60%+ returns in 2025: Here’s how AI-powered stock investing has changed the game

Investing.com -- On the heels of the best May in three decades, June kicked off with further—albeit more moderate—gains for stock market investors.

In fact, after fluctuating between below 5,000 and above 6,000, it’s easy to lose sight of the fact that the S&P 500 has only now turned positive for the year, up a modest 2.11% YTD in the first five and a half months of the year (an annualized gain of about 4%).

Against this volatile backdrop, selecting the right fundamentally solid, growth-prone stocks has proven more essential for those seeking above-average returns than anytime in the last few years.

For instance, while the market trades mostly sideways in June, those following our monthly updated AI-picked list of stocks for less than $10 a month are banking significantly higher returns.

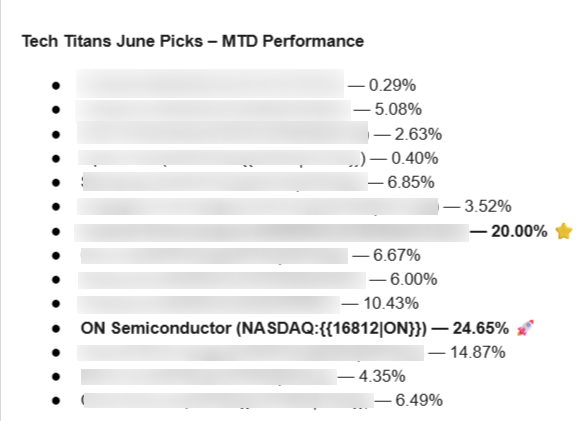

In fact, one of the stocks from this list, ON Semiconductor (NASDAQ:ON), picked at the start of the month, is already up a massive 24.65% this month alone.

Not only that, but the entire portfolio—composed of 15 picks—is up an impressive 7.5% in June ALONE, with ALL of its picks in the green this month.

Below the is the full portfolio performance broken down individually (names accessible exclusively to Investing members).

Click on the image to unlock all the picks NOW:

(InvestingPro members have full direct access to the list.)

Longer-term, the results are even better. In fact, our premium members who have been following our AI-powered Tech Titans portfolio (strategy) since launch in November 2023 have now more than doubled their principal, gaining a massive 105.55% so far. That’s a whopping 66.76% outperformance over the benchmark.

*These are real-world gains, not backtested simulations or hypothetical returns.

But how do these AI picks work?

Let’s break them down for you:

Every first of the month, our AI updates its list of picks, up to 20 new names per strategy, based on a compilation of more than 150 industry-recognized financial models.

Some stocks are added, some remain, while others are removed from the list. While not a must, these moves reflect how the AI model views their mid-term prospects in terms of stock price growth.

The performance of the strategy is then calculated on an equally weighted basis, comprising all the stocks within the strategy.

While users don’t need to follow equal weighting to the letter, the result of this calculation signals how assertive the model is in picking stocks within that respective strategy.

While it is mainly a game of probabilities, fetching results like the ones our AI did also requires spotting outstanding winners—and, perhaps even more importantly, knowing when to let go of them.

And, in fact, since its launch, it has had quite a few success stories like that. To wit:

Super Micro Computer (NASDAQ:SMCI):

- Return: +185.8%

- Held: Jan 2024 – Jul 2024

MicroStrategy Incorporated (NASDAQ:MSTR)

- Return: +94.9%

- Held: Dec 2023 – May 2024

NVIDIA Corporation (NASDAQ:NVDA)

- Return: +68.1%

- Held: Mar 2024 – Dec 2024

Just to name a few among several others.

As a matter of fact, our backtest suggests that going the long run is the surest path to long-term wealth generation. Check out the 10-year outperformance of Tech Titans over the S&P 500 below:

This means a $100K principal in our strategy would have turned into an eye-popping $1,348,039 by now.