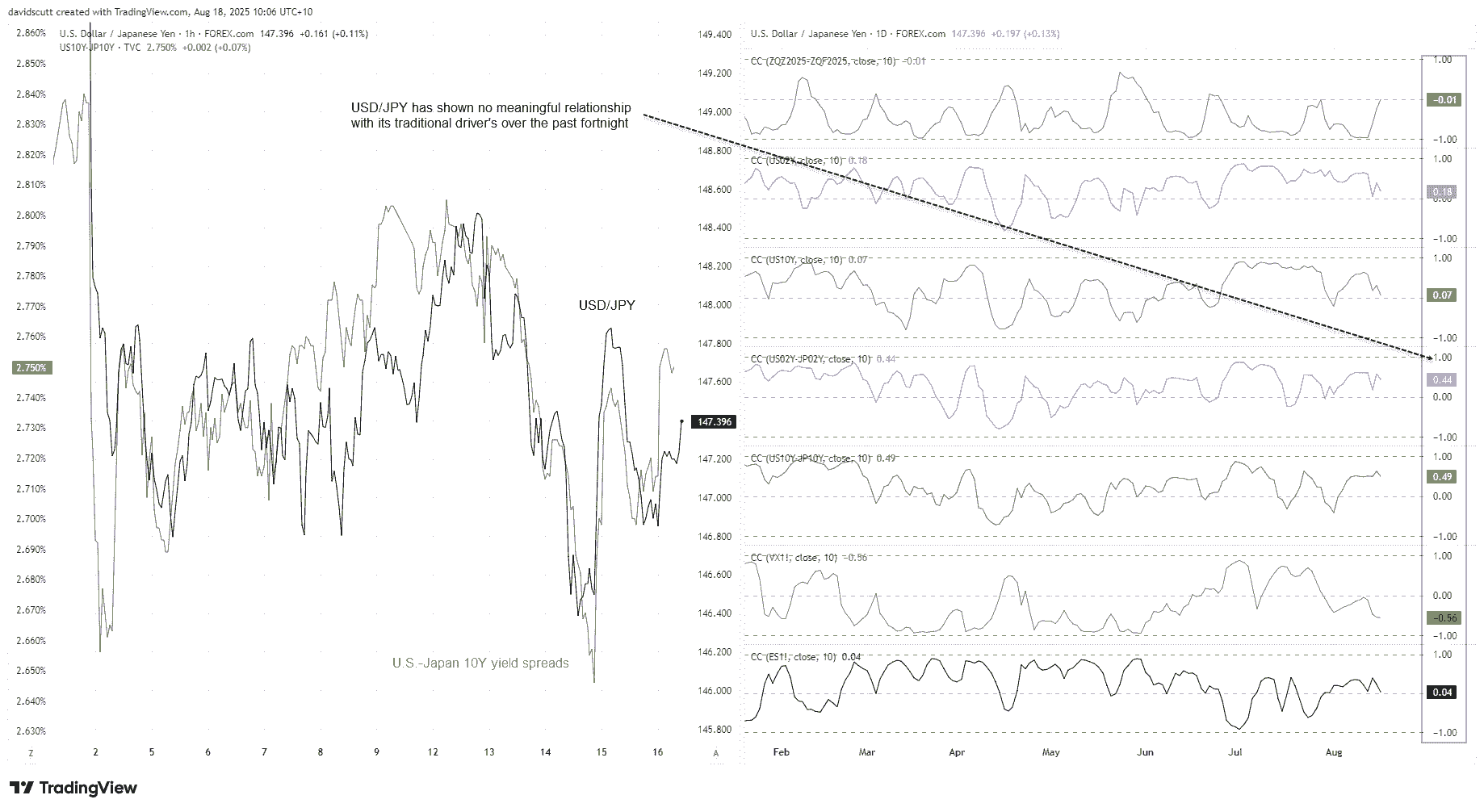

- Traditional USD/JPY drivers sidelined in August

- Powell’s Jackson Hole speech key risk event

- Range trade intact: 147–148 playbook remains

USD/JPY Outlook Summary

USD/JPY has been moving to its own tune in August, showing little connection with traditional drivers like rate differentials, volatility and risk appetite. With a quiet economic calendar for much of the week, it points to a likely continuation of range trading ahead of Federal Reserve chairman Jerome Powell’s speech at the Jackson Hole economic symposium on Friday. That is, unless President Donald Trump decides to spring another surprise on us, of course.

USD/JPY Dancing to its own Tune

The U.S. interest rate outlook, yield differentials with Japan and broader risk appetite have long been the key drivers of USD/JPY, but not this month. Correlation coefficients underline the shift, with only U.S.-China yield spreads showing any link, and even that has been weak compared to the past. The dog days of August are clearly upon us, and few seem willing to take big positions across rates or FX.

