European stocks mixed on Friday after volatile week; U.K. economic woes

In our previous update, see here, we concluded that Bitcoin (BTCUSD) was still a good buy. It was trading at $89.7K back then. Fast-forward and BTCUSD is currently trading at ~$101K, reaching as high as $104,028, a ~15% gain. Hence, our method of analysis, the Elliott Wave Principle (EWP), is preferred because it is price-based, and the price is the aggregate opinion of all market participants.

Thus, all you need to do is follow the price action and its set of limited patterns, and you will know most of the time what to expect next. Note that “most of the time” means ~70%, not 99.9%. Still, that gives anyone who understands the EWP plenty of an edge in trading. And if you don’t understand the EWP, learn it.

In our previous update, we found

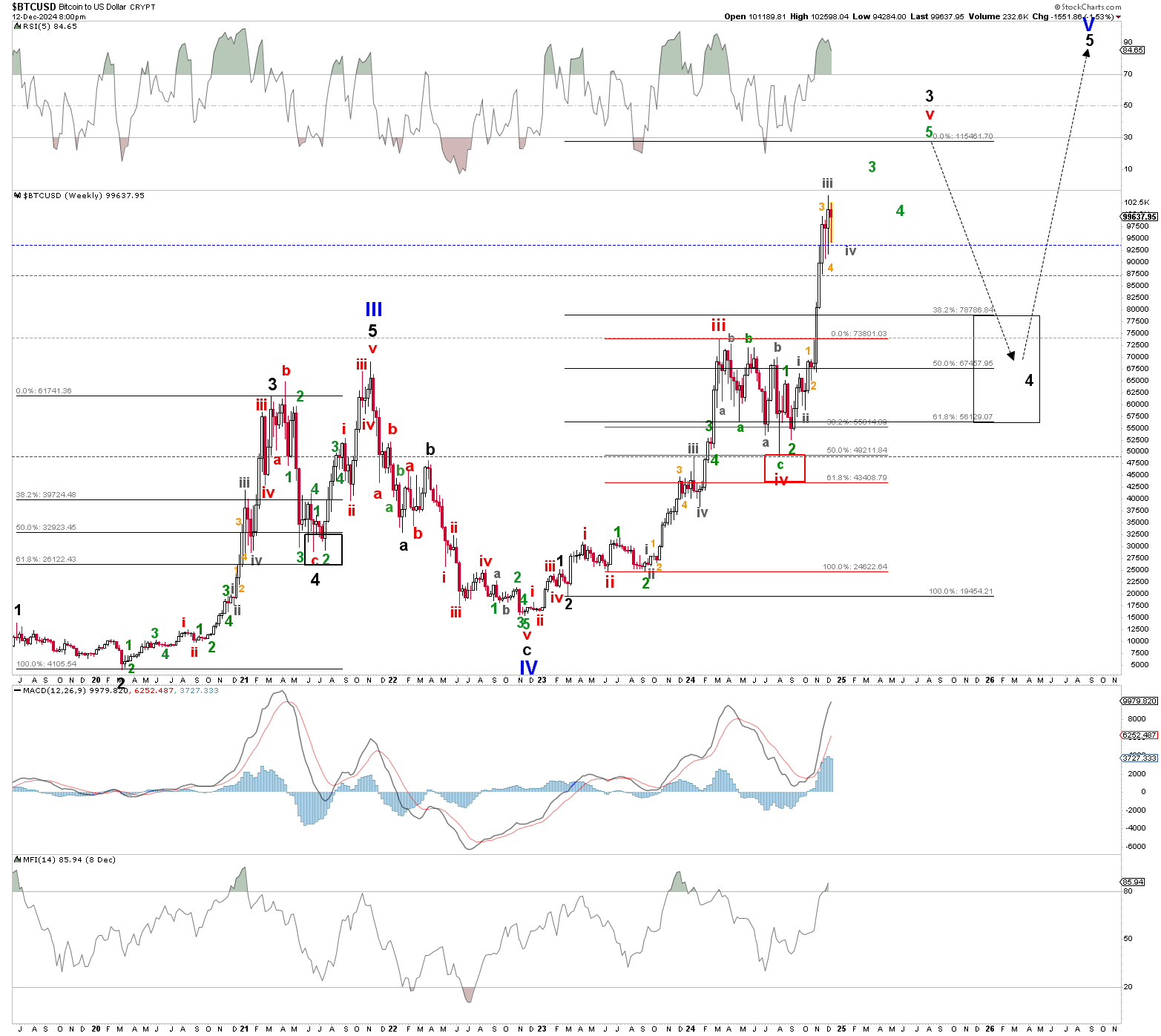

“Based on the impulse pattern, BTC should wrap up the orange W-3 of the grey W-iii of the green W-5 of the red W-iii. The ideal target for the orange W-3 is $106,500 to 109,220.” Last week, BTC reached as high as $104,028 and started to correct. See Figure 1 below.

Hence, the orange W-3 and W-4 were completed, unfortunately just shy of the ideal target zone. Now, the question is whether the grey W-iii was completed at the recent all-time high of $104,028.

Another down week this week will confirm this thesis as we assess down weeks as corrective. In that case, we can anticipate the grey W-iv to bottom out at, ideally, $90+/-2K before the next rally kicks in to ~$110K, completing the green W-3. One more down-up sequence should be expected to complete the green W-4 and W-5 sequences, respectively, at ideally $115+/-2K.

Once the green W-5 of the red W-v of the black W-3 completes, we should expect BTC to experience a severe 4th wave correction (black W-4) like this summer and 2021. Both saw 50-62% retracements of the prior same-degree 3rd waves. That would mean BTC could drop to as low as $56-67K before it resumes its rally to our adjusted upside target of $216K to $445K by the end of 2025.