Joby Aviation closes $591 million stock offering with full underwriter option

At the height of his 94 years, the greatest of all time, Warren Buffett, announced this past weekend that—60 years and over 5.5 million percent gains later—he is finally ready to step down from the helm at Berkshire Hathaway (NYSE:BRKb) (NYSE:BRKa).

To honor the legend who not only developed and popularized the investment philosophy that forms the foundation of our approach to financial markets but also inspired the mathematical framework behind our Fair Value tool, Investing.com breaks down one of the most fantastic periods of outperformance in the legendary investor’s life: the last year and a half, spanning from November 2023 until April this year.

Based on significantly more selling than buying, the ultimate masterclass in wealth creation is not just a tribute to Buffett’s value investing philosophy. More than that, it serves as a wake-up call to those chasing market gains regardless of fundamentals or broader market conditions.

So, please sit back and enjoy as we take you through the final dance of the greatest of all time.

Buffett Beats the S&P 500’s Bull Market While Remaining a Net Seller

Back in November 2023, Berkshire Hathaway was coming from another solid year, where it had gained 11.28%, very much in line with the S&P 500’s 10.38% during that same period.

Back then, only a few realized that disparity was about to widen. One of those was Investing.com’s Fair Value tool, which flagged that the stock was still undervalued, with a 37.45% upside potential.

And then came Buffett’s masterclass, as the stock rallied a powerful 42.58%, easily outpacing the S&P 500 by more than 10%.

But the most impressive aspect of this rally might have been the fact that Buffett, contrary to the rest of the market, did it while selling more than buying, as well as by anticipating market trends with a comfortable margin.

Let’s take a closer look at Buffett’s last dance below.

*If you’d like to learn more about how Berkshire Hathaway’s business model generates such strong returns for investors, here’s the breakdown from our WarrenAI Gen AI tool.

Breaking Down the Masterclass: Berkshire Hathaway’s Market-Beating Performance

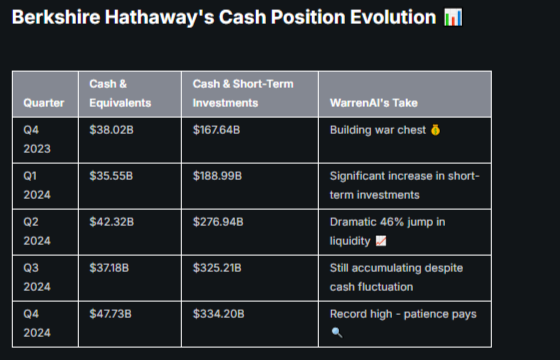

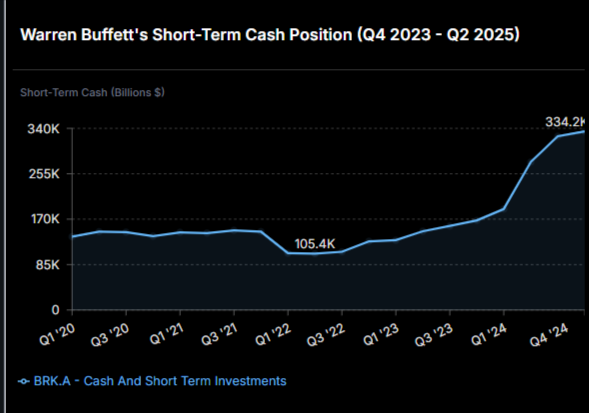

At the time of the Fair Value signal, the S&P 500 had already gained 18.5% YTD. Yet Buffett didn’t chase the rally. Instead, he quietly stockpiled cash. As of May 2025, Berkshire’s cash and short-term investments reached a record high of $348 billion.

We asked WarrenAI to give us a breakdown of Warren Buffett’s building cash position since November 2023. Here’s what it said:

Source: WarrenAI

Source: WarrenAI

Between late 2023 and mid-2025, Warren Buffett took Berkshire Hathaway through one of its most dramatic portfolio reshuffles in recent memory.

