Bill Gross warns on gold momentum as regional bank stocks tumble

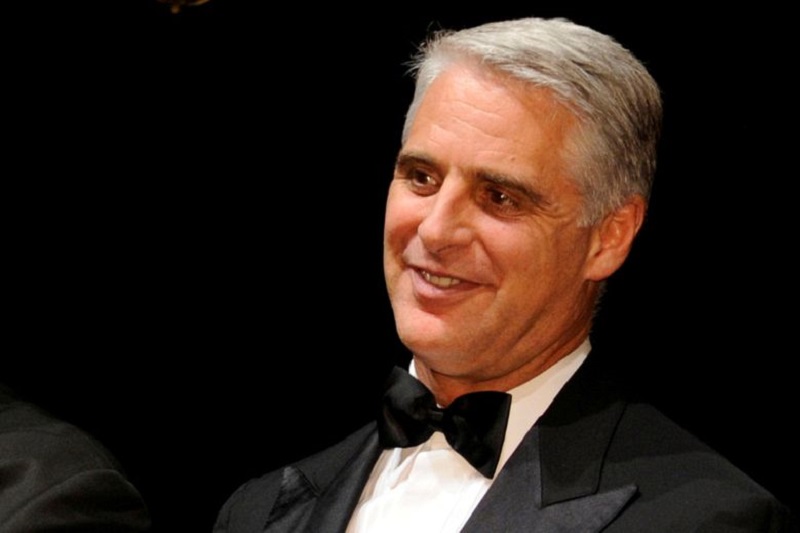

Investing.com -- UniCredit SpA (BIT:CRDI) is likely to withdraw its offer for Banco Bpm SpA (BIT:BAMI), chief executive Andrea Orcel said in an interview published Friday by Italian daily La Repubblica. He cited ongoing challenges posed by government restrictions and legal appeals, which have complicated the bank’s pursuit of a deal.

"But if we don’t manage to resolve (the problems), as is probable, we will withdraw," Orcel said.

Shares in UniCredit rose more than 1% on Friday in Milan following the news.

Orcel noted that UniCredit is working to meet the Italian government’s conditions tied to the so-called ’golden power’ rules, which include exiting business operations in Russia.

This move has also been encouraged by the European Central Bank (ECB). However, Orcel acknowledged the difficulty in complying fully.

"We have done more than was requested by the ECB," he said, adding that UniCredit has scaled back its presence in Russia more than any other bank, but a suitable buyer has yet to emerge “either to Russia or to the West.”

Orcel confirmed that UniCredit has earmarked capital to cover potential losses in the event that its Russian operations are nationalized.

Separately, he addressed speculation about a potential move for Germany’s Commerzbank (ETR:CBKG), saying that efforts had been blocked by both the German government and the bank itself.

For now, UniCredit would continue to be a shareholder and “closely watch (Commerzbank’s) transformation path.”

He also emphasized that the bank’s growth does not depend on acquisitions. “Our future is very bright with or without M&A,” Orcel said.

On another front, Orcel said UniCredit had alerted Italy’s market watchdog Consob about possible irregularities in the government’s sale of a 15% stake in Monte dei Paschi di Siena last November. "We tried it take part (in the sale) but we could not manage," he said.

He pointed to concerns over the participation of asset manager Anima, which was under a passivity rule linked to a Banco BPM takeover approach, and Banco BPM’s own involvement in the transaction through its unit, Banca Akros.

Milan prosecutors are investigating the sale and have questioned Orcel as a witness, according to Reuters.