Tonix Pharmaceuticals stock halted ahead of FDA approval news

By Geoffrey Smith

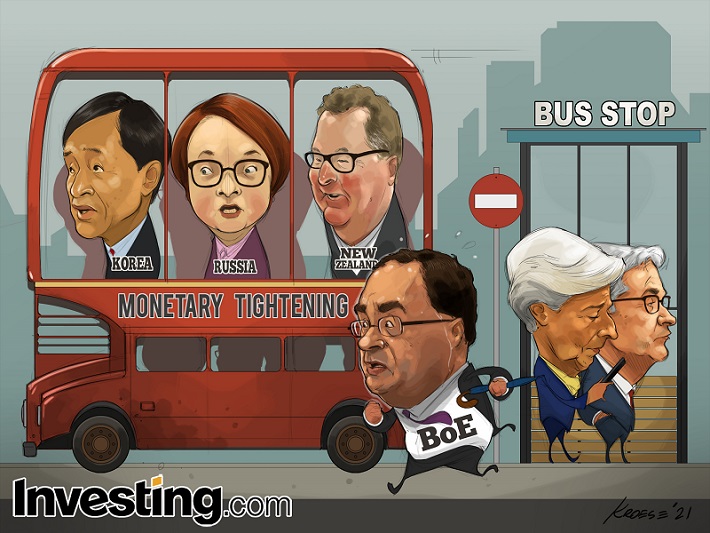

Investing.com -- Interest rate hikes are starting to resemble the proverbial London bus: none come for ages, then a bunch of them come at once.

After being confined to emerging markets for much of 2021, the trend is now reaching advanced economies. Norway, New Zealand, South Korea and Iceland have all raised their key rates since August. The next, it seems almost certain, will be the U.K.

Interviews with two senior Bank of England officials at the weekend left little doubt in the market's mind that the Bank's first rate hike since August 2018 will come before the end of the year. Michael Saunders, one of the Bank's leading inflation hawks, told the Sunday Telegraph that the market is right to expect interest rates to rise "significantly earlier" than it had originally thought, while Governor Andrew Bailey admitted to the Yorkshire Post that: "obviously" he was "concerned" that inflation is running well above target. At 3.2% in August, consumer price inflation was at its highest in nine years.

For most of this year, the BoE had been in the same camp as the Federal Reserve and European Central Bank, in seeing the rise in inflation as only temporary. While Bailey said he still thinks that's true, he has a bigger problem than either the Fed or ECB in that his institution doesn't have the same credibility. Market indicators of inflation expectations have started to move up rapidly. The implied forecast for the five-year period starting in five years time had risen to 3.6% by the end of September, the highest it had been since the eve of Lehman Brothers' collapse in 2008.

"We have seen some very big and unwanted price changes,” Bailey said. "We have got to...prevent the thing becoming permanently embedded because that would obviously be very damaging.”

It's hardly surprising that, among G7 countries, inflation expectations are de-anchoring first in the U.K., a country whose institutional memory is scarred by the experience of stagflation in the 1970s. Brexit has added an extra layer of complexity to labor market problems in evidence across the developed world since the pandemic began. Moreover, there is reasonably clear evidence that higher prices are already driving wages higher - the start of the dreaded 'wage-price spiral' that is the heart of real inflation (as opposed to the freakish spike in used car prices that drove the inflation scare earlier this year in the U.S.)

Data released on Tuesday by the Office for National Statistics showed average earnings excluding bonuses up 6.0% in the year through August. While that was down from a peak of 7.3% in June, it's still well above any level the Bank would normally consider sustainable.

The same process is also taking place - at a slightly slower tempo - in the U.S. According to Bloomberg data, the so-called 5y5y inflation breakeven has risen to just under 2.6%. The Fed, too, has a challenge ahead to keep its credibility.

In emerging Europe, the central banks of Czech Republic, Hungary, Romania and Poland have all raised interest rates in the last month, the last of them in the face of significant government pressure not to.

Only at the European Central Bank - and its even more deflation-prone neighbor in Switzerland - are officials still relaxed the way things are going. The ECB's latest economic forecasts still project the CPI to be below its 2% target in two years' time. That's tantamount to a justification for easing policy further, in the eyes of many in Frankfurt. The ECB's chief economist Philip Lane told a conference on Monday that one-off rises in prices - especially those dominated by fluctuations in energy prices - shouldn't be confused with a rise in underlying inflation. A decade's worth of ECB research shows that energy has accounted for a bigger part of CPI increases in recent years than it used to, just because underlying inflation is so weak.

Having overestimated underlying inflation pressures for most of its history, the ECB arguably runs the risk of not identifying genuine inflation if and when it finally does arrive. Its recent record suggests, however, that it is right to keep calm for now. For the U.K., however, the bus is pulling out, and it will be a scramble to get aboard in time.