JFrog stock rises as Cantor Fitzgerald maintains Overweight rating after strong Q2

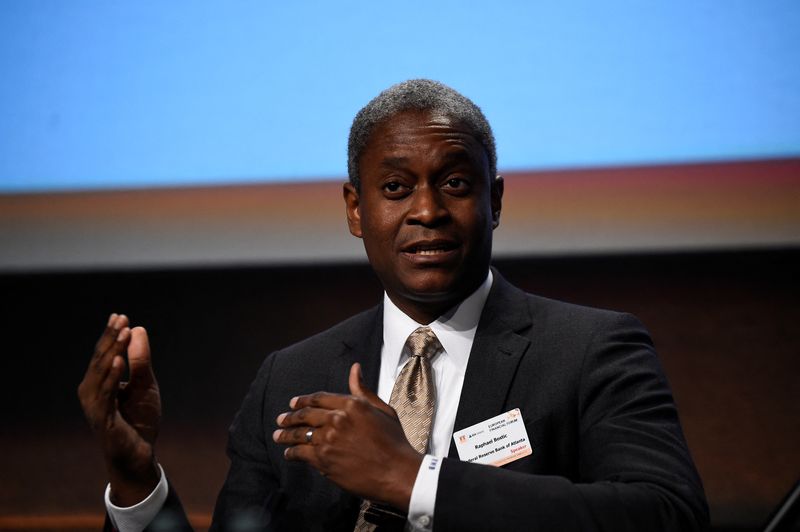

Investing - The U.S. Federal Reserve is likely to cut interest rates this year, according to Atlanta Federal Reserve President Raphael Bostic, even if the timing remains uncertain.

"I still have that belief" that interest rates can be lowered this year, Bostic said in an interview with Reuters published earlier Friday, despite inflation remaining well above the central bank’s target during the first quarter of this year.

"There is an expectation for most of the employers I talk to that they will get back to pre-pandemic wage growth," Bostic said in the interview. And with the possible exception of tech companies, "we're hearing from pretty much everyone ... their pricing power is pretty much at its limit."

That should result in inflation falling back as the year progresses, allowing the central back to start cutting interest rates.

"I don't think we're going to know that for at least a couple of months," he added. "I'm hopeful that we do continue to see this slowing down because my outlook really says that you're going to have to see some slowing down in order to get inflation back to our 2% target ... We still are seeing robust job growth."

The Federal Open Market Committee last week voted to hold the benchmark interest rate steady again in the 5.25%-5.50% range, a decision that Bostic supported.

The Atlanta Fed head said last month that he would be open to lifting interest rates if inflation remains at elevated levels, comments that resulted in a sharp rise in bond yields and a selloff on Wall Street.

"If inflation stalls out or even starts moving in the opposite direction, away from our target, I don't think we'll have any other option but to respond to that," Bostic said in April.