Gold prices stabilizes after Fed’s Williams signals a December rate cut

- Markets are set for a volatile month, as a plethora of important economic decisions line up

- However, investors should keep in mind that short-term volatility does not imply bad returns in the long run

- In fact, investing in the stock market has historically been the most profitable long-term investment

A number of extremely important events are about to hit the markets and set the tone for the coming months.

The first was yesterday, when the Federal Reserve Chairman spoke to the Senate Banking Committee. The second is when he will testify on the economic outlook and monetary policy actions before the Joint Economic Committee, later today.

Investors will watch to see if he gives any clues about the Fed's monetary policy. We already know that people pay attention to keywords or phrases. We saw how the market reacted last week when the Atlanta Fed President said that the bank might consider pausing rate hikes in the summer.

On Friday, we have the US employment report. The market expects 203,000 nonfarm payrolls after a surprising 517,000 in the prior month.

Next week on Tuesday, we will see the US inflation report. The market expects the CPI to come in at 6%, down from 6.4%. On the other hand, the all-important core CPI is expected to rise to 5.4%.

Finally, on the 22nd, the Fed will decide on interest rates, and Powell will hold a press conference. After these events, investors will have better clarity on whether the Fed will pause its rate hikes in the coming months.

Why You Need to Be Invested in the Stock Market

But regardless of what happens this month with the data I have just discussed, one thing is clear: you need to be invested in the stock market.

The reason is simple: historically, no other investment has been more profitable than gold, bonds, and real estate. No other investment has ever made more money for investors or generated higher returns over the long term.

It has survived world wars, economic crises, recessions, depressions, pandemics, major international terrorist attacks, assassinations of presidents (including the White House), natural disasters (earthquakes, floods, droughts, volcanoes, tsunamis), cyber-attacks, bubbles, major corporate bankruptcies, frauds, and multi-million dollar scams. The list could go on and on.

As a result of many of these causes, the stock market has suffered significant falls, sometimes lasting several years. But in the end, it has always recovered and rallied to new all-time highs.

The stock market is the best barometer of human sentiment. It reflects all kinds of emotions, from the positive (joy, optimism, euphoria, confidence, hope) to the negative (uncertainty, doubt, fear, anxiety, panic, greed, avarice).

That is why one of the keys is to know how to manage expectations, be cool, be calm in difficult moments, and be very patient.

As I said, investing in the stock market is by far the best investment you can make in the long term. You don't believe it? Well, let's have a look at the numbers. They never lie.

In the following table, we can see the profitability of the stock market, United States 10-Year bonds, gold, and real estate over different periods (since 1800, since 1900, since 1971, and since 1980, all up to 2020, which is the data I have).

| MARKET | From 1800 to 2020 | From 1900 to 2020 | 1971 to 2020 | From 1980 to 2020 | |||||

| Stock Market | 8,6% | 10,1% | 10,5% | 11,6% | |||||

| Bonds | 5,2% | 4,7% | 7,3% | 7,9% | |||||

| Gold | 2,1% | 3,8% | 8,3% | 3.4% | |||||

| Real Estate | ? | 3.5% | 5% | 4.3% |

And, after factoring in inflation:

| MARKET | From 1800 to 2020 | From 1900 to 2020 | 1971 to 2020 | From 1980 to 2020 | |||||

| Stock Market | 6.80% | 6.40% | 6.50% | 8.30% | |||||

| Bonds | 3.50% | 1.70% | 3.40% | 4.80% | |||||

| Gold | 0.40% | 0.80% | 4.30% | 0.30% | |||||

| Real Estate | ? | 0.50% | 1% | 1.30% |

As you can see, whether we take inflation into account or not, long-term stock market investing easily beats other classic investments such as 10-year bonds, gold, and real estate.

Moreover, since 1950, the S&P 500 has delivered a positive total return in 57 out of 73 years (78% of the time), despite an average annual decline of -13.8%. No one said it would be easy. Being patient is key.

There have been periods when the stock market has not been the best-performing asset, but this has not been the norm. Since 1800, there have only been 6 out of 22 decades in which the stock market did not dominate the performance rankings.

And only gold has been the only asset, other than the stock market, to repeat in the first place, and that was in the 1970s after the US went off the gold standard and in the 2000s with the technology bubble and the 2008 financial crisis.

