Gold prices hit record high above $3,800/oz on US shutdown risks, rate cut bets

The U.S. Federal Reserve maintained interest rates between 5.25% and 5.5% yesterday, aligning with the widespread market predictions.

During his speech, Fed Chair, Jerome Powell, also managed to reduce market expectations of any rate cuts to happen in March. Markets now estimate the probability of rate cuts to be communicated at the Fed’s meeting in March at just 35.5%, down from 48% just a week ago.

All Eyes on Inflation

In the Q&A session that followed the press release, Jerome Powell substantiated the need to gain 'greater confidence' that inflation continues to trend downwards toward the desired 2% before any rate cuts can be entertained.

It’s obvious that the Fed is in a really difficult spot here.

Because apart from battling inflation, the evidence that the economic system is in distress is clear. Especially the banking sector is in distress, and prospects of that to change under the current rate environment is low.

Noteworthy, the New York Community Bank, the bank that acquired the now-defunct Signature Bank (OTC:SBNY), just saw its stock tumble more than 40%.

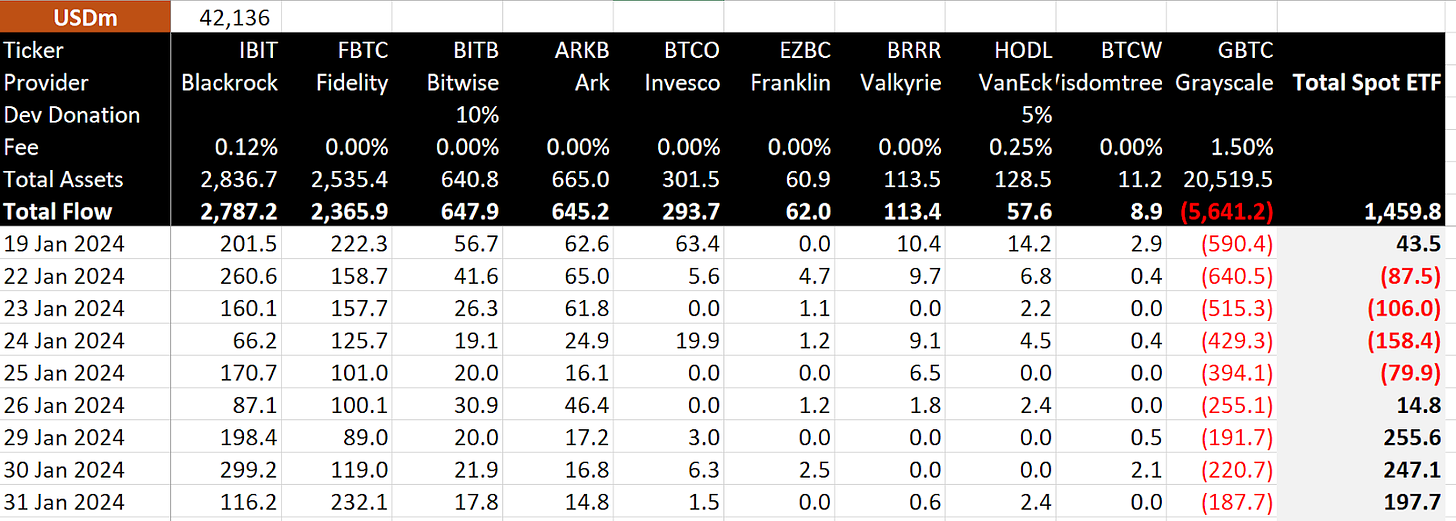

Bitcoin Spot ETFs Net Inflows Turning Positive

Although Grayscale continues to experience outflows, the rate of outflow is diminishing as the days pass, and the net inflow into the other vehicles has been picking up.

Over the last three days, the total net inflows have consistently ranged between $200 million and $250 million. I anticipate this influx of capital into Bitcoin to be persistent, which has the potential to push the price of BTC higher despite the policy uncertainty.

Source: BitMEX Research

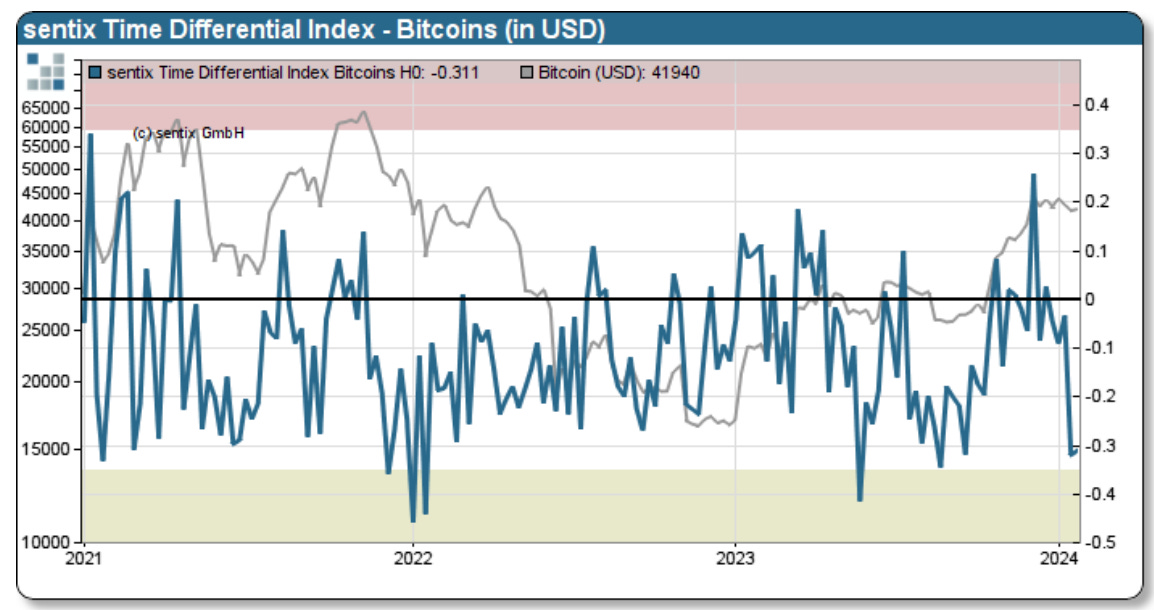

Whales are Accumulating - Are you?

It is also worth observing that while BTC's price seems to have entered a consolidation range, whales have been aggressively accumulating. Data from IntoTheBlock reveals that Bitcoin whales increased their holdings by over $3 billion in January alone.

This happens at a time when the general sentiment has fallen into neutral territory and at a time where miners have been actively reducing their BTC inventory.

With those factors in mind, it is difficult to stay entirely bearish on the outlook for BTC even though the uncertainty around economic policy remains a threat for a continued rally.

Bitcoin Ordinals - Not a Passing Fad

In the past year, Bitcoin ordinals have emerged as one of the leading NFT trends.

Despite initial skepticism from some enthusiasts claiming their lack of utility, the count of ordinals on the Bitcoin blockchain has surged to over 56 million, a remarkable increase from less than 1 million a year ago.

Even more intriguing is the remarkable value some ordinal collections have achieved. In December, the BitcoinShrooms collection, among the earliest ordinal projects, fetched an astonishing USD$450,850, setting a record at Sotheby's Auction.

At this pace, Bitcoin's blockchain has the potential to evolve into a foundational element for various crypto facets. While this could result in an increase in on-chain fees, it might also signify the emergence of a new ecosystem thriving on the Bitcoin blockchain, beyond BTC itself.