Palantir shares slip by 7% despite posting record revenue in third quarter

Since the Broadcom (NASDAQ:AVGO) coverage mid-June, AVGO shares are up 27%. At that time, just ahead of the stock’s 10-for-1 split, we posited that Broadcom’s dual business model (data center/cybersecurity) is yet to yield significant gains for shareholders.

Most recently on Thursday, Broadcom pleasantly surprised AVGO shareholders. Not only did Broadcom beat the earnings per share (EPS) forecast at $1.25 reported vs $1.13 estimated, but the company reported 220% year-on-year AI revenue growth.

Over the week, AVGO stock has been up 20%, up to the current price of $215.23 per share at the time of writing. But is this the right time to get Broadcom stock exposure?

Broadcom’s Diversified and Complementary Business Model

After acquiring VMware for an enormous $69 billion, completed in November 2023, Broadcom made a significant pivot. Operating in the same cloud-based cybersecurity niche as Crowdstrike, VMware added Infrastructure as a service (IaaS) to Broadcom’s business model.

This move is quite similar to Tesla (NASDAQ:TSLA) attempting to materialize Full Self-Driving (FSD) for the emerging robotaxi-based ride-hailing market. In the case of Broadcom, the company gained a recurring revenue model on top of the cyclical hardware infrastructure offering. VMware’s multi-cloud management and virtualization perfectly complement Broadcom’s existing networking, storage, and semiconductor solutions.

In other words, Broadcom aimed for the full stack regarding data center infrastructure, covering both software and hardware. As of the latest Q4 2024 earnings report, the lean infrastructure software division continues to outperform.

Broadcom’s IaaS Gambit Continues to Pay Off

While Broadcom’s semiconductor solutions division generated $8.23 billion in revenue, a 12% yoy growth, the infrastructure software segment achieved $5.82 billion in revenue, a 196% growth. Broadcom increased its annual revenue by 51% to $14.05 billion. This elevated the company’s net income (GAAP) by 23% yoy, to $4.32 billion.

AVGO investors can also look forward to stock buybacks and dividend payouts. These expenditures come from Broadcom’s free cash flow (FCF), which increased by 16% yoy to $5.48 billion, or 39% of revenue.

Broadcom’s Confidence-Boosting Dividends and Buybacks

Ending the fiscal year 2024, Broadcom spent $5.2 billion on the stock buyback program while returning $7.17 billion to shareholders via dividend payments. Currently, AVGO shares have a 1.17% dividend yield at a $2.12 annual payout per share. At the same time, Broadcom has a forward price-to-earnings (P/E) ratio of 29.24.

For comparison, Meta Platforms (NASDAQ:META) has a 0.32% dividend yield at $2 per share annual payout, giving investors forward P/E ratio of 24.88. For fiscal year 2025, Broadcom increased its dividend by 11%, to $2.36 per share (annually). This marks Broadcom’s 14th consecutive annual dividend increase.

Reminder: dividend aristocrat companies need to raise their dividends for at least 25 consecutive years to gain that moniker.

Broadcom’s AI-Boosted Outlook

Given the relatively high P/E ratio, it is clear that investors expect more from Broadcom’s AI-driven revenue. Out of the company’s total $51.6 billion revenue for FY24, the expanding AI infrastructure market contributed $12.2 billion, having grown 220% year-on-year.

Broadcom accomplished this thanks to its next-gen custom accelerators (XPUs) for AI. Namely, the 3.5D XDSiP greatly reduces component latency (between memory, CPU, I/O) and signal bandwidth by using a 3D – 2.5D chip stacking approach. This manufacturing technique makes AI computing platforms cheaper, more energy efficient, and more compact.

Considering that AI hyperscalers like Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL) need nuclear power to scale their data center operations, Broadcom is expected to contribute with its computing optimization prowess.

For Q1 2025, the company projects revenue guidance to $14.6 billion, 22% higher than the year-ago quarter.

Where is the AI Growth Limit?