The shift began in late 2023, when Berkshire made a bold move into insurance, taking a $6.6 billion stake in Chubb (NYSE:CB). But even as Buffett added new names, the real theme of the months ahead would be trimming—and, in some cases, exiting positions entirely.

By early 2024, Buffett had begun a wave of high-profile exits. Most striking was a near-50% reduction in Apple (NASDAQ:AAPL), generating roughly $75.5 billion in sales. Long considered Berkshire’s crown jewel, Apple’s trimming sent a clear message: Buffett was repositioning for what’s next.

He followed that up with more cuts: over $5 billion in Bank of America (NYSE:BAC) shares sold, a massive reduction in Citigroup (NYSE:C), and full exits from Paramount Global (NASDAQ:PARA), HP (NYSE:HPQ), and Ulta Beauty (NASDAQ:ULTA). Smaller trims came in names like Capital One (NYSE:COF), Louisiana-Pacific (NYSE:LPX), and T-Mobile US (NASDAQ:TMUS).

But it wasn’t all selling. In Q4 2024, Berkshire added to its stakes in a few select names: Constellation Brands (NYSE:STZ), Domino’s Pizza (NYSE:DPZ), Pool Corporation (NASDAQ:POOL)., and Sirius XM (NASDAQ:SIRI), the last of which grew to over 117 million shares worth $2.68 billion. Buffett also continued to build his position in Occidental Petroleum (NYSE:OXY) and modestly increased VeriSign (NASDAQ:VRSN).

During this time, the most notable geographical diversification move was Buffett’s investment in Japanese trading companies, which represents a significant international allocation outside Berkshire’s traditionally US-focused portfolio.

By May 2025, Berkshire had emerged with a more concentrated, defensive portfolio and had built a massive cash position of $347 billion. So, when the market sank in the face of Trump’s trade war woes, Buffett was already one step ahead of everyone else, ready to screen the market for opportunities.

That’s when BRK stock really took off, posting one of its best quarters in history against the S&P 500, posting a legendary 20% outperformance over the benchmark in the quarter alone.

The Oracle’s Legacy Lives on in our Fair Value Tool

But while Buffett is sadly retiring, his teachings live on in those who follow the principles of his value investing philosophy. This is the case with our own Fair Value tool, which constantly monitors the market, analyzing key fundamentals to maintain an updated price target for every stock in the market.

You can also screen the market for long/short opportunities at a glance with our lists:

Not subscribed to InvestingPro yet?

Unlock full access to the lists mentioned above by subscribing to InvestingPro through this link.

Now, this wasn’t the first time the tool flagged an undervalued stock that eventually entered a sustained uptrend, just like Berkshire Hathaway stock did.

Over time, Fair Value has consistently helped investors spot both undervalued gems and overvalued risks. Those who paid attention to the signals often walked away with solid gains or avoided painful losses.

Here are just a few past wins:

- Risks Too High? Here’s How Investors Avoided a 30%+ Wipeout on These Big Cap Names

- Selloff or Market Correction? Either Way, Here’s What to Do Now

- This Tool Called It: 2 Stocks That Beat S&P 500’s Meteoric Rally by a Hefty Margin

- Buying the Tariff-Induced Dip? This Method Has Consistently Delivered 50%+ Winners

- Several Stocks Remain Cheap Despite Overvalued Market - Here’s How to Spot Them

- Here’s How to Spot Bargains With 45%+ Upside Even When Markets Are Overbought

Conclusion

But perhaps even more than delivering a masterclass in wealth building, Buffett’s last dance leaves us with something bigger for life in general: the lesson that greatness is a never-ending pursuit, driven by the simple desire of always wanting a little more, whatever that is.

After all, who would have imagined that the legendary investor would reach his peak at the age of 94 - and without his lifetime partner, Charlie Munger, by his side?

Farewell, Warren, it’s been an honor to watch you and to be inspired by you.