Bill Gross warns on gold momentum as regional bank stocks tumble

The war between Russia and Ukraine has raised nerves around the world, and understandably so. It has also spooked investors, both for the unpredictable impacts it might have and coming within a climate of already elevated inflation and macro headwinds. The S&P 500 dropped 5% from the beginning of February to March 4th, as a sign of these nerves.

While the state of the world is uncertain, the outlook for long-term investors may not be as bleak as it appears at first blush. It seems counterintuitive and unthinkable, and yet: investing in times of war tends to pay off!

In fact, the mental error we often make is to assume war causes markets to go down and investors to lose money.

Knowing the history and dynamics of the market can help us not to fall into these generalizations which, in the end only hurt us more than if we ignored the situation.

A Look Back At History: The Graph

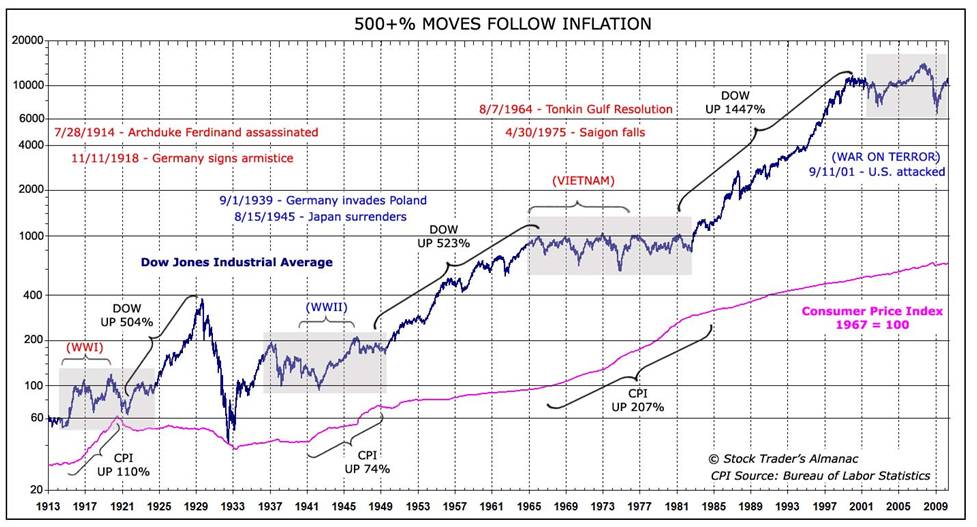

What you see in the image below, is the chart of the Dow Jones Industrial Average in times of war. In particular, we focus on three very important events which, hopefully, will prove to be more intensive wars than the Russia-Ukraine conflict:

- World War I

- World War II

- Vietnam War

Source: Bureau of Labor Statistics

Even just looking at the graph, with the war periods highlighted in gray, we can see how the values at the end of the war were in line with and often higher than at the beginning, and that this holds for each of the three occasions mentioned above.

The numbers

Let's see the exact numbers in each of the three conflicts....

First World War

In the 6 months following the outbreak of World War I, the Dow Jones Industrial Average lost 30%. At that time, since the war had seriously affected the financial world, it was decided to close the stock exchange (an echo of which we hear today in the closing of the Russian stock exchange).

Six months later, when it fully reopened entering 1915, the Dow Jones scored its highest ever increase in a single year: +88%!

At the end of the conflict, which lasted from 1914 to 1918, the American index gained a total of 43%, or an annualized 8.7%.

World War II

When Hitler invaded Poland on September 1, 1939, the market rose 10% in the following session on September 5, 1939. With the attack on Pearl Harbor (December 1941), stocks opened down (by just 2.9%, however) but recovered in less than a month. When the Allied Forces invaded France in 1944, the Dow Jones Industrial Average registered a 5% increase in the following month.

As with World War I, at the end of the conflict, which lasted from 1939 to 1945, the Dow Jones gained 50% overall, or 7% annualized.

Vietnam War

Although a more circumscribed conflict (and perhaps similar to the one between Russia and Ukraine), the Vietnam War also had similar trends for stock markets. In 1965, when American troops arrived in Vietnam, the Dow Jones closed the year with a 10% gain. At the end of the conflict, in 1973, the market realized an overall performance of 43%, or 5% annualized.

Considering therefore all 3 periods, we can say that the stock market has realized an average of 45% overall and about 7% annualized.

Conclusion

Now, as always, we should not take the data of the past and think that the future will be exactly the same. What we can say however, is that history and numbers show that it is wrong to say that in times of war you lose money. If anything, the opposite has borne out.

The real question that we must ask ourselves, however, whether reflecting on the +88% rebound from World War I, or even a time like the April 2020 post-Covid rebound, is this: was I in the market at that time or was I out of it out of fear?

Those are moments for which we cannot afford, if we really want to achieve important goals in terms of results, to stay out of the markets.

Investing can always be profitable with the right time horizon, and perhaps in times of war, with the mis-perception of risks by other investors, there are more opportunities to emerge.