Source: TradingView

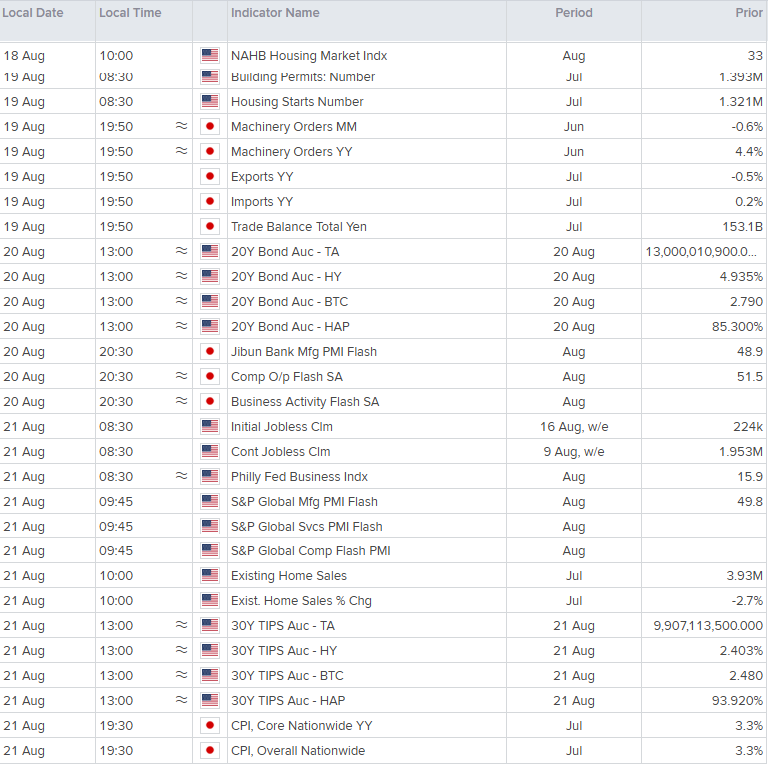

Quiet Calendar Risks More Range Trade

That looks set to continue early in the week with no major data due in the U.S. or China. The S&P flash global PMIs will generate headlines, as will Japanese trade data and national CPI on Friday. There’s also a 20-year Treasury auction to navigate, a tricky tenor that often struggles for demand even before factoring in policy and economic uncertainty. But will these events really move the dial for USD/JPY? Highly doubtful.

Source: LSEG (U.S. ET shown)

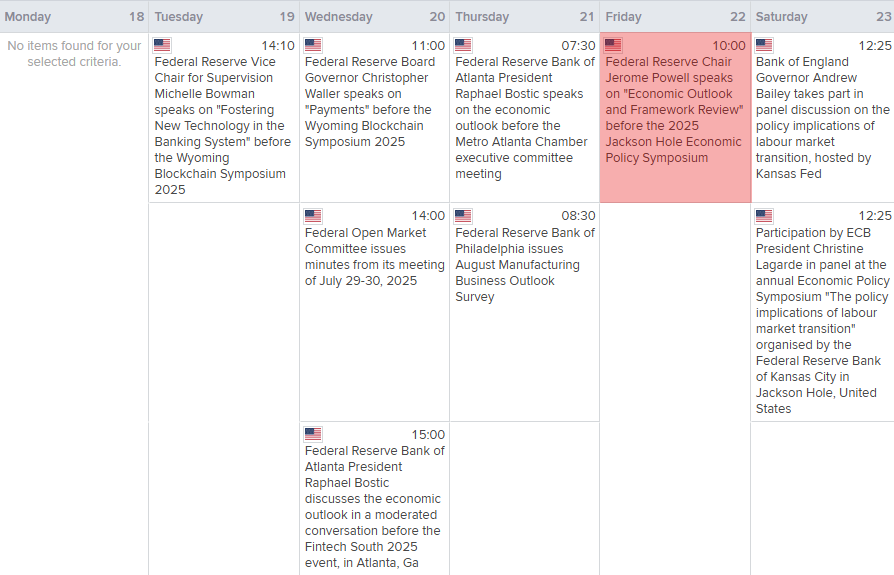

Geopolitics is a potential volatility source, including Trump’s meeting with Zelenskyy in Washington on Monday, but unless it sparks a major rift between the U.S. and Europe, it’s more noise than signal. Instead, the key known risk this week arrives on Friday with Powell’s Jackson Hole speech.

Source: LSEG (U.S. ET shown)

Anyone who has been tracking this event since the days of the Global Financial Crisis would know that it can often be hit and miss when it comes to delivering meaningful market impact, especially outside of crisis periods. That suggests this occasion may come and go with little volatility.

But you never know in an era where Fed independence is being openly questioned, leading to what can only be described as supreme confidence among market participants that the Fed will be cutting interest rates multiple times this year even though there’s mounting evidence that inflationary pressures are starting to reaccelerate, especially in services prices.

Along with the obvious politicisation of the FOMC, the dovish shift in market pricing largely stems from the belief that U.S. labour market conditions are deteriorating following the release of the weak July nonfarm payrolls report earlier this month.

Powell Pushback Incoming?

