TSX futures subdued as gold rally takes a breather

(For a Reuters live blog on U.S., UK and European stock

markets, click LIVE/ or type LIVE/ in a news window)

* St Gobain soars after upbeat Q4 forecast

* Miners, oil stocks gain on U.S. stimulus hope

* DeliveryHero slips after new share issuance

(Updates prices throughout, adds comments)

By Amal S and Shreyashi Sanyal

Jan 7 (Reuters) - European stocks climbed for a second

straight session on Thursday as construction stocks gained on

upbeat sales forecast from Saint Gobain and commodity-linked

shares rose on hopes of larger U.S. stimulus after Democrats won

Senate control.

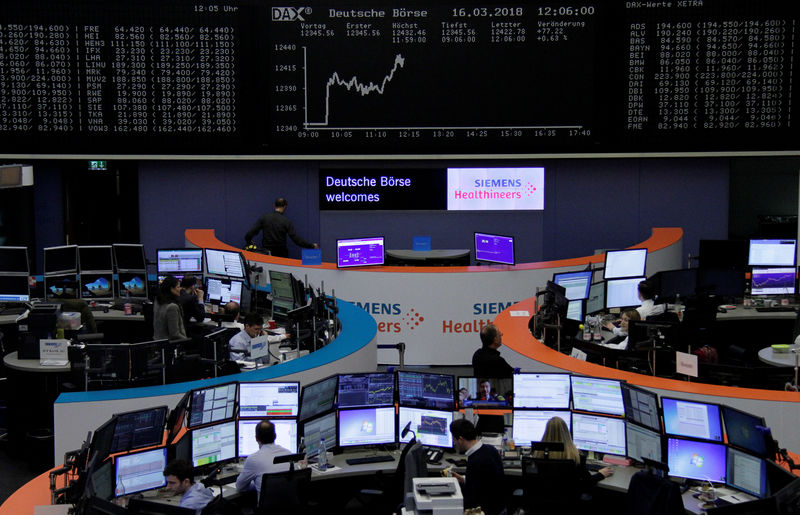

The pan-European STOXX 600 index .STOXX advanced 0.5% to

near February 2020 highs, while London's blue-chip FTSE 100

.FTSE gained 0.2% and Germany's DAX index .GDAXI was up

0.6%.

Construction & material stocks .SXOP were the top gainers,

led by a 2.3% rise in France's Saint Gobain SGOB.PA after it

said fourth-quarter results would significantly exceed

expectations. Meanwhile, economically sensitive sectors such as mining

.SXPP , energy .SX7E and industrials extended their rally on

the prospects of more U.S. stimulus after Democrats won control

of the Senate.

"While a Blue Wave could pave the way for stricter

regulations and tax hikes, investors try to see it from a

positive side... and further stimulus measures are likely to

follow and without a months-long stalemate," said Milan

Cutkovic, market analyst at Axi.

Gains in Swedish industrial companies Atlas Copco

ATCOa.ST , Sandvik SAND.ST and Volvo VOVLb.ST drove

Stockholm stocks .OMXSPI to all-time highs.

"We highlight that Basic Resources, Construction & Materials

have underperformed since the beginning of December and, given

their sensitivity to fiscal policy in general through

infrastructure investment, they have catch up potential,"

Unicredit analysts said in a note.

European wind turbine makers Vestas VWS.CO , Orsted

ORSTED.CO and Siemens Gamesa SGREN.MC all extended gains

from the previous session.

Renewable stocks are widely considered as winners of a Joe

Biden administration, given the U.S. president-elect's proposed

$2 trillion climate plan.

Sentiment was also boosted by European approval for a second

COVID-19 vaccine developed by Moderna Inc MRNA.O . Meanwhile, demand for German-made goods defied expectations,

rising 2.3% in November, the latest in a string of data points

showing the Europe's largest economy being unexpectedly

resilient in the face of the pandemic. Among other movers, LafargeHolcim LHN.S rose 2.4% after

the world's biggest cement maker said it would buy Firestone

Building Products from Bridgestone Americas in a deal worth $3.4

billon. Delivery Hero DHER.DE slipped 2.9% after the German food

delivery firm said it raised around 1.2 billion euros ($1.48

billion) by issuing new shares to fund growth. Mitchells & Butlers MAB.L dropped 3.2% after the British

pub operator said it was exploring an equity capital raise as a

new national lockdown shut its sites across England.