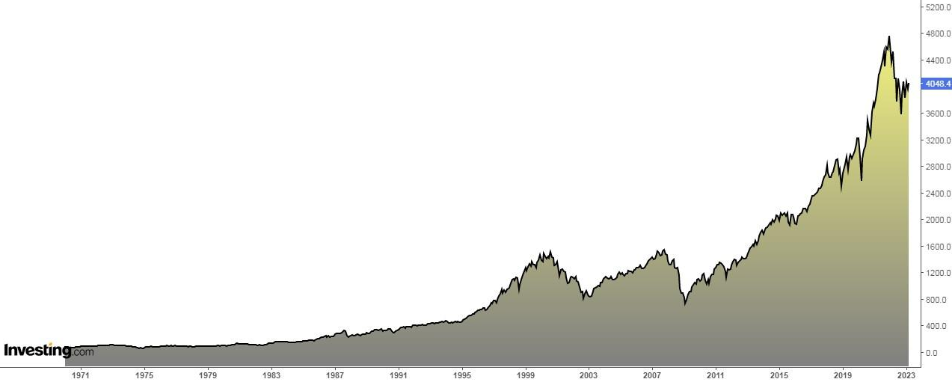

Below is a chart of the S&P 500 from 1970 to 2023. I think there is little more to say.

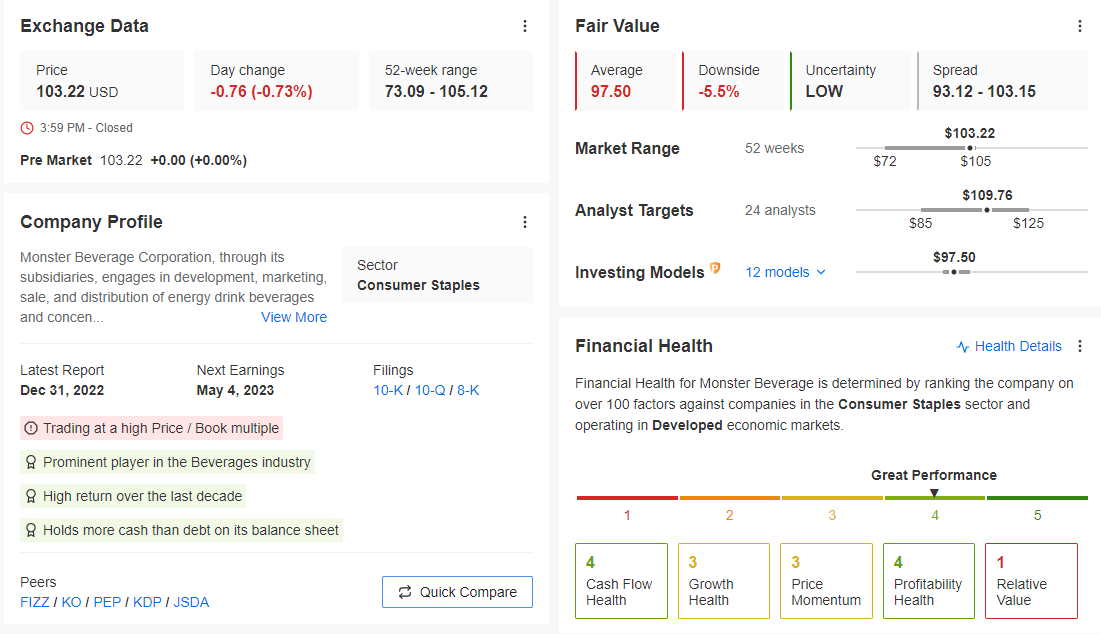

If we talk about S&P 500 stocks, looking at the period from 1 January 1992 to 31 December 2021, there have been tremendous returns, including dividends, over the last 30 years (total return):

Top Stocks by Total Return:

- Monster Beverage (NASDAQ:MNST) +255957%.

- Amazon (NASDAQ:AMZN) +222190%.

- Pool (NASDAQ:POOL) +82916%

- Nvidia Corporation (NASDAQ:NVDA) +80773%

- Cerner (NASDAQ:CERN) +66062%

- Johnson Controls (NYSE:JCI) +61322%

- NVR (NYSE:NVR) +58259%

- Netflix (NASDAQ:NFLX) +55866%

- Idexx Laboratories (NASDAQ:IDXX) +47249%

- Apple (NASDAQ:AAPL) +42994%

- Microchip Technology (NASDAQ:MCHP) +41234%

- Altria (NYSE:MO) +41175%

- Starbucks (NASDAQ:SBUX) +40834%

Source: Investing Pro

Monster Beverage, the maker of Monster energy drinks, is a standout performer. It has been the best performer in the US stock market since the turn of the century. The company has increased its profits year on year since 2008, and its sales have grown by at least 9% a year since 2001.

Disclosure: The author does not own any of the securities mentioned.