The question is how Powell will address this viewpoint given the theme of this year’s symposium is titled, “Labour Markets in Transition: Demographics, Productivity, and Macroeconomic Policy.” Will he endorse market pricing, giving a nod to a cut next month, or will he push back and cite factors other than economic conditions to explain the slowdown in payrolls growth?

I suspect Powell might, given weakness in payrolls—a lagging economic indicator—is not being confirmed by other data such as inflation and consumer spending, which remain strong.

Whichever way he decides to go, the answer to the question on how he sees U.S. labour market conditions evolving will go a long way to determining the likely reaction in U.S. interest rate markets, and likely USD/JPY.

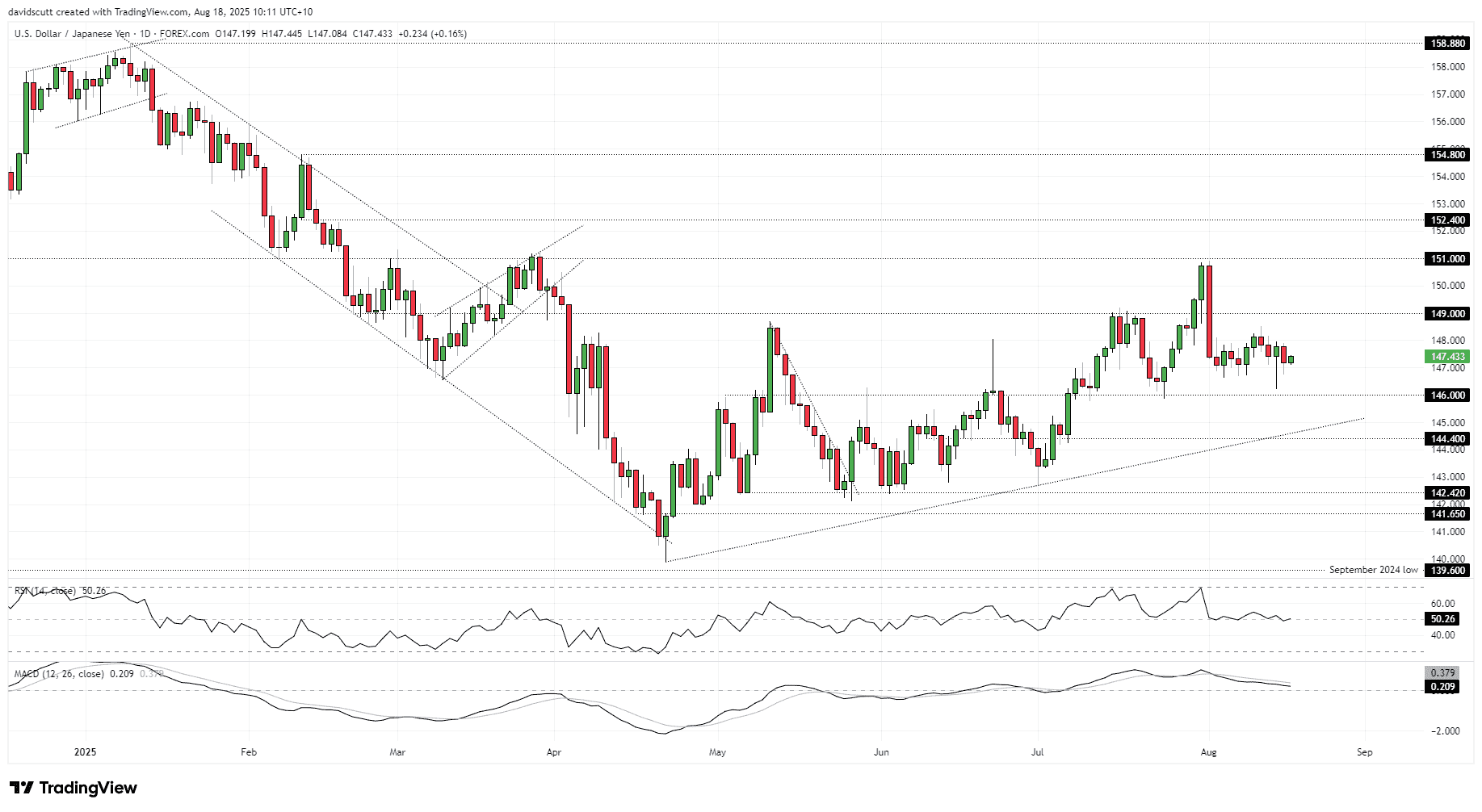

USD/JPY Shifting Sideways

Source: TradingView

For traders, the playbook in August has been to buy dips beneath 147.00 and sell rallies above 148.00. That’s unlikely to change without a major catalyst ahead of Powell’s speech. Support sits at 146.00 and 144.40, with the April uptrend line near 144.60. Resistance is found at 149.00 and 151.00. Momentum signals like RSI (14) and MACD are neutral, putting the emphasis on price action rather than directional bias.