UnitedHealth tests AI system to streamline medical claims processing - Bloomberg

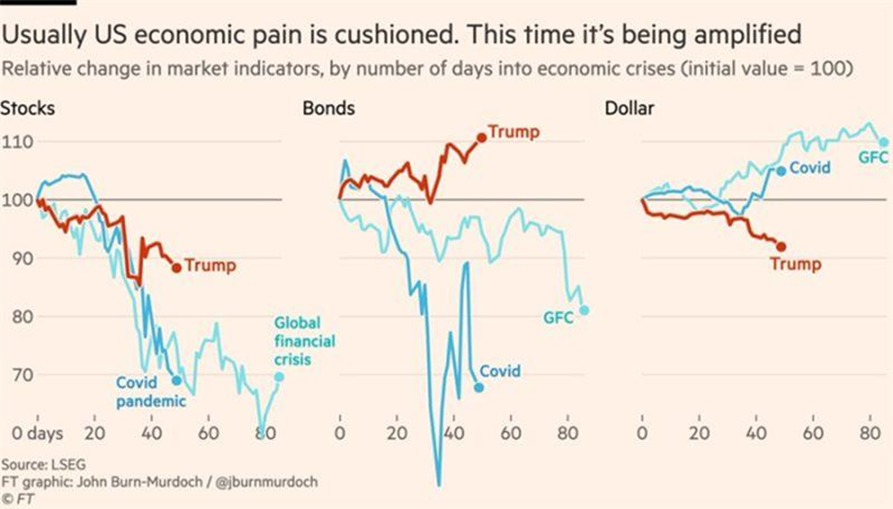

In past economic downturns, US economic pain was often softened by falling bond yields and a rising Dollar, which led to lower interest rates and boosted consumer spending power. This time, however, the opposite is happening. Bond yields remain high, and the dollar is far from strengthening.

Households and businesses are exposed to tighter credit, sticky inflation, and fewer financial incentives. With the usual shock absorbers missing, the impact of the economic slowdown could be significantly more painful.

Source: FT

IMF’s Downward Revisions

The International Monetary Fund (IMF) sharply downgraded its global growth forecasts for 2025 and 2026, citing soaring US tariffs and escalating trade tensions. It lowered growth estimates for the US, China, and many other countries, warning that continued trade disputes could slow growth even more.

The IMF announced on Tuesday an updated World Economic Outlook, compiled just 10 days after President Trump announced universal tariffs on nearly all trading partners and higher rates on many countries—which are now currently suspended.

The IMF lowered its global growth forecast by 0.5 percentage points to 2.8% for 2025, and by 0.3 points to 3% for 2026, down from its earlier estimate of 3.3% for both years. It also said inflation is now expected to fall more slowly than previously thought, reaching 4.3% in 2025 and 3.6% in 2026, with significant upward revisions for the US and other advanced economies.

The IMF described the report as a ’reference forecast’ based on data up to 4 April, noting the rapidly changing and complex global situation.

Source: FT, TRT World

Tit-for-Tat Retaliation Between China and The US

Although the Trump administration granted a 90-day tariff pause to most countries, China was left out of the list. Tariffs on Chinese goods soared to a staggering 145%. However, after weeks of tit-for-tat measures, the bold threats soon gave way to a more cautious tone. “145% is very high and it won’t be that high,” Trump told reporters during an Oval Office Q&A. “It won’t be anywhere near that high. It’ll come down substantially. But it won’t be zero.”

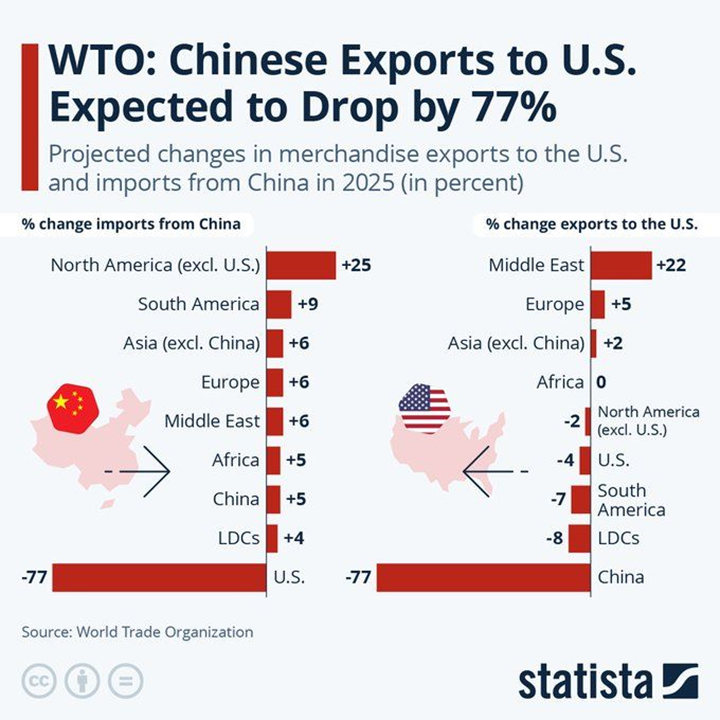

Decoupling from the world’s manufacturing giant is easier said than done, especially when American supply chains still heavily depend on Chinese production. According to the World Trade Organization, Chinese exports to the US are expected to decrease by 77% in 2025. China is set to make up ground elsewhere—while exports to the rest of North America are forecasted to rise by 25%.

Source: Statista @StatistaCharts, WTO

You Don’t Lose Until You Sell

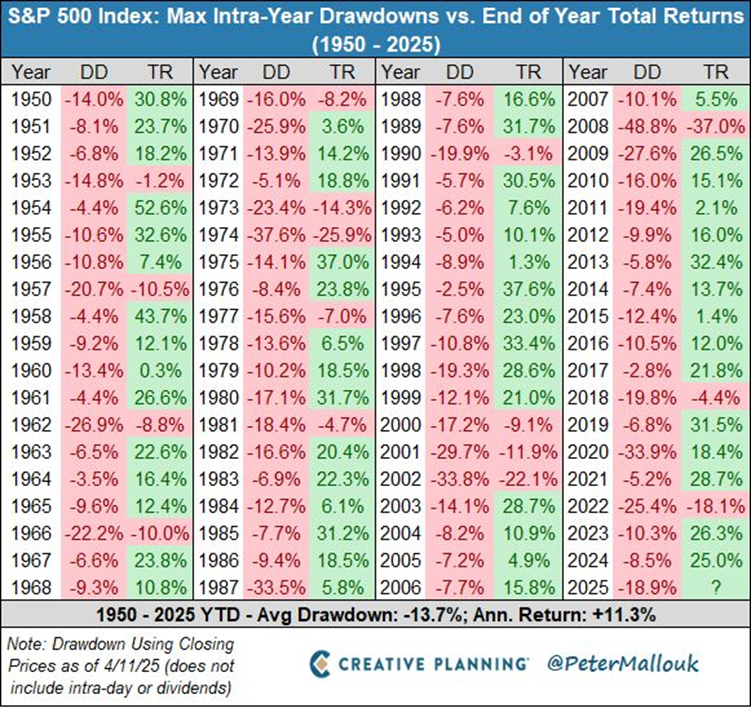

The S&P 500 has returned an average of 11% per year since 1950 and has done so despite an average intra-year drawdown of 14%, and often drawdowns that are much worse. The lesson? Volatility doesn’t equal a permanent financial loss unless you sell.

Source: Peter Mallouk