AI products remain in uncharted territory. While OpenAI’s ChatGPT impressed with text-to-text generation, and Anthropic’s Claude did the same for coding and AI agents, they still must demonstrate more consistent reliability.

Further, it is likely that text-to-video generation will be the real milestone game-changer. Not only are humans visually focused, but drastically higher computing demands would overwhelm current AI infrastructure. After all, high-res video generation requires up to 100 more computing power per second compared to text-to-text.

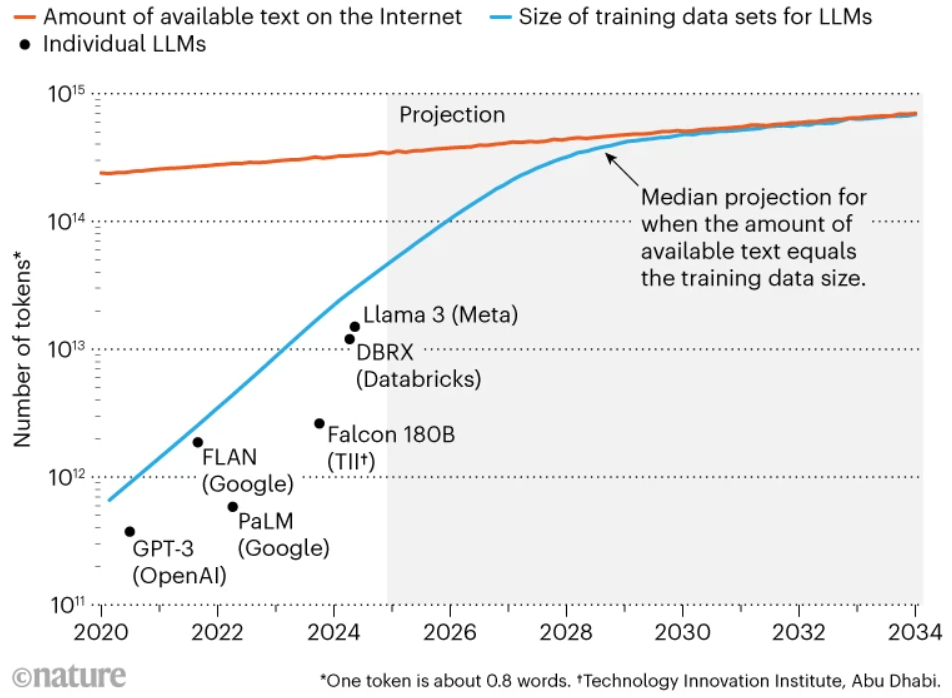

In turn, demand for Broadcom’s AI compute optimization would soar. At the same time, this demand could prove vital to offset the AI model training ceiling regarding text-to-text. Recently, Nature magazine projected that text data for AI models could hit a limit by 2028.

The workaround for this issue is largely focused on accessing non-public data and simulations to generate new data. MarketsandMarkets forecasts global AI market size to increase from $214.6 billion in 2024 to $1.3 trillion in 2030, giving AI investors an approximate Compound Annual Growth Rate (CAGR) of 35.7%.

Broadcom Stock Forecast

Over the last two years, Nvidia (NASDAQ: NASDAQ:NVDA) took the public spotlight, gaining first-mover advantage in the AI data center sector just as Bitcoin achieved in the world of cryptocurrencies. This translates to somewhat diluted interest for other companies, including Broadcom.

Against the 52-week average of $147.23, AVGO stock is now priced at $215.23 per share. This price level is aligned with WSJ’s median price target of $216.51. The high expectation is $260 while the bottom AVGO price forecast is $160 per share.

The bottom line is a stock market correction should be expected. Last week, BlackRock’s CEO Larry Fink sold $50.4 million BLK shares, the highest insider sale in the asset manager’s history. Given that Fink has access to Aladdin Analytics’ inner workings, it is fair to say this is a signal that should not be ignored.

If such a market correction occurs, investors should revisit AVGO stock as one of the top AI data center/cybersecurity companies with strong fundamentals.

***

Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.