Navitas stock soars as company advances 800V tech for NVIDIA AI platforms

- Reports Q2 2022 results on Friday, July 22, before the open

- Revenue Expectation: $33.7B; EPS Expectation: $1.33

- VZ shares have underperformed this year amid slowing subscriber growth

When U.S.’s largest wireless carrier, Verizon Communications (NYSE:VZ), reports earnings tomorrow, investors will likely see that heated competition and cost pressures took a significant toll on the company’s profits last quarter.

In April, the New York-based Verizon lowered its sales projection to around flat this year, compared with a prior projection of 3% growth. Chief Financial Officer Matt Ellis explained at the time:

“Obviously, the competitive environment in wireless remains strong. Some costs will be higher than we initially thought for the year--we’re seeing inflation rates and the impact on interest expense.”

Earnings are also expected to be at the lower end of the company’s previous guidance. For the quarter that ended on June 30, Verizon is forecast to report $1.33 a share profit on sales of $33.7 billion, almost unchanged from the same period a year ago.

Those headwinds have led VZ shares to underperform its peers this year. The stock, trading at $47.61 at the time of writing, has weakened about 8.3% this year. AT&T (NYSE:T) and T-Mobile (NASDAQ:TMUS) have gained 1% and 15.1%, respectively, during the same period.

During the past five quarters, the company added the lowest number of subscribers compared with AT&T and T-Mobile, which are trying to extend their customer growth streak by capitalizing on their investments in 5G technology.

In its latest earnings report, AT&T said wireless subscribers kept growing in the second quarter. The telecom company reported a net gain of 813,000 postpaid phone connections in the June quarter, topping the average 400,000-phone projection from Wall Street analysts polled by FactSet.

Shrinking Pie

Analysts at JPMorgan are increasingly concerned about Verizon’s subscriber growth outlook for postpaid phones in 2022. The bank said in a note:

“We see limited growth upside for Verizon in wireless, no near-term buyback given the CAPEX spend for C-Band and potentially a headwind from rising rates.”

There are already signs that inflationary cost pressures, supply chain disruptions, and higher borrowing costs have begun to impact telecom operators. AT&T said earlier today that more of its customers are starting to put off paying their phone bills, leading the wireless carrier to cut its forecast for free cash flow this year by $2 billion.

However, the segment is also showing some resilience amid the macroeconomic scenario. Verizon and its peers have begun to pass on higher costs to customers by increasing their charges this year. The company expects to book an additional $600 million in the second half of this year after introducing a new $1.35-per-line increase in administrative fees for consumers and a $2.20-per-line “economic adjustment charge” on business customers, according to Bloomberg.

Collectively, fee and service increases will boost revenue for the large carriers by $3 billion, according to LightShed Partners analyst Walt Piecyk cited in the report.

Long-Term Potential

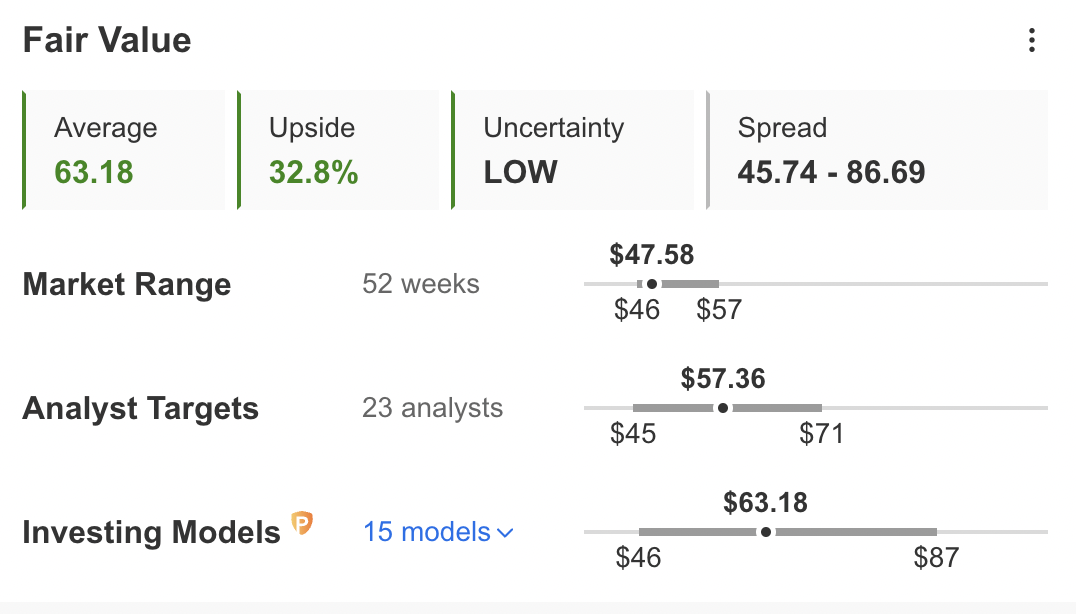

Despite the economic challenges and competition cutting back on the company’s short-term outlook, Verizon continues to remain a solid dividend stock that investors can buy and hold in their income portfolios. InvestingPro Fair Value model implies a 32.8% upside potential to the stock, with ‘low’ uncertainty.

Source: InvestingPro

Moreover, telecom utilities are considered among the safest stocks to own during an economic downturn because the services they provide are deemed essential and way down in the list of areas where people would cut spending.

VZ currently pays a $0.64 per share quarterly dividend, representing an annual dividend yield of 5.22%. The payout has been growing steadily since 2007.

Disclosure: The writer doesn’t own stocks mentioned in this article.

***

The current market makes it harder than ever to make the right decisions. Think about the challenges:

- Inflation

- Geopolitical turmoil

- Disruptive technologies

- Interest rate hikes

To handle them, you need good data, effective tools to sort through the data, and insights into what it all means. You need to take emotion out of investing and focus on the fundamentals.

For that, there’s InvestingPro+, with all the professional data and tools you need to make better investing decisions. Learn More »