ION expands ETF trading capabilities with Tradeweb integration

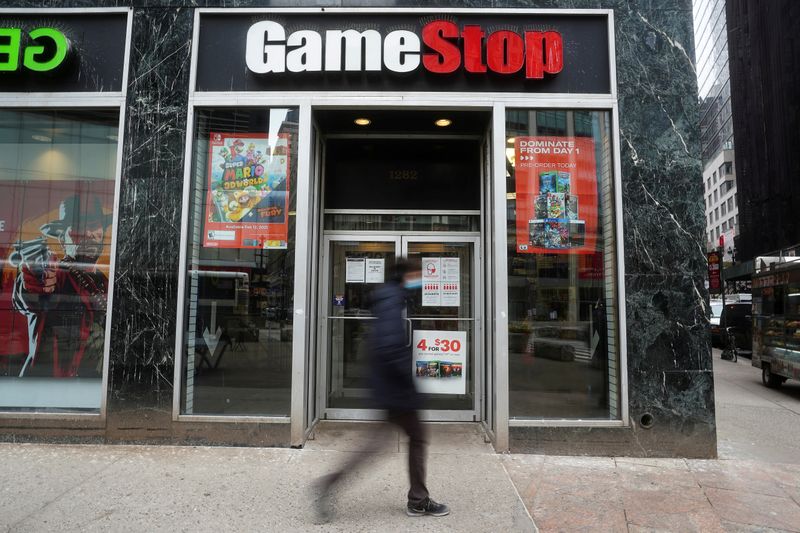

NEW YORK - GameStop Corp. (NYSE:GME), currently trading at $24.35 with a market capitalization of $10.95 billion, announced Tuesday it has completed the distribution of warrants to purchase common stock to its shareholders and convertible noteholders, following through on its previously announced shareholder warrant dividend. According to InvestingPro data, the company maintains a strong financial position with more cash than debt on its balance sheet.

Stockholders of record as of October 3, 2025, received one warrant for every ten shares of GameStop common stock held, with fractional warrants rounded down to the nearest whole warrant. Holders of the company's 0.00% Convertible Senior Notes due 2030 and 2032 also received warrants on an as-converted basis using the same ratio. The stock has shown resilience despite recent market volatility, with a one-year total return of nearly 20%.

Each warrant entitles the holder to purchase one share of GameStop common stock at a cash exercise price of $32.00. The warrants are exercisable immediately and will expire on October 30, 2026, at 5:00 p.m. New York City time.

To qualify for the warrant distribution, shareholders needed to have purchased or held their shares no later than October 2, 2025. The company noted that shareholders and convertible noteholders might experience delays in receiving their warrants due to broker-dealer procedures.

The warrants were distributed by GameStop's warrant agent in accordance with the terms of the warrant agreement filed with the U.S. Securities and Exchange Commission on October 6, 2025.

GameStop has made additional information about the warrant distribution available on its investor relations website, including a Warrant Dividend Distribution FAQ. The company maintains robust financial health with a current ratio of 11.37, indicating strong liquidity. InvestingPro subscribers can access 10+ additional financial tips and comprehensive analysis tools to better evaluate this investment opportunity.

This information is based on a press release statement issued by GameStop Corp.

In other recent news, GameStop Corp. has filed a prospectus with the SEC, indicating potential future offerings of various securities. This filing outlines the possibility for GameStop to offer and sell common stock, preferred stock, debt securities, depositary shares, warrants, purchase contracts, units, and subscription rights. Additionally, GameStop announced it will distribute a special dividend in the form of warrants to shareholders of record as of October 3, 2025. The distribution will involve one warrant for every ten shares of common stock, with approximately 59 million warrants expected to be issued. Furthermore, Quantum BioPharma Ltd. has made a strategic investment by purchasing 2,000 shares of GameStop. Quantum BioPharma describes this move as part of its strategy to combat market corruption and enhance shareholder value. These developments reflect GameStop's ongoing efforts to engage with shareholders and explore financial opportunities.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.